Please use a PC Browser to access Register-Tadawul

Labcorp (LH): Evaluating Valuation After Dividend Boost and Strong Earnings Growth

Labcorp Holdings Inc. LH | 286.47 | -0.92% |

Labcorp Holdings announced that its board will pay a cash dividend of $0.72 per share this December, supported by steady earnings growth. For investors, this move signals ongoing confidence in the company’s financial health and future outlook.

Labcorp’s share price momentum is gaining traction, with a 14.4% rise over the past three months and a strong year-to-date price return of nearly 24%. This follows solid revenue growth and digital health investments, which have contributed to a 1-year total shareholder return of almost 32% as management continues to prioritize both growth and rewarding shareholders.

If recent gains have you thinking bigger, now is the perfect time to broaden your search and discover See the full list for free.

With so much momentum and upbeat analyst sentiment, is Labcorp’s impressive run a sign that shares remain undervalued? Or is the market already factoring in all of its future growth potential for investors?

Most Popular Narrative: 4% Undervalued

Labcorp Holdings' most widely followed narrative values the stock about 4% higher than its recent close. This small margin suggests the narrative is nearly in sync with where shares currently trade, making its fair value projection especially worth a closer look.

Labcorp's strategic collaborations and acquisitions, such as with Inspira Health and BioReference Health, are expected to drive revenue growth by expanding its presence in high-growth therapeutic areas like oncology and strengthening partnerships with health systems.

Curious what bold earnings and margin projections are baked into this valuation? Behind this number lies an ambitious financial roadmap and key assumptions that could make or break the outlook. Dive in to see the surprising elements analysts believe justify this price target.

Result: Fair Value of $294.65 (UNDERVALUED)

However, shifts in regulations or heightened competitive pressures could quickly challenge these upbeat forecasts and alter Labcorp’s expected growth trajectory.

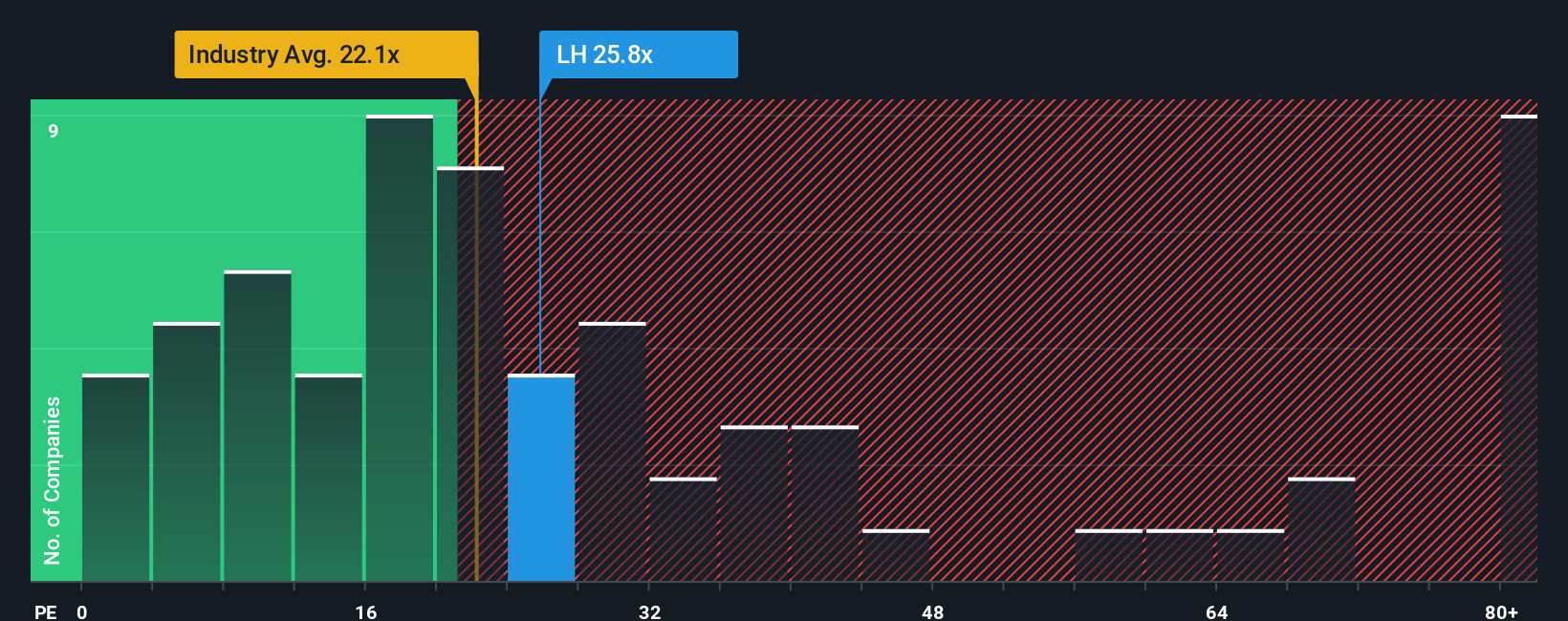

Another View: An Expensive Multiple?

Looking at Labcorp’s price-to-earnings ratio, the picture changes. Shares currently trade at 30.8 times earnings, which is meaningfully higher than both the US Healthcare industry average of 20.8 and its main peer average of 17.6. Even the fair ratio is lower at 25.3.

This elevated multiple means investors are paying a premium for future growth. Will the company’s results meet these high expectations, or is the risk of a re-rating greater?

Build Your Own Labcorp Holdings Narrative

If you’re keen to test your own perspective or want a fresh take grounded in personal research, building your Labcorp Holdings narrative is quick and straightforward. The process often takes under three minutes. Do it your way

A great starting point for your Labcorp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next move count. Exceptional opportunities are only a click away, and missing out could mean leaving gains on the table. Don’t limit yourself. Step up your portfolio by checking out these hand-picked themes:

- Boost your income stream by tapping into high-yielding opportunities with steady payouts through these 18 dividend stocks with yields > 3%.

- Seize rapid growth prospects in emerging sectors by getting ahead of the curve with these 24 AI penny stocks.

- Target strong upside potential by focusing on companies trading below their intrinsic value with these 870 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.