Please use a PC Browser to access Register-Tadawul

Las Vegas Sands Draws Fresh Focus On Asia Tourism Recovery Risks

Las Vegas Sands Corp. LVS | 60.87 | +1.53% |

- Las Vegas Sands (NYSE:LVS) is drawing fresh attention as global tourism and luxury travel interest pick up, with a particular focus on its Macau and Singapore resorts.

- The company sits at the center of Asia’s post pandemic tourism recovery story while facing ongoing regulatory and market volatility in these regions.

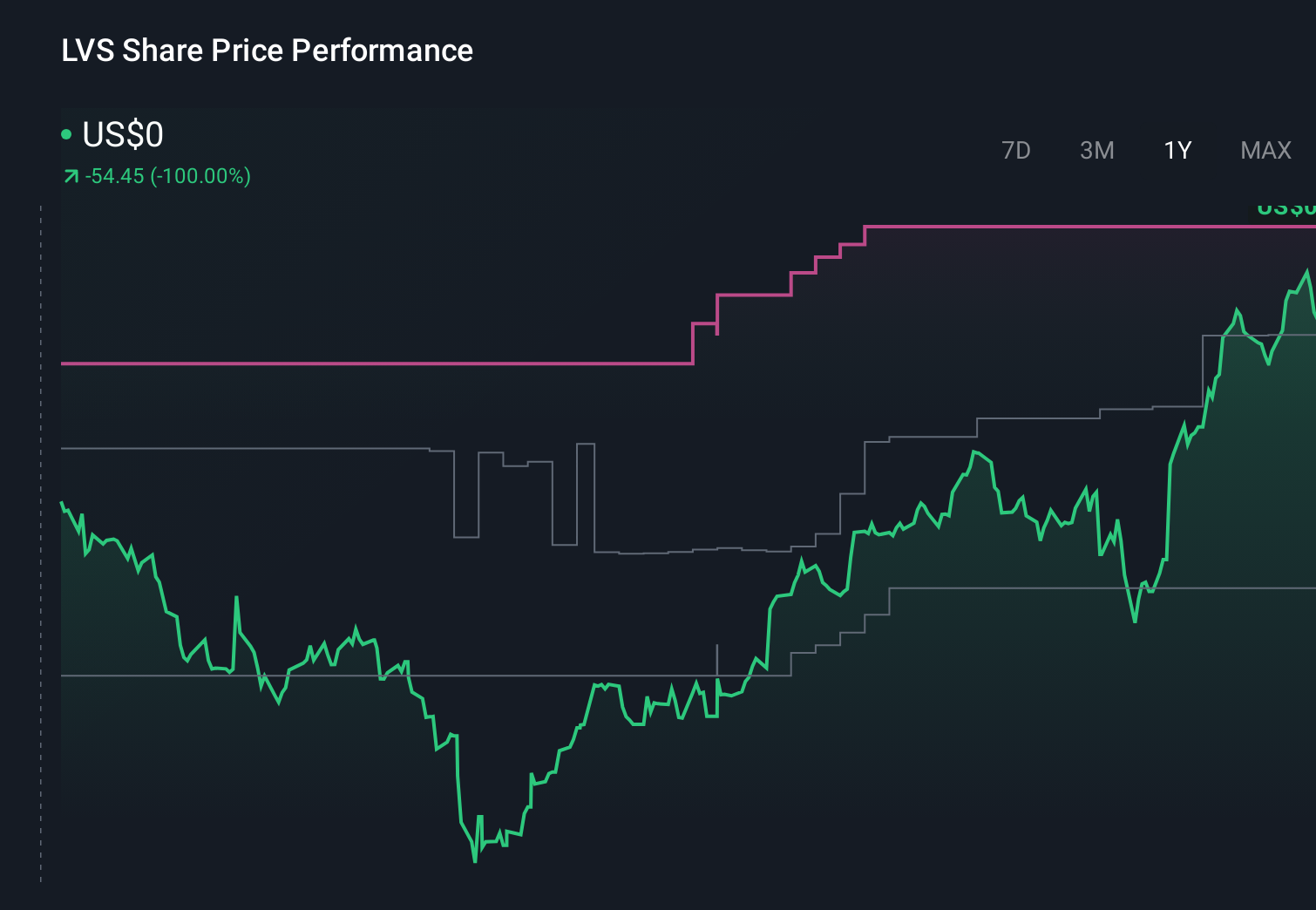

- Investors are reassessing the stock, with NYSE:LVS last closing at $59.94 and a 1 year return of 40.9% alongside a 27.9% return over 5 years.

For investors watching travel and leisure, Las Vegas Sands is increasingly back on the radar. The stock most recently closed at $59.94, with a 40.9% return over the past year and 27.9% over 5 years, which helps explain why renewed tourism headlines are getting attention. At the same time, shorter term moves have been more mixed, including a 9.5% decline over the past 30 days.

The key question now is how resurgent travel demand in Macau and Singapore interacts with continuing regulatory and macro risks in those markets. If you are following NYSE:LVS, the setup combines potential upside tied to tourism trends with volatility that can cut both ways, so keeping an eye on new policy moves and travel data will be important.

Stay updated on the most important news stories for Las Vegas Sands by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Las Vegas Sands.

Investor attention around Las Vegas Sands looks closely tied to expectations for travel flows into Macau and Singapore, which are central to its resort portfolio. When sentiment improves on global tourism and luxury spending, interest in the stock tends to pick up as investors look for ways to express a view on high end travel in Asia that also carries exposure to casino activity.

Las Vegas Sands Narrative: Is the Recovery Story Back in Focus?

The renewed focus on Las Vegas Sands fits a broader narrative that treats the company as a concentrated way to express a view on Asia focused travel recovery and premium gaming demand. For investors who already see the stock as a higher risk, higher potential exposure, fresh attention around tourism trends can reinforce the idea that sentiment may swing quickly as data and headlines change.

Risks and Rewards: What the Recent Interest Signals

- Strong brand visibility in Macau and Singapore ties the company closely to international travel and luxury tourism themes that many investors watch.

- Recent share price returns of 40.9% over 1 year and 27.9% over 5 years show that sentiment shifts around travel and gaming can be meaningful for holders.

- Analysts have flagged 3 key risks overall, including concerns that debt is not well covered by operating cash flow, which can matter if travel conditions soften.

- Regulatory changes and potential travel slowdowns in key Asian markets can add volatility to the story, particularly for investors with shorter time horizons.

What to Watch Next

Looking ahead, investors will likely focus on the upcoming fourth quarter 2025 results call and any commentary on visitor trends, regulatory developments, and balance sheet flexibility in Macau and Singapore. If you want to see how different investors are interpreting this setup, you can read community views in this narrative discussion and compare them with your own expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.