Please use a PC Browser to access Register-Tadawul

Landmark TVA SMR Deal Might Change The Case For Investing In NuScale Power (SMR)

NuScale Power SMR | 18.10 | -1.33% |

- ENTRA1 Energy recently announced an agreement with the Tennessee Valley Authority to deploy up to 6 gigawatts of NuScale Power's small modular reactor capacity across seven states, marking the largest planned SMR rollout in the U.S. to date.

- Alongside this, a sizable share sale by Fluor Corp and analyst downgrades have spotlighted financial and execution risks just as NuScale’s technology achieves key commercialization milestones.

- We'll explore how this landmark deployment agreement shapes NuScale Power’s commercialization prospects amid heightened execution and funding scrutiny.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

NuScale Power Investment Narrative Recap

For NuScale Power, owning shares means believing in the company's ability to pioneer commercial small modular reactor (SMR) technology, capitalizing on exclusive NRC design approval and first-mover advantage. The recent ENTRA1 Energy and TVA agreement confirms potential large-scale deployment, supporting the main commercialization catalyst; however, concerns around project execution and near-term funding requirements remain central risks and are not materially lessened by this news.

Among recent announcements, the September 2025 commitment to support ENTRA1 Energy’s landmark 6 GW deal with TVA stands out for its scale and alignment with NuScale’s growth ambitions. This underscores both the magnitude of commercial opportunity and why successful execution of this contract is crucial to unlocking the next phase of NuScale’s revenue and credibility milestones.

Yet in contrast to the excitement around contracts, investors should be aware the complexity of actually securing long-term customer agreements and associated cash flows remains unresolved as...

NuScale Power's narrative projects $402.3 million revenue and $42.2 million earnings by 2028. This requires 121.5% yearly revenue growth and a $178.8 million earnings increase from current earnings of $-136.6 million.

Uncover how NuScale Power's forecasts yield a $41.69 fair value, a 6% upside to its current price.

Exploring Other Perspectives

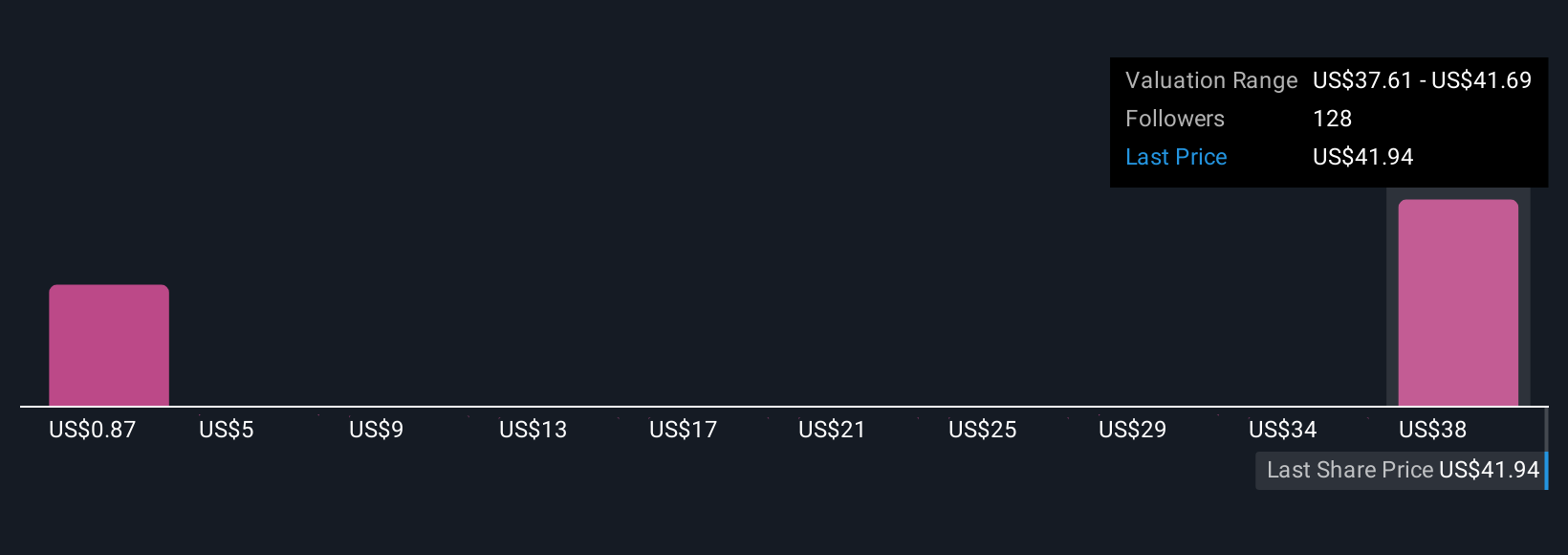

Thirteen members of the Simply Wall St Community estimate NuScale’s fair value between US$0.87 and US$41.69. The challenge of finalizing customer agreements still looms, shaping the path for future returns amid widespread investor debate.

Explore 13 other fair value estimates on NuScale Power - why the stock might be worth less than half the current price!

Build Your Own NuScale Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NuScale Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NuScale Power's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.