Please use a PC Browser to access Register-Tadawul

Lemonade, Inc.'s (NYSE:LMND) Earnings Haven't Escaped The Attention Of Investors

Lemonade LMND | 81.36 82.70 | +8.38% +1.65% Pre |

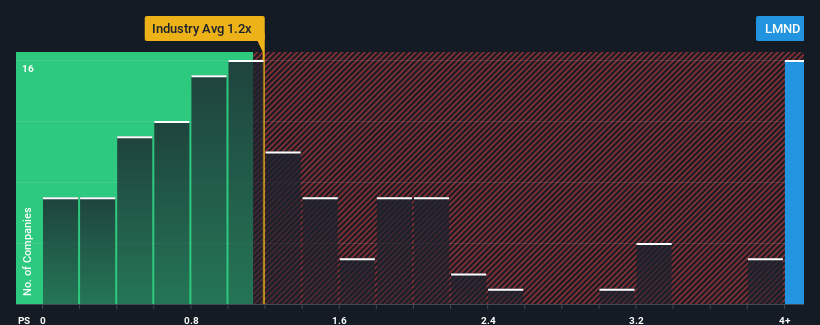

When close to half the companies in the Insurance industry in the United States have price-to-sales ratios (or "P/S") below 1.2x, you may consider Lemonade, Inc. (NYSE:LMND) as a stock to avoid entirely with its 4.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Lemonade's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Lemonade has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Lemonade will help you uncover what's on the horizon.How Is Lemonade's Revenue Growth Trending?

Lemonade's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 30% per annum during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.3% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Lemonade's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Lemonade's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Lemonade shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

If you're unsure about the strength of Lemonade's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.