Please use a PC Browser to access Register-Tadawul

Lantheus Holdings (LNTH) Faces Class Action Over Pylarify Sales Projections

Lantheus Holdings Inc LNTH | 64.89 | +0.05% |

Lantheus Holdings (LNTH) is currently facing a class action lawsuit for allegedly providing misleading statements about its financial outlook, leading to a decrease in the sales of its principal product, Pylarify. In the past week, Lantheus experienced a 4.81% decline in its share price. This occurred while the U.S. stock markets reached record highs, driven by inflation data that kept hopes for interest rate cuts alive. While the legal proceedings might have added weight to Lantheus’s decline, it contrasted with the broader market’s upward movement, highlighting investor concerns specific to the company's challenges.

The recent class action lawsuit facing Lantheus Holdings could significantly impact the company's strategic narrative, which emphasizes growth opportunities in Alzheimer's and oncology imaging. If the allegations prove true, they might amplify investor worries about the company’s leadership and operational transparency amidst market pressures. This could further exacerbate the investor sentiment that has already contributed to a 4.81% share price decline.

Despite short-term volatility, Lantheus's long-term shareholder returns are notable, with a 300.15% increase over the past five years. However, these gains are contrasted by underperforming relative returns over the last year, as Lantheus lagged behind the US Medical Equipment industry, which returned 0.7%, and the broader US market, which enjoyed a 19.1% increase.

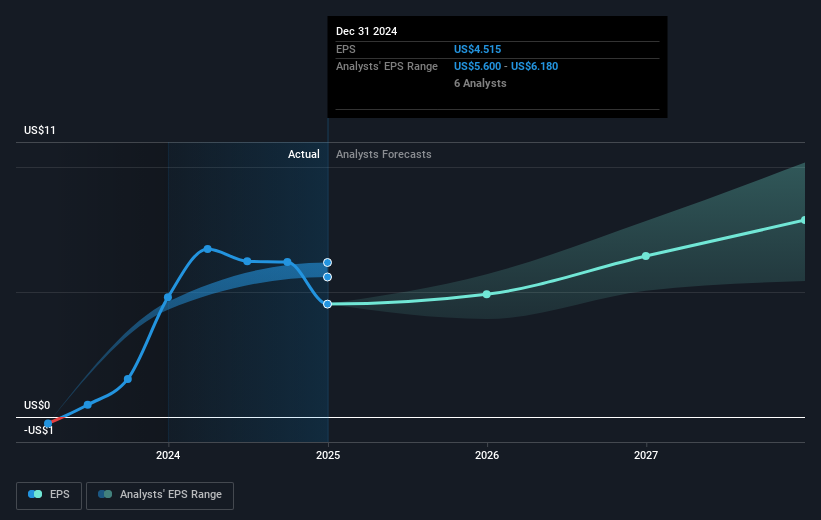

The legal issues may hinder Lantheus's ability to actualize earnings and revenue forecasts. With revenue growing 5.7% annually and earnings anticipated at US$419.8 million by September 2028, uncertainty regarding legal outcomes could necessitate revisions to these projections. Such outcomes also pose risks to achieving an analyst consensus price target of US$89.5, especially when the current share price stands at US$52.50, reflecting a significant gap that suggests substantial recovery is needed. While longer-term growth prospects remain buoyant, the pending legal challenges present immediate headwinds to both market confidence and valuation progress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.