Please use a PC Browser to access Register-Tadawul

Lennox Buybacks Retire 40% Of Shares And Shape Growth Outlook

Lennox International Inc. LII | 561.01 | +1.94% |

- Lennox International (NYSE:LII) has completed a new share repurchase tranche, buying back nearly 0.85% of its shares in the most recent quarter.

- This brings total buybacks under the long running program to almost 40% of the company’s outstanding shares.

- The latest activity reflects an ongoing focus on returning capital to shareholders through repurchases.

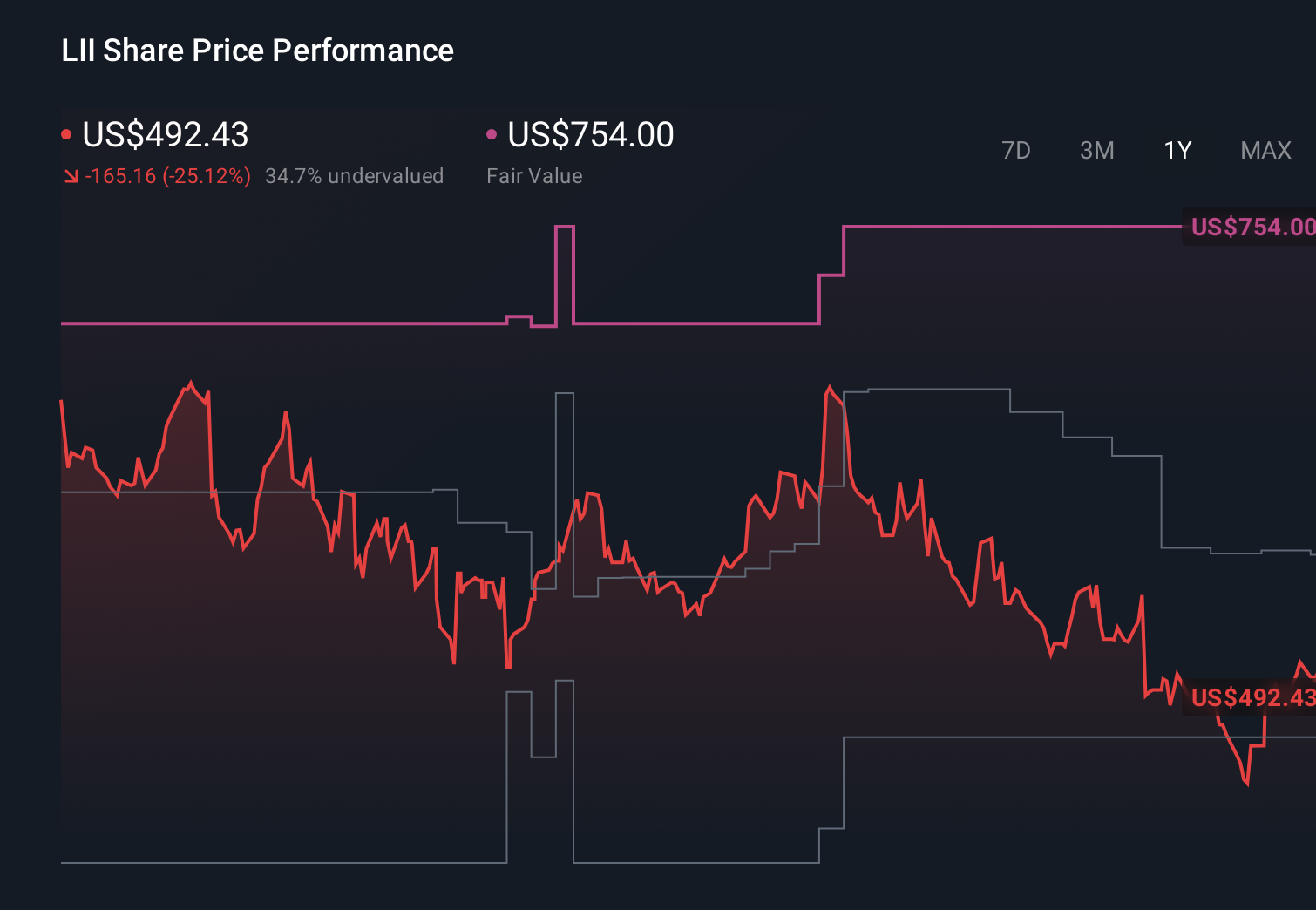

For investors watching NYSE:LII, the scale of the buyback program is now a core part of the story. The stock closed at $529.29, with returns up 6.9% over the past week and 6.1% year to date, while the 3-year return stands at 105.4% and the 5-year return at 91.8%. The 1-year return shows an 8.4% decline, which gives helpful context for how the latest repurchases fit into recent trading.

With almost 40% of shares already retired under this long running program, future updates on the pace and size of repurchases are likely to stay in focus. You might want to watch how management balances buybacks with other uses of cash, such as reinvestment or potential dividends, and how these decisions affect earnings per share and ownership concentration over time.

Stay updated on the most important news stories for Lennox International by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Lennox International.

The latest US$150 million repurchase, retiring 0.85% of Lennox International’s shares in one quarter and nearly 40% since 2014, signals that management continues to see value in shrinking the share count even as sales and net income for 2025 stayed broadly flat year on year. With revenue at US$5,195.3 million and net income at US$805.8 million, the modest uplift in earnings per share suggests that buybacks are already playing a role in supporting per share metrics during a patchy demand backdrop.

Lennox International narrative, how buybacks fit the long term story

The long running repurchase program lines up with existing narratives that focus on a steady, balanced long term outlook supported by commercial expansion, digital tools and energy efficient products. For investors following how Lennox positions itself against peers like Trane Technologies and Carrier Global, the combination of capital returns and guidance for 2026 revenue growth of about 6% to 7% with help from acquisitions points to a management team that is trying to keep shareholder returns aligned with its growth and reinvestment plans.

Risks and rewards to keep in view

- ⚠️ A very large cumulative buyback means less cash available for downturn protection or future investment if residential demand or construction activity weakens further.

- ⚠️ Analysts highlight two key risk factors, including leverage concerns and the potential for insider selling to change, which could change how supportive buybacks look over time.

- 🎁 Earnings per share from continuing operations held up at US$22.79 despite softer revenue, which suggests the reduced share count is helping to support per share results.

- 🎁 Analysts also see one reward factor, with earnings forecast to grow, so fewer shares on issue could matter more if that growth plays out.

What to watch next

From here, it is worth tracking how aggressively Lennox continues to repurchase stock relative to its 2026 revenue guidance, any further acquisition activity and ongoing headwinds like channel destocking and weak residential demand. If you want to see how different investors are connecting these buybacks with Lennox’s long term growth, risks and competitive position versus names like Trane and Carrier, take a few minutes to check community narratives on Lennox International’s dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.