Please use a PC Browser to access Register-Tadawul

Krystal Biotech RMAT Win For KB707 And What It Means For Valuation

Krystal Biotech, Inc. KRYS | 261.80 | -0.33% |

- Krystal Biotech received FDA Regenerative Medicine Advanced Therapy (RMAT) designation for KB707, an inhaled, redosable immunotherapy for advanced non small cell lung cancer.

- The designation is based on early clinical evidence that KB707 may provide meaningful antitumor activity in advanced or metastatic NSCLC.

- RMAT status can create a faster and more flexible regulatory path for therapies targeting serious or life threatening conditions.

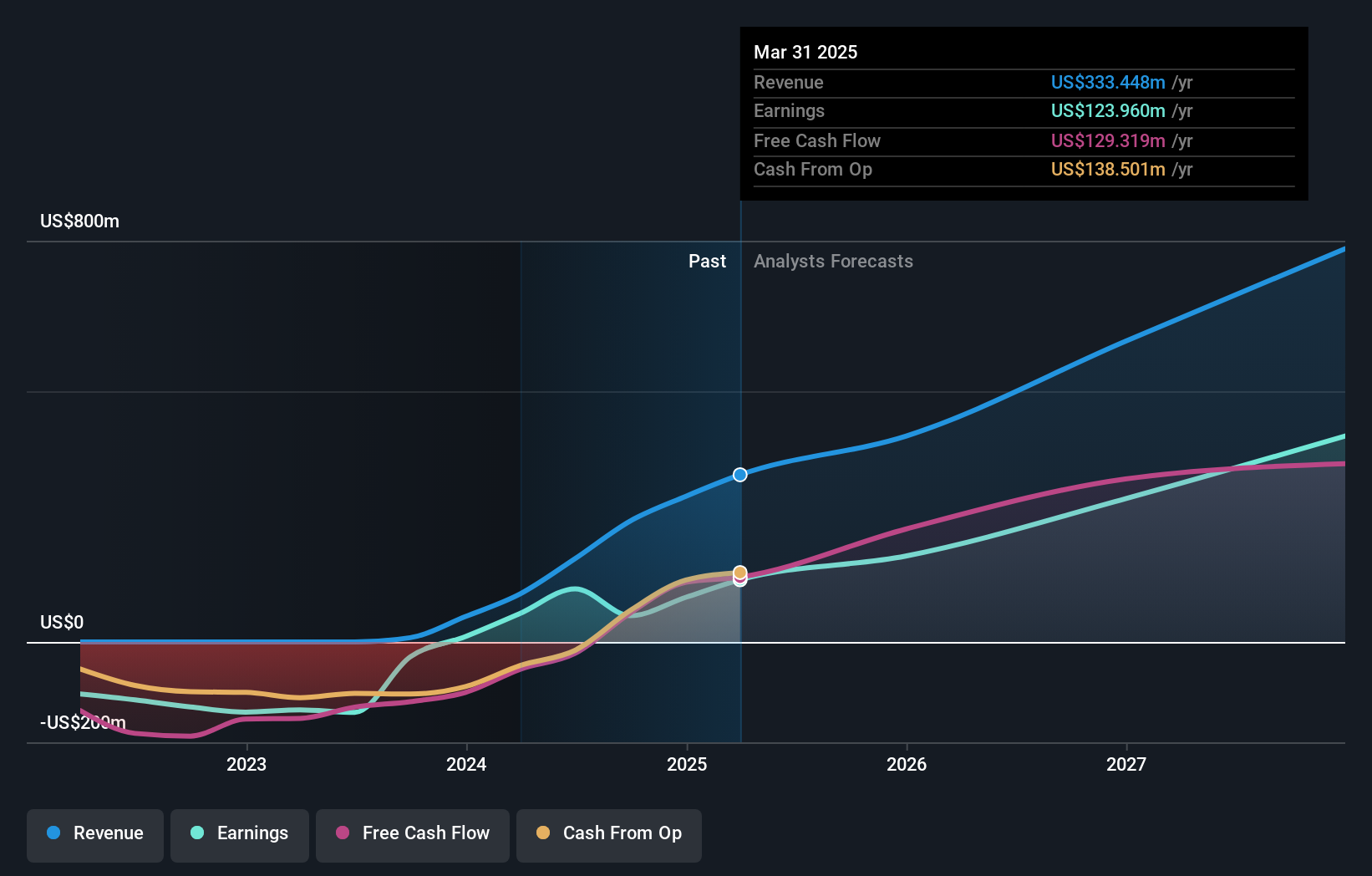

For Krystal Biotech, ticker NasdaqGS:KRYS, this RMAT decision lands with the stock trading around $270.7 and very large multi year returns, with the 1 year move at 80.6% and the 3 year change at 260.9%. Those figures reflect a company that is already on investor radars, so an additional regulatory milestone around KB707 is likely to be closely watched.

For you as an investor, the key takeaway is that RMAT can open more frequent interaction with the FDA and potential eligibility for expedited review. This may influence how KB707 progresses. The real test will be how future clinical data in advanced NSCLC develop over time and whether they continue to support the promise suggested by the early antitumor activity.

Stay updated on the most important news stories for Krystal Biotech by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Krystal Biotech.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$270.70, Krystal Biotech trades about 6% below the US$289.10 analyst target, which sits comfortably inside the wider US$220 to US$336 range.

- ✅ Simply Wall St Valuation: Simply Wall St currently assesses the shares as trading around 52.7% below its estimated fair value.

- ✅ Recent Momentum: The stock shows a 3.6% gain over the last 30 days, suggesting steady interest around the time of the RMAT news.

There is only one way to know the right time to buy, sell or hold Krystal Biotech. Head to Simply Wall St's company report for the latest analysis of Krystal Biotech's Fair Value.

Key Considerations

- 📊 RMAT status for KB707 adds a new potential growth driver on top of Krystal Biotech's existing revenue and profit base.

- 📊 Watch upcoming KB707 NSCLC trial updates, regulatory interactions and how they line up with the current P/E of 39.5 versus the Biotechs industry average of 22.0.

- ⚠️ Even with no specific risks flagged in the data, KB707 remains an early stage lung cancer program where clinical and regulatory outcomes can materially affect sentiment.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Krystal Biotech analysis. Alternatively, you can check out the community page for Krystal Biotech to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.