Please use a PC Browser to access Register-Tadawul

Leadership Change in Digital Strategy Could Be a Game Changer for American International Group (AIG)

American International Group, Inc. AIG | 75.00 74.00 | +0.13% -1.33% Post |

- On August 18, 2025, American International Group, Inc. announced that Claude Wade, Executive Vice President, Chief Digital Officer and Global Head of Business Operations & Claims, would step down from his current responsibilities on December 31, 2025, due to ongoing health issues, and Scott Hallworth would join as Chief Digital Officer effective September 1, 2025.

- This leadership transition places an executive with both deep insurance and technology experience at the helm of AIG’s digital, data, and GenAI strategy, potentially influencing how the company expands its use of advanced digital tools across core operations.

- Now, we'll review how the appointment of Scott Hallworth as Chief Digital Officer could influence AIG's digital transformation narrative.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American International Group Investment Narrative Recap

For most shareholders, owning American International Group (AIG) is about believing in the company's ongoing transformation, driven by digitalization and operational improvements aimed at sustainable earnings growth. The appointment of Scott Hallworth as Chief Digital Officer underscores AIG's commitment to accelerating its GenAI and data initiatives, but this leadership change is not expected to materially impact the company’s primary short-term catalyst, continued expansion of digital tools to boost efficiency. The biggest risk remains AIG's exposure to volatile catastrophe losses, which could pressure margins despite these digital advances.

The August 6, 2025, earnings release was particularly relevant, as AIG reported significant year-over-year net income growth and improvement in profit margins. This financial momentum provides a favorable backdrop as Mr. Hallworth joins to advance AIG’s digital transformation, supporting the catalyst of operational efficiency and underwriting advancement. However, despite these headwinds, investors should consider...

American International Group's projections point to $31.3 billion in revenue and $3.8 billion in earnings by 2028. This is based on analysts' assumptions of 4.5% annual revenue growth and a $0.5 billion increase in earnings from the current $3.3 billion.

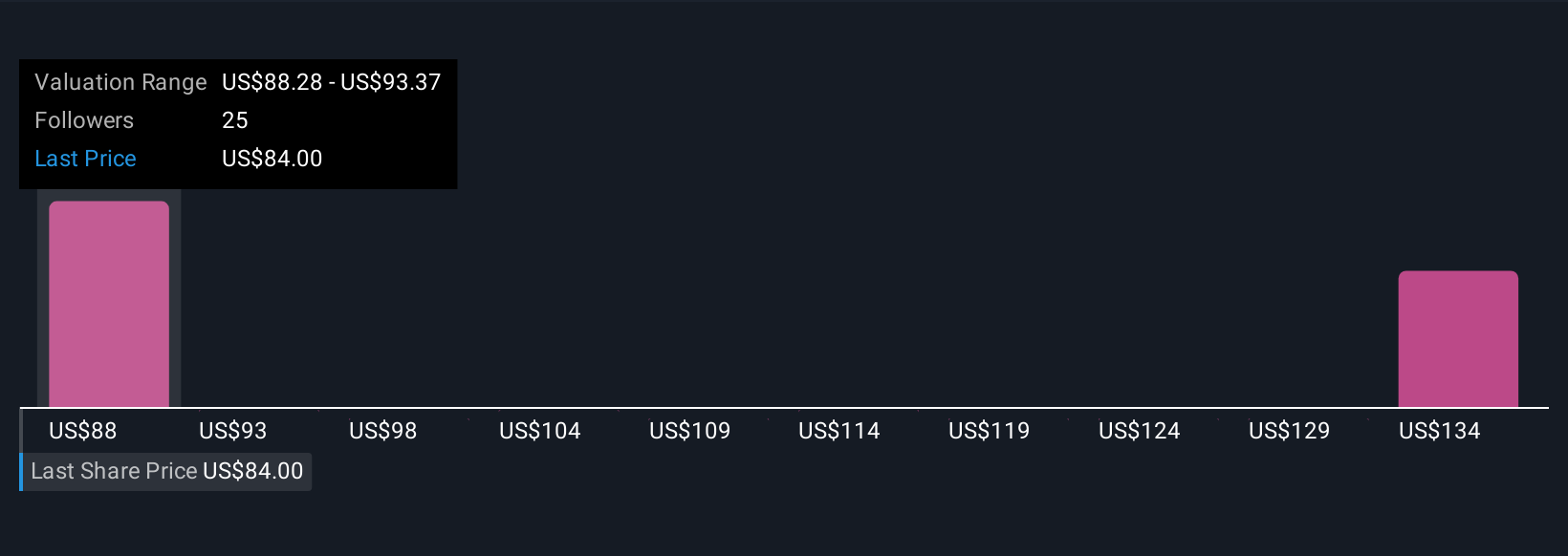

Uncover how American International Group's forecasts yield a $88.28 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from US$88.28 to US$139.84 per share. While opinions diverge widely, recent executive appointments highlight the emphasis on technology-driven transformation that could influence future outcomes.

Explore 4 other fair value estimates on American International Group - why the stock might be worth as much as 68% more than the current price!

Build Your Own American International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American International Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free American International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American International Group's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.