Please use a PC Browser to access Register-Tadawul

Kratos Defense & Security Solutions (KTOS) Unveils Driverless Trucking Technology in Motorsports Logistics

Kratos Defense & Security Solutions, Inc. KTOS | 73.13 | -1.52% |

Kratos Defense & Security Solutions (KTOS) captured attention with its 72% price movement in the last quarter, likely bolstered by its collaboration with Champion Tire & Wheel for the Brickyard 400, marking the debut of driverless trucking in motorsports logistics. During the same period, Kratos also advanced their 5G-NTN capabilities alongside Intelsat and announced a new facility in Oklahoma. While the overall market showed optimism with the S&P 500 reaching record highs, Kratos' specific innovations and collaborations would have added notable weight to its stock performance, countering any minor market pullbacks.

The recent achievements of Kratos Defense & Security Solutions highlight potential for significant future growth. The collaboration with Champion Tire & Wheel introduces innovative logistics solutions with driverless trucks, which could set a precedent for further advancements in Kratos' technology. This, along with their expansion of 5G-NTN capabilities and the new Oklahoma facility, provides a robust foundation for continued revenue growth.

Over the past three years, Kratos' shares have achieved a total return of 294.16%, highlighting the company’s strong performance. Comparatively, over the past year, Kratos outperformed the US Aerospace & Defense industry, which returned 37.1%. This indicates a solid standing within its sector.

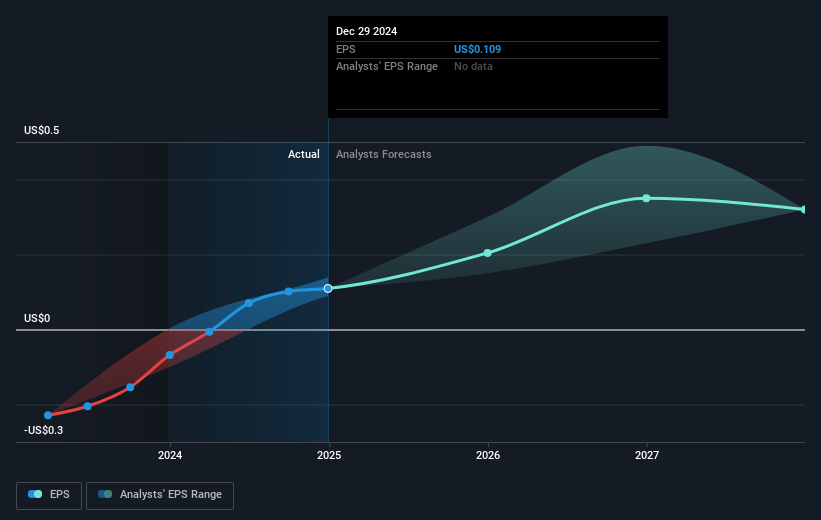

The recent developments are expected to bolster Kratos' revenue and earnings projections. The pursuit of ventures such as the MACH-TB hypersonic contract, along with increasing defense budgets, offers potential for enhanced revenue and profit margins. Analysts foresee annual revenue growth of 16% and an increase in profit margins from 1.7% to 4.4% within three years.

With a current share price of US$59.36, Kratos is trading above the average analyst price target of US$55.46, though the consensus suggests the stock is slightly undervalued. Investors should consider these factors and future growth prospects while recognizing that analyst targets reflect current expectations rather than future guarantees. As always, individual research is recommended before making investment decisions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.