Please use a PC Browser to access Register-Tadawul

KULR Technology Group (KULR) Is Up 9.2% After Launching Advanced Space-Grade Battery Management System

KULR Technology Group Inc KULR | 3.80 | -2.31% |

- In late September 2025, KULR Technology Group launched its next-generation kBMS, an advanced battery management system tailored for defense and space applications, featuring innovations such as radiation-tolerant chipset integration, dual-redundant hardware, reduced power draw, and in-field recalibration.

- This product broadens KULR's scope beyond thermal management, enabling it to offer comprehensive battery safety and intelligence solutions across a range of mission-critical industries.

- We'll explore how the introduction of a space-rated, recalibratable battery management system could shape KULR's investment thesis and sector positioning.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

KULR Technology Group Investment Narrative Recap

To be a KULR shareholder, you have to believe the company can successfully transition from a services model to a product-driven business and grow mission-critical revenue faster than ongoing dilution or cost pressures erode value. The recent launch of the kBMS broadens KULR’s technological reach and could strengthen its position in defense and space, but its immediate impact on margin improvement or revenue predictability appears limited, as execution and delivery remain the main near-term catalyst and risk.

Among recent developments, KULR’s addition to the S&P Global BMI Index stands out. While this milestone increases visibility among institutional investors, the underlying risk of shareholder dilution, due to ongoing equity financing and still-variable revenue from new product ramps, remains a central theme for those following the near-term catalysts suggested by the kBMS launch.

But despite these opportunities, investors should be aware that ongoing dilution could continue to undermine...

KULR Technology Group's narrative projects $73.8 million revenue and $7.5 million earnings by 2028. This requires 78.5% yearly revenue growth and a $24.8 million earnings increase from current earnings of -$17.3 million.

Uncover how KULR Technology Group's forecasts yield a $30.00 fair value, a 530% upside to its current price.

Exploring Other Perspectives

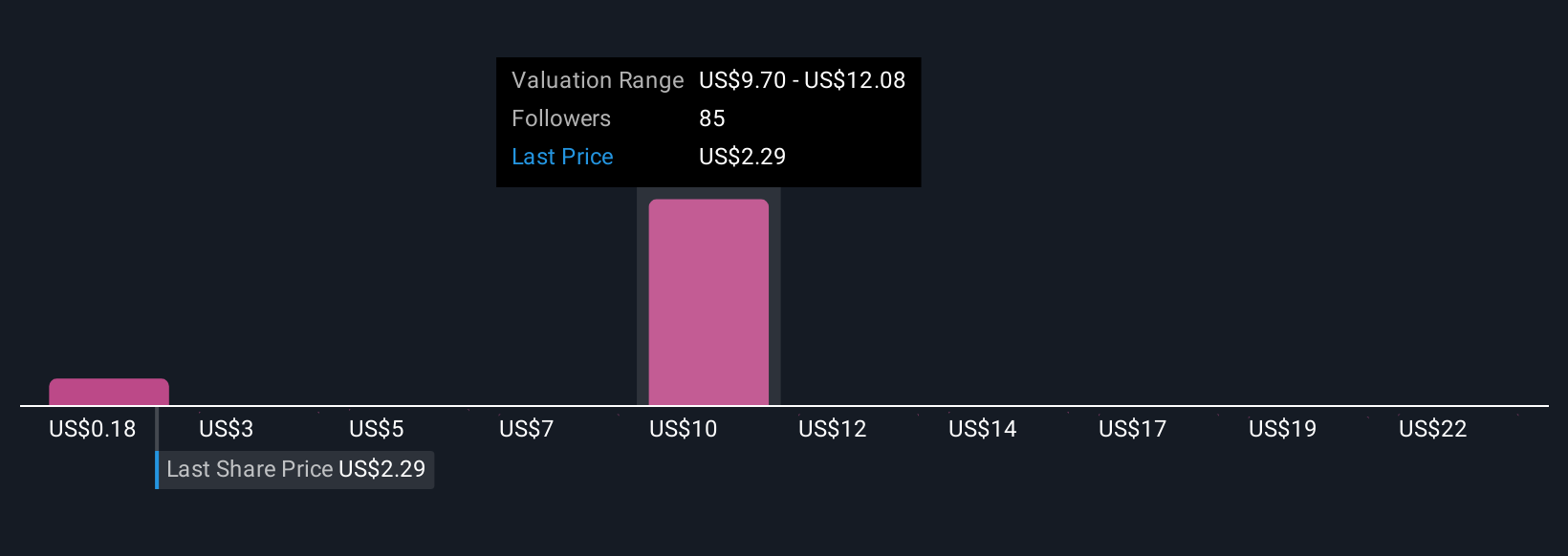

Community estimates for KULR’s fair value range from US$0.36 to US$99.50, with 27 viewpoints submitted to the Simply Wall St Community. While optimism for new product launches runs high, lingering concerns about recurring dilution and unpredictable revenue growth continue to shape investor sentiment.

Explore 27 other fair value estimates on KULR Technology Group - why the stock might be worth less than half the current price!

Build Your Own KULR Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KULR Technology Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free KULR Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KULR Technology Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.