Please use a PC Browser to access Register-Tadawul

LightPath Technologies, Inc. (NASDAQ:LPTH) Stocks Shoot Up 37% But Its P/S Still Looks Reasonable

LightPath Technologies, Inc. Class A LPTH | 12.34 | -2.30% |

LightPath Technologies, Inc. (NASDAQ:LPTH) shares have had a really impressive month, gaining 37% after a shaky period beforehand. The last month tops off a massive increase of 162% in the last year.

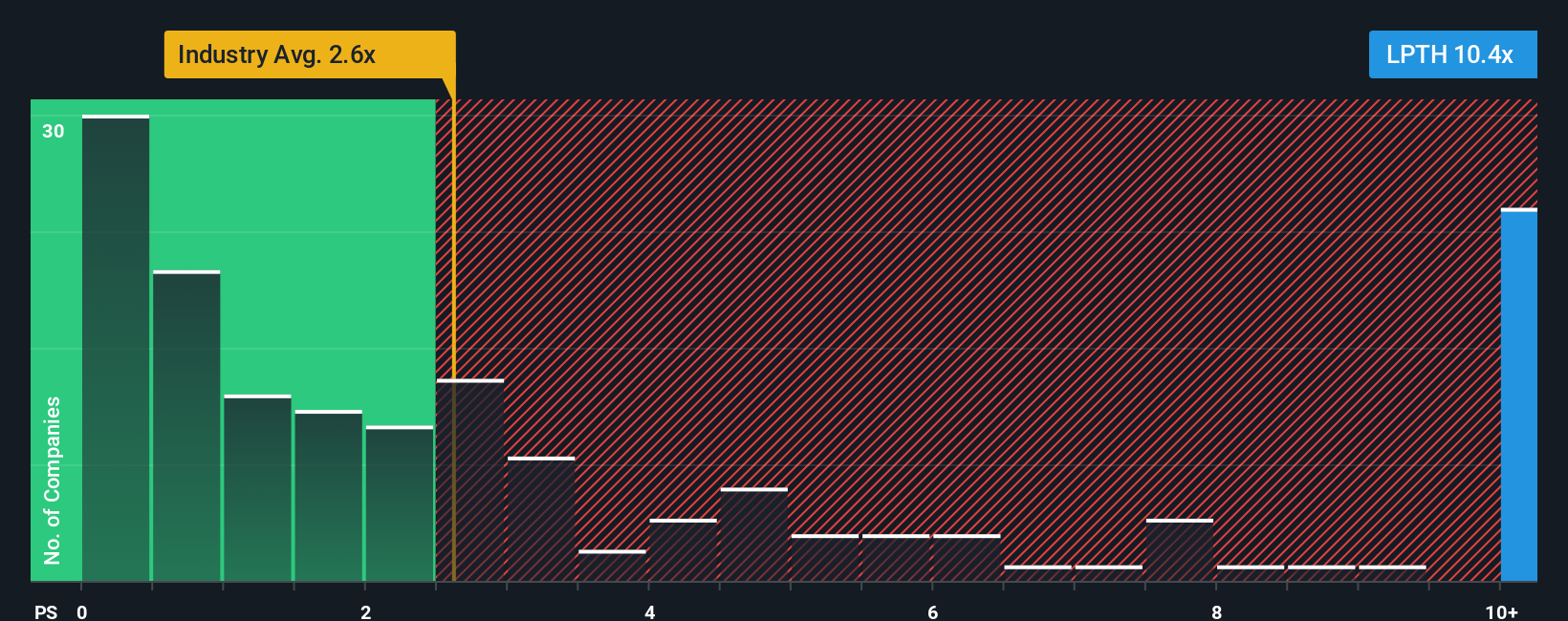

Since its price has surged higher, you could be forgiven for thinking LightPath Technologies is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 10.4x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 2.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does LightPath Technologies' P/S Mean For Shareholders?

LightPath Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LightPath Technologies.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as LightPath Technologies' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. As a result, it also grew revenue by 30% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 48% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 18% growth forecast for the broader industry.

With this information, we can see why LightPath Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does LightPath Technologies' P/S Mean For Investors?

LightPath Technologies' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that LightPath Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.