Please use a PC Browser to access Register-Tadawul

Leadership Transition to Former Ansys CEO Might Change The Case For Investing In Procore Technologies (PCOR)

Procore Technologies PCOR | 74.45 | -3.10% |

- Procore Technologies recently announced that Ajei Gopal, former President and CEO of Ansys, will become CEO Designate and join the Board of Directors, succeeding founder Tooey Courtemanche following the third quarter results, with Courtemanche shifting to his role as Chair.

- Gopal's track record of scaling global technology firms and leading Ansys through a very large US$35 billion acquisition brings seasoned leadership as Procore reiterates its financial guidance during this transition.

- We'll explore how Gopal's arrival and leadership experience might shift Procore's investment narrative and growth outlook going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Procore Technologies Investment Narrative Recap

To own Procore Technologies stock, investors must believe in the company’s position as a leading construction technology platform with room for further adoption, especially as digital transformation in construction accelerates. The CEO transition to Ajei Gopal brings deep enterprise technology experience, but near-term catalysts, like ongoing enterprise AI adoption and execution in global markets, remain the main focus; the CEO change does not materially alter these immediate drivers or the current margin and expansion risks facing the business.

In terms of relevant recent announcements, Procore’s reaffirmed Q3 and full-year 2025 guidance, issued alongside the leadership update, signals continuity in operational expectations despite the management transition. Investors tracking progress against catalysts, such as expanding international revenue and scaling AI-powered solutions, may see this guidance maintenance as an indication that major initiatives remain on track during the executive change.

By contrast, investors should still be mindful that concentrated North American exposure could amplify the impact of economic slowdowns, particularly if...

Procore Technologies' narrative projects $1.8 billion revenue and $240.6 million earnings by 2028. This requires 14.3% yearly revenue growth and a $383.4 million increase in earnings from -$142.8 million.

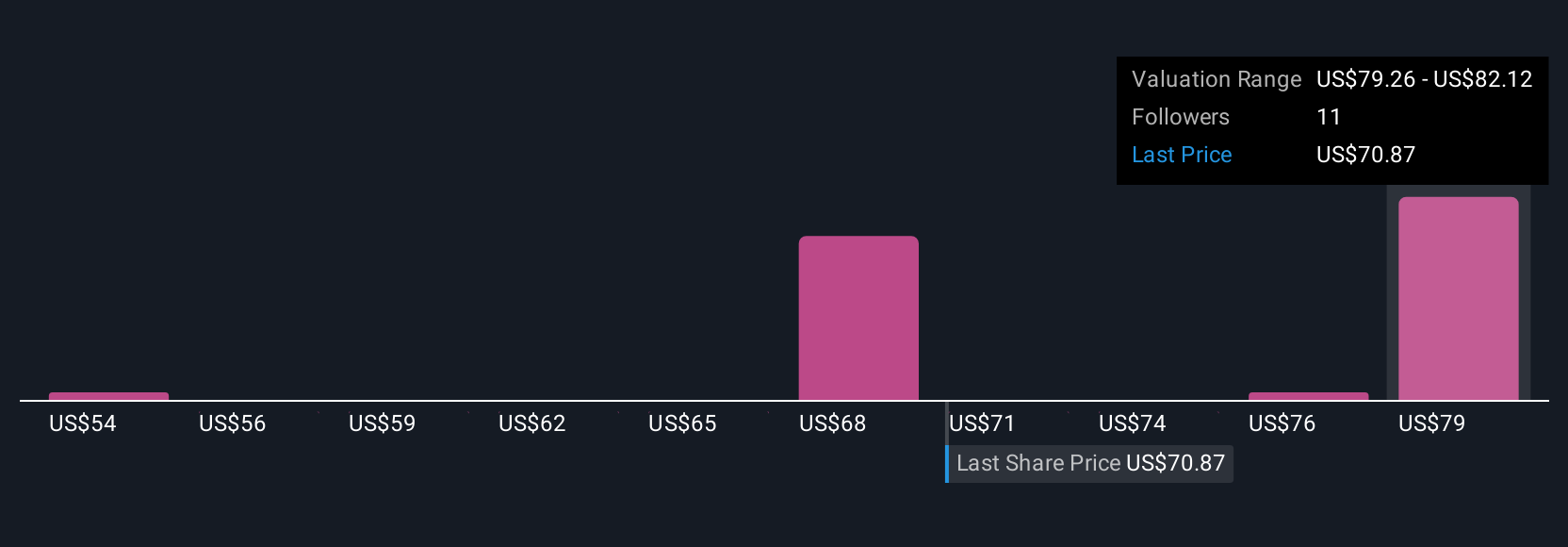

Uncover how Procore Technologies' forecasts yield a $82.12 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Four community fair value estimates for Procore range widely from US$53.58 to US$82.12, reflecting considerable differences in investor outlook from the Simply Wall St Community. With international growth still in early stages and concentrated revenue in North America, these diverse perspectives remind you to weigh how exposure to regional cycles could affect longer-term potential.

Explore 4 other fair value estimates on Procore Technologies - why the stock might be worth as much as 14% more than the current price!

Build Your Own Procore Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Procore Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Procore Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Procore Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.