Please use a PC Browser to access Register-Tadawul

LifeStance Growth Raises Questions On Scale Profitability And Shareholder Value

Lifestance Health Group, Inc. LFST | 7.15 | -0.56% |

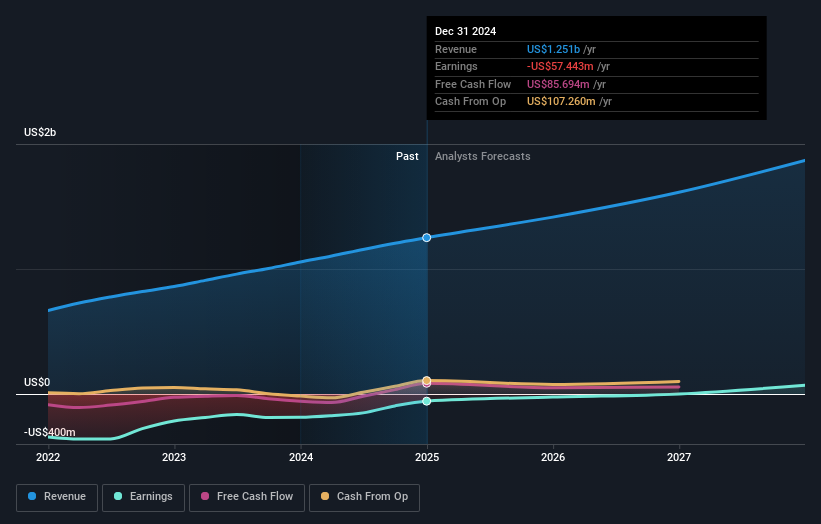

- LifeStance Health Group is facing operational challenges that are coinciding with continued value pressure as it pursues growth.

- Concerns center on subscale operations, limited distribution channels relative to peers, and a track record of negative returns on capital tied to its expansion efforts.

- These issues raise fresh questions about the long term competitiveness and profitability of NasdaqGS:LFST for current and potential shareholders.

LifeStance Health Group, trading on NasdaqGS:LFST at a recent share price of $7.03, is drawing attention for how its growth efforts align with shareholder outcomes. The stock is up 2.9% over the past week, but has seen a 3.0% decline over the past month and an 11.8% decline over the past year, with a 29.0% gain over three years creating a mixed picture for longer term holders.

For investors, the key question is whether LifeStance can address subscale operations and its relatively narrow distribution reach while improving returns on capital. Upcoming periods are likely to focus less on headline growth and more on whether the company can translate its model into more durable profitability and a clearer competitive footing.

Stay updated on the most important news stories for LifeStance Health Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on LifeStance Health Group.

For LifeStance, the tension right now is between its growth footprint and what that growth is doing to shareholder value. Management has built one of the larger outpatient mental health networks in the US, with around 8,000 clinicians across 33 states, but the business is still described as subscale and carrying negative returns on capital. That combination suggests the current clinic and virtual network is not yet generating enough profitable volume to cover the cost of expansion and overhead. With fewer distribution channels than larger rivals such as Universal Health Services, HCA Healthcare, or Teladoc Health in virtual care, LifeStance has less flexibility to spread fixed costs or steer patients efficiently across its system.

How This Fits Into The LifeStance Health Group Narrative

- The focus on clinician productivity and technology in the existing narrative could be directly tested here, because improving utilization per clinician is one way to turn subscale operations into a more efficient network.

- At the same time, the current pattern of value destruction challenges the idea that expansion and M&A alone can support long term margin expansion without stronger discipline on capital allocation.

- The narrative gives weight to acquisitions and a strong balance sheet, but it does not fully address what happens if free cash flow stays weak and limits future investments or shareholder returns.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for LifeStance Health Group to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Ongoing subscale operations and negative returns on capital indicate that each dollar reinvested into growth has not yet created value for shareholders.

- ⚠️ Weaker free cash flow limits LifeStance’s ability to fund technology upgrades, acquisitions, or potential shareholder returns compared with larger, better funded competitors.

- 🎁 A large, nationwide clinician network positions the company to benefit if demand for insured mental health services continues to build and volumes grow within the existing footprint.

- 🎁 Management attention on productivity and digital tools could, if executed well, turn the current infrastructure into a more efficient platform with better unit economics over time.

What To Watch Going Forward

It is worth watching whether upcoming earnings updates show progress on converting the 33 state network into a more self funding model. Key signals include any commentary on clinician retention, visit volumes per clinician, and trends in free cash flow. You might also track how LifeStance positions itself against larger behavioral health and virtual care operators, and whether it adds new distribution channels that can widen patient access without adding disproportionate cost.

To stay informed on how the latest news impacts the investment narrative for LifeStance Health Group, head to the community page for LifeStance Health Group to keep up with the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.