Please use a PC Browser to access Register-Tadawul

Landstar Leans On Heavy Haul And AI As Earnings Face Pressure

Landstar System, Inc. LSTR | 153.14 | +2.05% |

- Landstar System (NasdaqGS:LSTR) is accelerating growth initiatives in heavy haul and U.S. Mexico cross border freight.

- These segments now represent about 20% of the business and delivered record heavy haul revenue in FY2025.

- The company plans to allocate about half of its 2026 IT capital spending to AI enablement and related technology.

- The moves come as the freight market remains soft and insurance costs stay elevated.

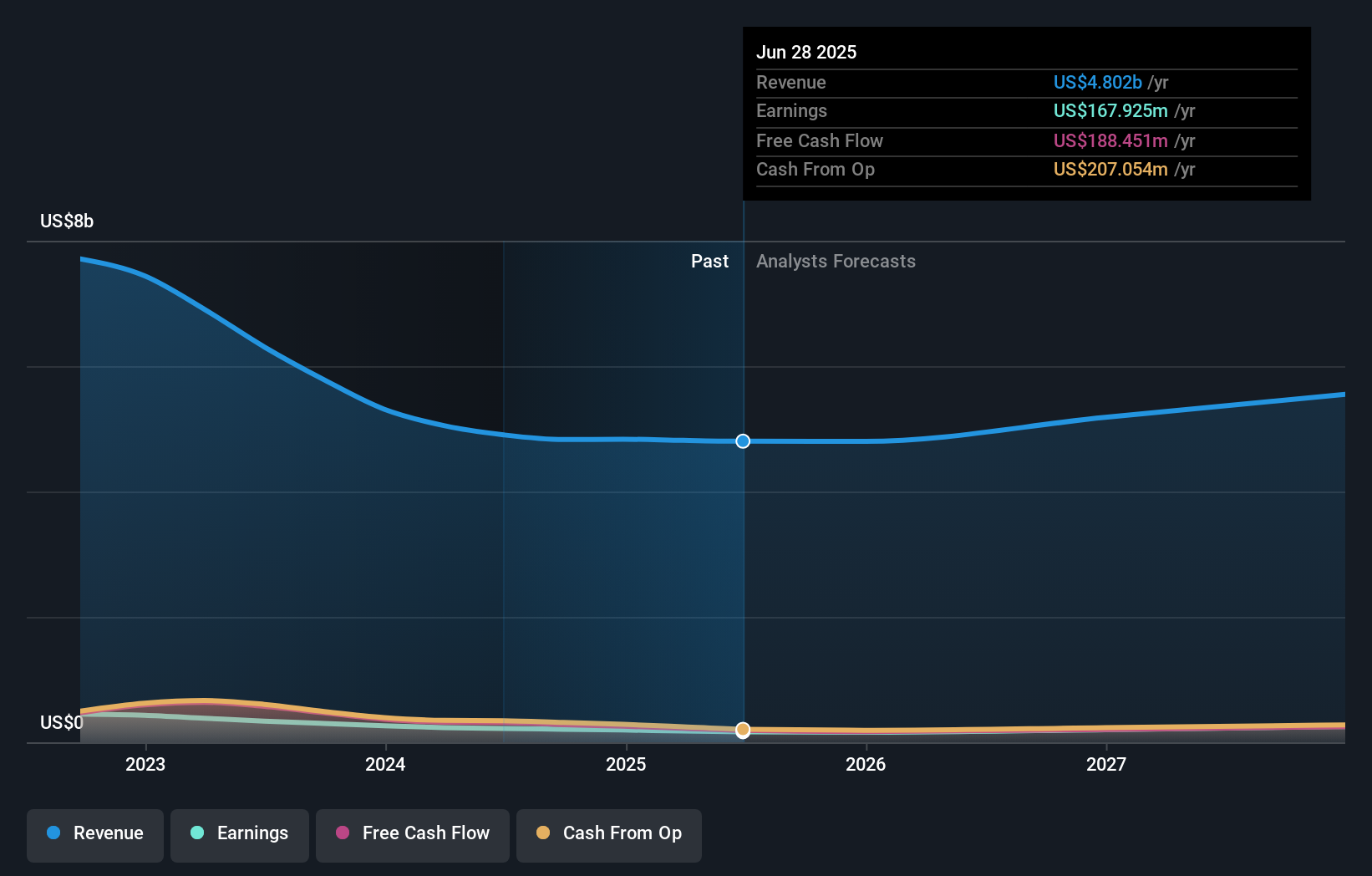

Landstar System, a North American asset light truck brokerage and logistics company, is leaning into heavy haul and U.S. Mexico cross border freight at a time when many shippers are reassessing how they move complex and time sensitive loads. With these services now accounting for about 20% of its business and heavy haul revenue hitting a record in FY2025, the mix of freight the company is handling is changing in a visible way. This shift is happening while the broader trucking sector continues to work through a soft freight market and higher insurance expenses.

At the same time, Landstar System is earmarking roughly half of its 2026 IT capital budget for AI focused projects that are intended to support agent productivity and operational efficiency. For you as an investor, the combination of heavier exposure to complex freight and a larger technology budget results in a different risk and opportunity profile compared with a traditional truck broker that stays closer to standard dry van loads. How effectively the company executes on these priorities could influence how its competitive position evolves in the coming years.

Stay updated on the most important news stories for Landstar System by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Landstar System.

For you as an investor, the key tension in this update is that Landstar is leaning into higher complexity freight and AI-powered tools at the same time as full year 2025 sales and net income were lower than the prior year and Q4 earnings missed expectations. Heavy haul and U.S. Mexico cross-border services, plus a sizeable AI-focused IT budget, point to a company trying to differentiate its asset-light model versus peers like C.H. Robinson and RXO, while still dealing with elevated insurance and claims expenses and a soft freight market.

How This Fits Into The Landstar System Narrative

The push into record heavy haul revenue of US$569 million in 2025 and a heavier AI allocation ties directly into the longer term narrative that specialized freight and technology can support efficiency and margin stability over a cycle. At the same time, the recent drop in net income from US$195.95 million to US$115.01 million and lower profit margins shows why analysts also focus on risks such as insurance costs, cyclical end markets and competition from more tech-centric brokers.

Risks and Rewards To Keep In Mind

- ⚠️ Profit margins are lower than last year, and Q4 included US$22 million of unfavorable insurance claims, which pressures earnings quality.

- ⚠️ Freight demand remains soft, and analysts have highlighted exposure to cyclical sectors and competitive pressure from other large brokers.

- 🎁 Heavy haul revenue grew 14% in 2025 to a record level and rose 23% year on year in Q4, showing traction in specialized freight.

- 🎁 Landstar continues to return capital through dividends, including the US$0.40 quarterly payout, and ongoing buybacks that have reduced the share count over time.

What To Watch Next

Looking ahead, you may want to track whether AI-focused IT spending translates into better variable contribution margins, how insurance and claims trends develop, and whether heavy haul and cross-border growth can offset softer dry van freight. If you want to see how other investors are thinking about this story over the longer term, take a moment to check community narratives on Landstar System here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.