Please use a PC Browser to access Register-Tadawul

Legal Scrutiny And Governance Questions For Undervalued United Natural Foods

United Natural Foods, Inc. UNFI | 38.74 | +0.16% |

- Ongoing investigation by Kahn Swick & Foti, LLC into potential breaches of fiduciary duty by officers and directors of United Natural Foods, Inc. (NYSE:UNFI).

- A securities class action lawsuit tied to these issues is progressing in court after recent decisions allowed the case to move forward.

- The legal developments highlight governance and disclosure questions that could be material for current and prospective shareholders.

United Natural Foods, Inc. (NYSE:UNFI) operates as a distributor in the food sector, supplying natural, organic, and conventional products to retailers. For you as an investor, legal and governance questions can matter as much as product demand or distribution capacity because they can affect management focus, costs, and decision making over time.

As these proceedings advance, you may want to watch for updates on potential board or management changes, governance reforms, or financial impacts such as legal expenses or settlements. How the company responds and what courts decide could shape future risk perceptions around NYSE:UNFI, especially for investors who place a high weight on governance factors.

Stay updated on the most important news stories for United Natural Foods by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on United Natural Foods.

Quick Assessment

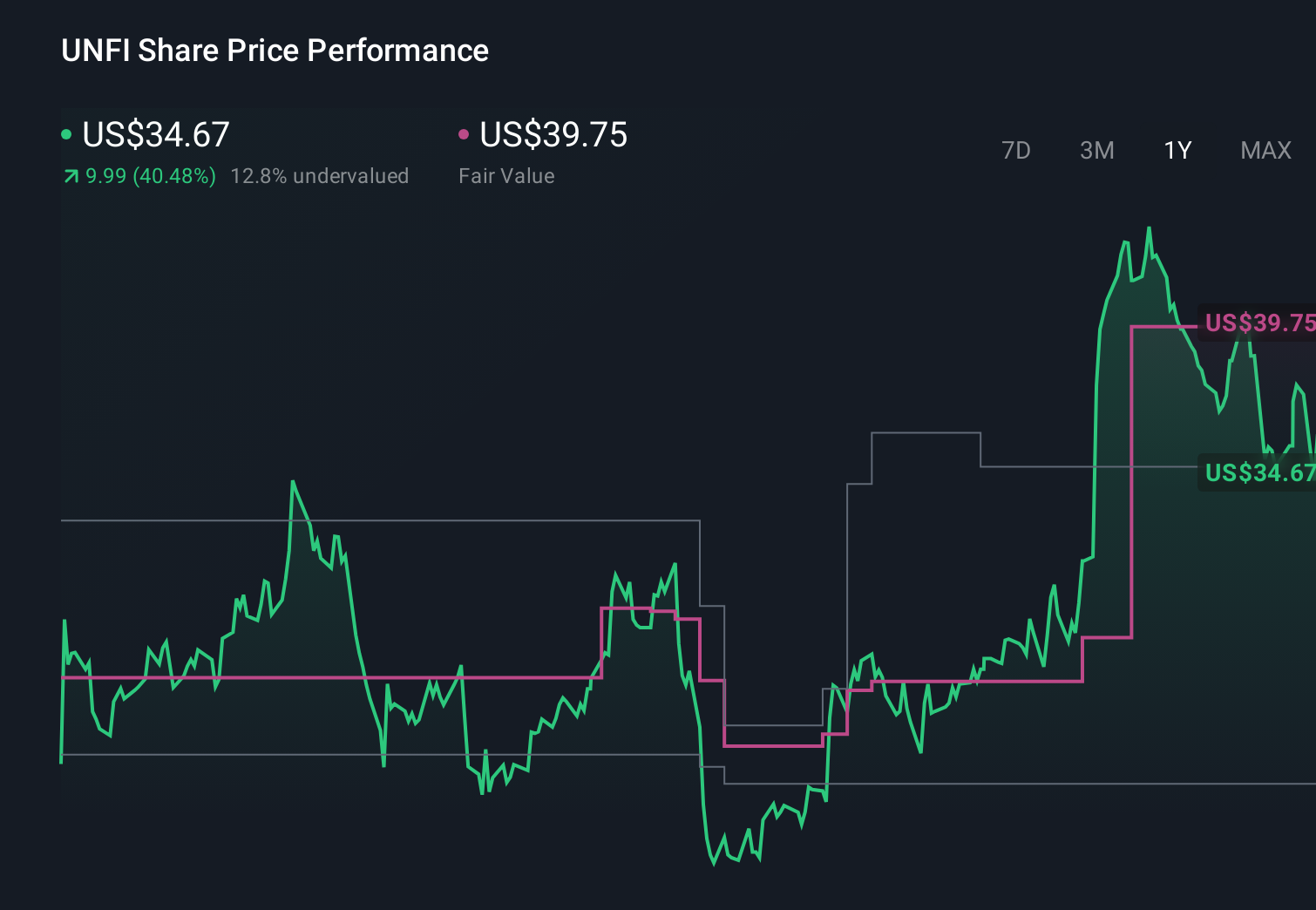

- ✅ Price vs Analyst Target: At US$34.28, the price sits below the US$41.13 analyst target range midpoint.

- ✅ Simply Wall St Valuation: Simply Wall St flags the shares as undervalued, trading about 72% below its estimated fair value.

- ✅ Recent Momentum: The 30 day return of roughly 0.82% shows slightly positive recent price action.

Check out Simply Wall St's in depth valuation analysis for United Natural Foods.

Key Considerations

- 📊 The fiduciary duty investigation and class action keep governance and oversight in focus for anyone holding or tracking NYSE:UNFI.

- 📊 Watch for any disclosures on legal costs, insurance coverage, or board changes, along with how the price tracks versus the US$41.13 target and valuation estimates.

- ⚠️ A key flagged risk is that interest payments are not well covered by earnings, which can matter more if legal outcomes add extra financial pressure.

Dig Deeper

For the full picture including more risks and rewards, check out the complete United Natural Foods analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.