Please use a PC Browser to access Register-Tadawul

LifeStance Health Group (LFST): Evaluating Valuation After Management Highlights Retention and Payer Headwinds at Healthcare Conference

LIFESTANCE HEALTH GROUP, INC. LFST | 6.76 | -2.31% |

Most Popular Narrative: 37.9% Undervalued

The most widely followed narrative sees LifeStance Health Group as significantly undervalued, expecting room for considerable upside if projections hold true.

Investments in AI and digital technology platforms (such as automated revenue cycle tools, patient engagement systems, and enhanced care matching) are expected to drive operating leverage, reduce administrative costs, and improve clinician productivity. These changes could result in higher net margins and increased earnings over the long term.

Want to know the secret engine behind this bullish price target? The narrative is betting on a stunning turnaround, fueled by bold assumptions on future earnings, profit margins, and sustained revenue momentum. Curious about the numbers that justify this rapid growth story and high future valuation? Find out more about the surprising forecasts and aggressive targets that drive this value estimate.

Result: Fair Value of $8.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent clinician shortages or tough new insurance negotiations could quickly reduce these optimistic expectations.

Find out about the key risks to this LifeStance Health Group narrative.Another View: Multiples Tell a Different Story

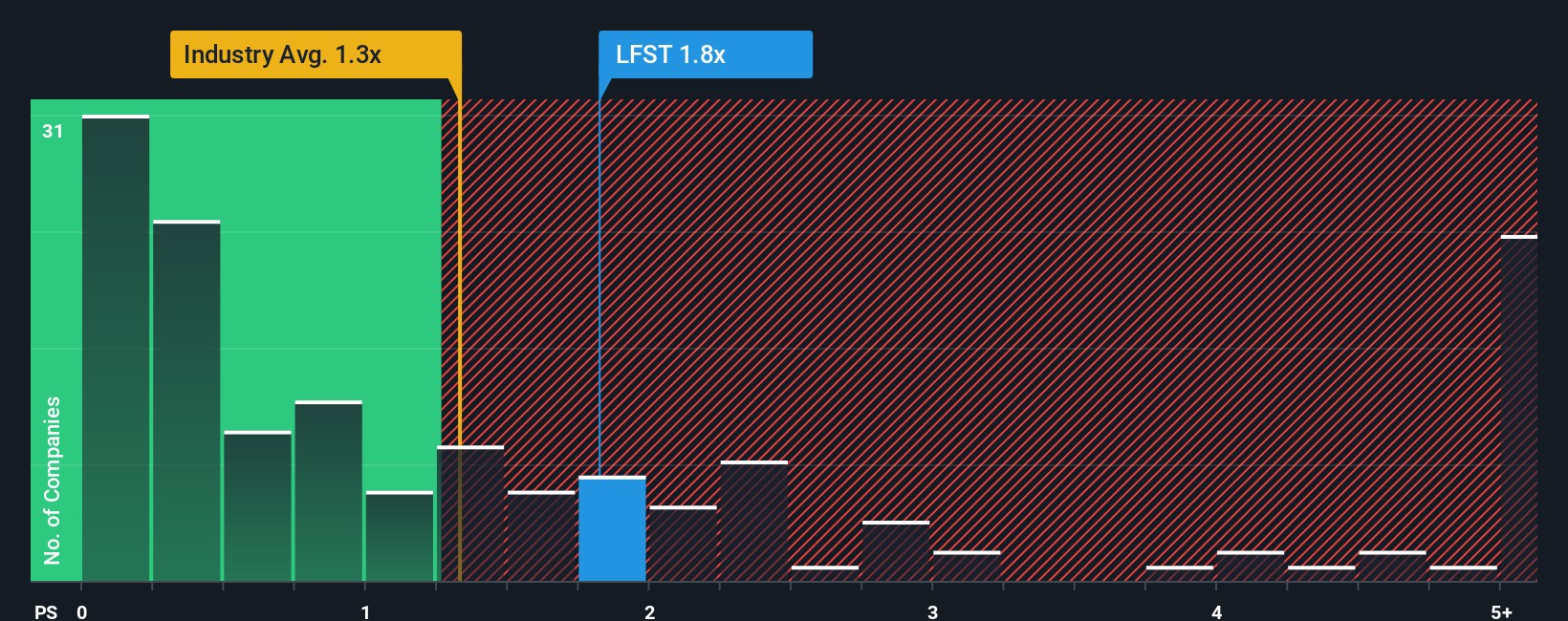

When we look through a different lens, things appear less rosy. Based on its sales ratio, LifeStance Health Group actually looks more expensive than others in the industry. Could the market be right to price in caution?

Build Your Own LifeStance Health Group Narrative

If you see things differently or want to dig deeper into the numbers, you have the tools to craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding LifeStance Health Group.

Looking for more investment ideas?

Don't limit your investing strategy to just one company. Seize the opportunity to find your next big winner by checking out these smart stock picks:

- Supercharge your portfolio with growth potential by targeting emerging technology companies shaking up the AI space with AI penny stocks.

- Tap into stable income streams and future-proof your wealth by browsing companies known for consistent, high-yield payouts thanks to dividend stocks with yields > 3%.

- Get ahead of the curve and uncover exceptional value plays. See which hidden gems are flying under the radar with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.