Please use a PC Browser to access Register-Tadawul

Knight-Swift (KNX) Upgrade: Are Regulatory Shifts Reshaping Its Competitive Position in Trucking?

Knight Transportation, Inc. KNX | 53.22 | +1.39% |

- Earlier this week, Bank of America upgraded Knight-Swift Transportation Holdings, pointing to tightening truckload supply and regulatory changes set to benefit the company’s earnings outlook.

- An interesting aspect of this upgrade is the focus on upcoming tariffs and enhanced driver regulations, which are expected to further limit trucking capacity and could favor larger operators like Knight-Swift.

- We'll explore how tightening truckload supply conditions highlighted in the latest upgrade could reshape Knight-Swift’s investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Knight-Swift Transportation Holdings Investment Narrative Recap

To be a shareholder in Knight-Swift Transportation, you need to believe in the company’s ability to capitalize on tightening truckload supply, benefit from regulatory shifts, and manage through industry cycles. The recent Bank of America upgrade points to near-term catalysts that could support higher earnings by constraining broader trucking capacity, although continued soft freight volumes and the risk of longer integration timelines for its LTL business remain the most significant hurdles. If tighter supply meaningfully boosts freight rates in the short term, it may help offset some of those margin concerns; if not, the main risk continues to be sustained pressure on earnings from slow demand recovery.

Among recent company updates, the July announcement of a new US$2.5 billion unsecured credit facility is especially relevant. This enhanced financial flexibility positions Knight-Swift to absorb potential volatility and invest in opportunities as regulatory and market dynamics evolve, especially if higher barriers to entry tighten industry capacity as some analysts expect. The effects of this financial move will become clearer as supply-side catalysts play out over the coming quarters.

Yet, in contrast, investors should keep a close watch on the ongoing costs and challenges tied to integrating the company’s expanding LTL segment, especially if…

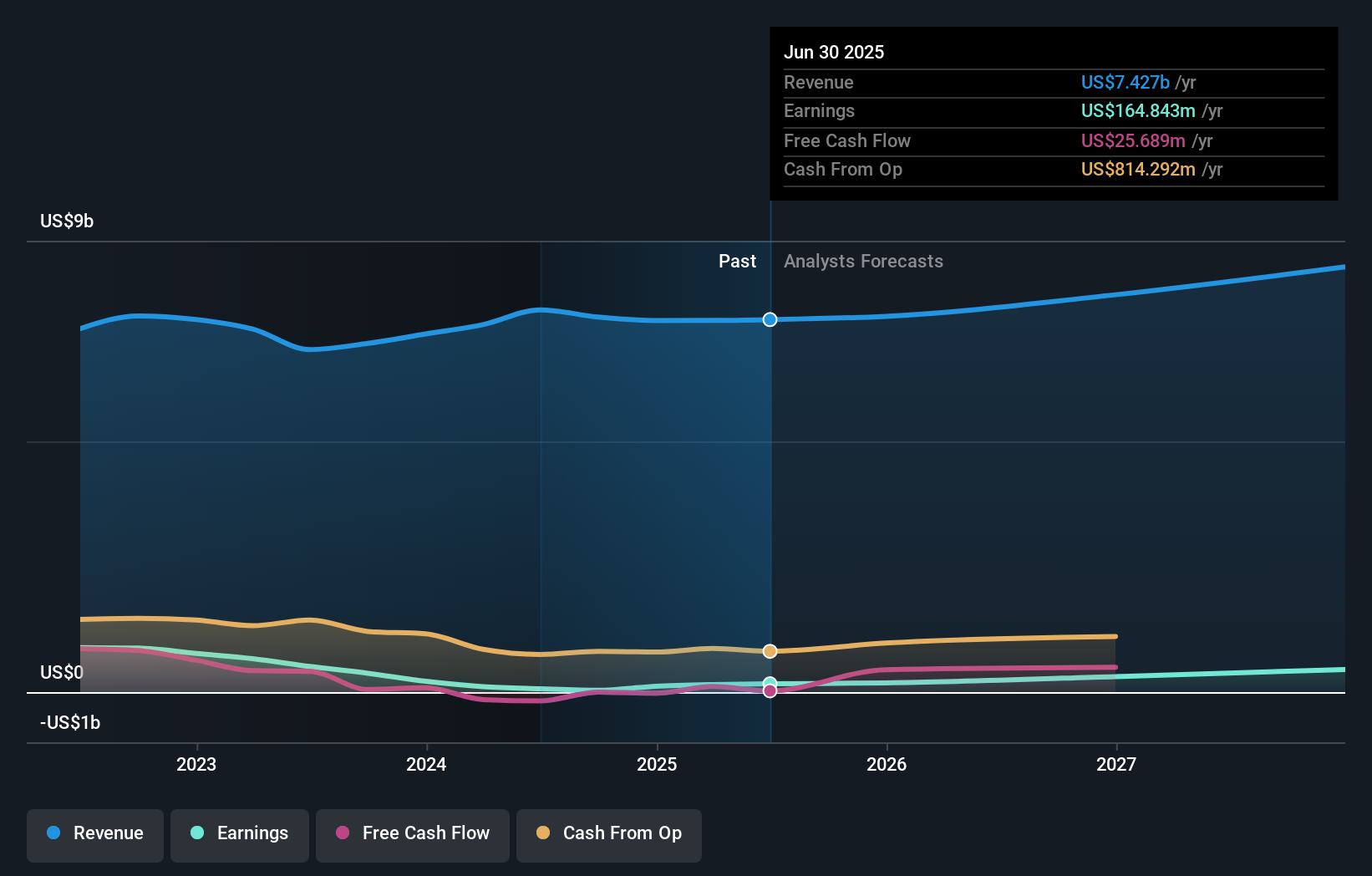

Knight-Swift Transportation Holdings' outlook anticipates $8.7 billion in revenue and $524.7 million in earnings by 2028. This scenario assumes a 5.3% annual revenue growth rate and an earnings increase of $359.9 million from current earnings of $164.8 million.

Uncover how Knight-Swift Transportation Holdings' forecasts yield a $52.21 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered fair value estimates ranging from US$52.21 to US$66.05 across just 2 analyses. While opinions differ widely on potential upside, tightening truckload supply and new regulations could prove decisive for the company’s outlook.

Explore 2 other fair value estimates on Knight-Swift Transportation Holdings - why the stock might be worth just $52.21!

Build Your Own Knight-Swift Transportation Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Knight-Swift Transportation Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Knight-Swift Transportation Holdings' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.