Please use a PC Browser to access Register-Tadawul

Live Oak Bancshares (LOB): Exploring Valuation as Investor Sentiment Shifts

Live Oak Bancshares, Inc. LOB | 35.51 | +0.57% |

Live Oak Bancshares (LOB) stock has drawn some attention lately as investors try to decide if there is value on the table, especially given the ups and downs in its recent performance. With financials showing strong annual growth, it is a conversation worth having.

Live Oak Bancshares’ share price has experienced some fluctuations over the past year, resulting in little overall net change. Its five-year total shareholder return of 14.6% indicates modest but positive long-term momentum. Markets appear to be recalibrating growth expectations, and occasional bursts of buying interest suggest that sentiment around future prospects is still evolving.

If you’re keeping an eye out for fresh opportunities, now’s a great time to broaden your perspective and discover fast growing stocks with high insider ownership

Yet with shares trading about 20% below their analyst target and strong underlying growth, the real question is whether there is hidden value to be found or if the market has already accounted for what comes next.

Most Popular Narrative: 17.4% Undervalued

At $34.71, Live Oak Bancshares is seen as trading well below its most widely followed narrative fair value of $42, despite mixed market sentiment. This recent pricing gap centers investor attention on whether future growth can bridge the divide.

Robust small business loan origination growth (record Q2 production), deepening of customer relationships (rise in clients with both loan and deposit relationships from 3% to 18%), and double-digit deposit growth signal that Live Oak is successfully capitalizing on the long-term trend of rising entrepreneurship and small business formation in the U.S. This is likely driving above-industry loan growth and fee income.

Want to know what’s boosting that high fair value? The narrative hints at aggressive expansion, digital transformation, and revenue surges fueling analyst optimism. Bold growth forecasts and a future profit multiple stand out. Curious which key financial assumptions drive this price target? See what powers this surprising valuation leap in the full story.

Result: Fair Value of $42 (UNDERVALUED)

However, new regulatory hurdles or a downturn in niche sectors could quickly reshape the outlook and challenge the current bullish narrative for Live Oak.

Another View: Pricing Based on Market Multiples

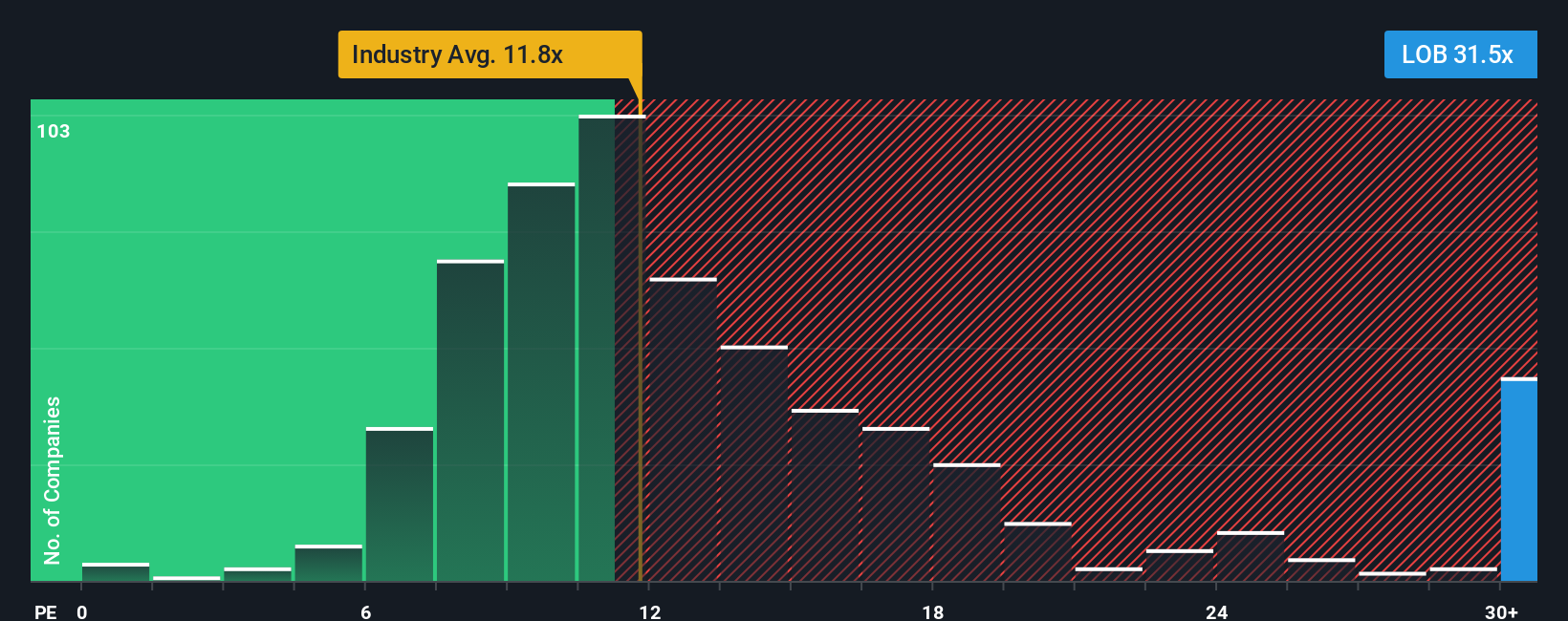

While the narrative-based fair value places Live Oak Bancshares in the undervalued camp, looking through the lens of the price-to-earnings ratio tells a different story. Shares are currently trading at 28.3 times earnings, which is far higher than the US Banks industry average of 11.7 and above the peer average of 25.4. The fair ratio, which represents what the market could move toward, stands at 20.7.

This sizable gap suggests the stock trades at a premium. This raises questions about whether the market is already pricing in ambitious growth or if patience will really reward investors at these levels. Should value hunters be wary, or is strength expected to catch up?

Build Your Own Live Oak Bancshares Narrative

If you like to reach your own conclusions or dig deeper into the numbers, you can craft your own view of Live Oak Bancshares in just a few minutes, and Do it your way.

A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take charge of your investing future by checking out tailored stock ideas handpicked for the current market. Miss out now and you could regret it later.

- Tap into tomorrow’s breakthroughs by checking out these 24 AI penny stocks which are driving advancements in artificial intelligence and reshaping entire industries with disruptive solutions.

- Accelerate your search for steady cash flow with these 19 dividend stocks with yields > 3% that offer attractive yields and a history of shareholder rewards.

- Seize opportunities in undervalued assets by reviewing these 901 undervalued stocks based on cash flows where market mispricings could create room for outsized gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.