Please use a PC Browser to access Register-Tadawul

Lacklustre Performance Is Driving Avis Budget Group, Inc.'s (NASDAQ:CAR) 27% Price Drop

Avis Budget Group, Inc. CAR | 131.03 | -2.86% |

To the annoyance of some shareholders, Avis Budget Group, Inc. (NASDAQ:CAR) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

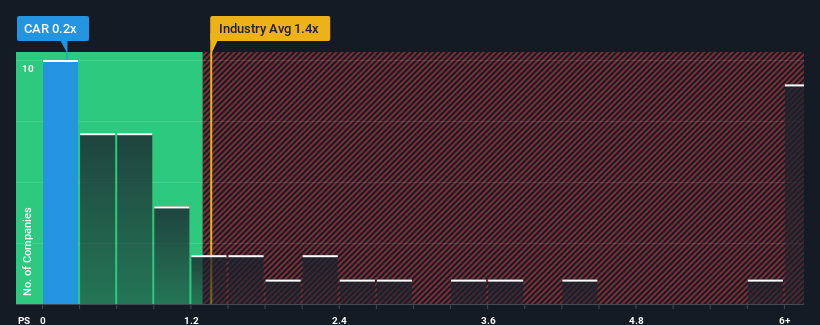

Since its price has dipped substantially, Avis Budget Group's price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Transportation industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Avis Budget Group Performed Recently?

Avis Budget Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Avis Budget Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Avis Budget Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Avis Budget Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.8%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 1.5% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 8.4% each year, which is noticeably more attractive.

In light of this, it's understandable that Avis Budget Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Avis Budget Group's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Avis Budget Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Avis Budget Group, and understanding should be part of your investment process.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.