Please use a PC Browser to access Register-Tadawul

Linde’s Strong 2025 Results And M&A Pipeline Might Change The Case For Investing In LIN

Linde plc LIN | 496.51 | +1.31% |

- In early February 2026, Linde plc reported fourth-quarter 2025 sales of US$8,764 million and full-year sales of US$33.99 billion, alongside full-year net income of US$6.90 billion and higher earnings per share versus the previous year.

- On the same earnings call, Linde’s leadership highlighted an active pipeline of tuck-in acquisitions focused on boosting network density and synergies, particularly across North America and parts of Asia, reinforcing M&A as a core plank of its growth approach.

- Next, we’ll examine how upbeat analyst views and insider share purchases after these results could influence Linde’s existing investment narrative.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Linde Investment Narrative Recap

To own Linde today, you need to be comfortable with a mature industrial gases group that leans on disciplined M&A, tight cost control and long contracts to compound value over time. The latest results and acquisition commentary support that thesis but do not materially change the near term picture, where the key catalyst remains continued execution on tuck in deals and the main risk is weaker industrial activity in Europe and parts of Asia putting pressure on base volumes.

Against this backdrop, the wave of reaffirmed positive analyst ratings and higher price targets after the February 2026 earnings release stands out, as it directly ties to how investors frame those same catalysts and risks. While some firms highlight durable demand and margin potential, others are more cautious, which underlines that execution on acquisitions and exposure to cyclical end markets will likely drive how closely results track these expectations.

Yet behind the upbeat commentary, investors should be aware that prolonged industrial softness in Europe and Asia could...

Linde's narrative projects $38.9 billion revenue and $9.1 billion earnings by 2028.

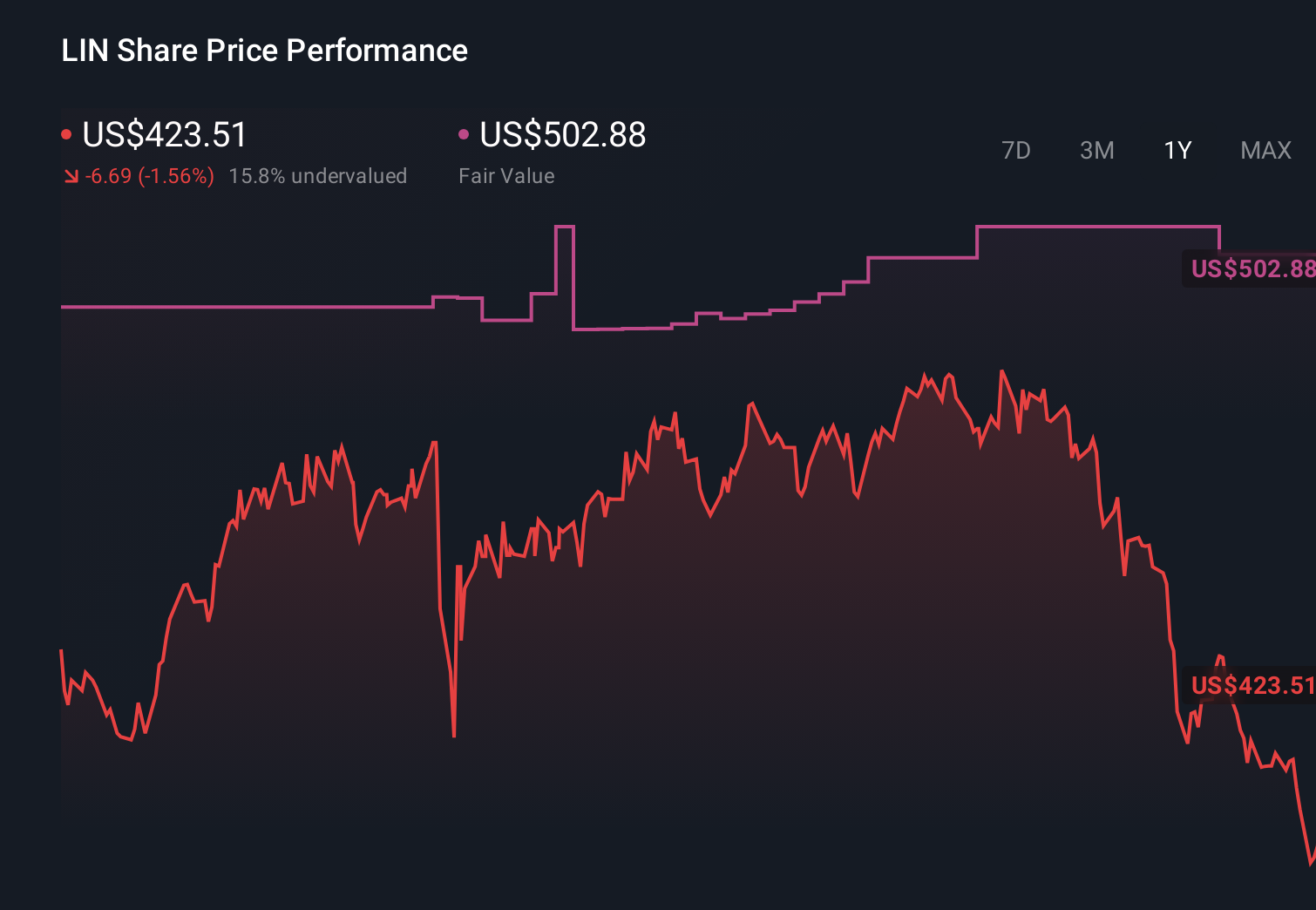

Uncover how Linde's forecasts yield a $503.52 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see Linde’s fair value between US$393 and US$510 per share, reflecting a wide band of expectations. When you set that against Linde’s reliance on continued tuck in acquisitions to enhance network density, it underlines why different investors may weigh the upside and the risk of weaker global industrial activity very differently.

Explore 5 other fair value estimates on Linde - why the stock might be worth 16% less than the current price!

Build Your Own Linde Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Linde research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linde's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- We've uncovered the 13 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.