Please use a PC Browser to access Register-Tadawul

LiveRamp’s (RAMP) New Retail Media Measurement Tools Could Be a Game Changer for Data Collaboration

LiveRamp Holdings, Inc. Common Stock RAMP | 30.21 | -0.30% |

- LiveRamp recently announced expanded measurement capabilities for retail media networks, enabling them to connect Meta campaign outcomes with their own first-party sales data using the LiveRamp Clean Room platform.

- This enhancement gives retailers and their partners new attribution insights across brands and products, potentially unlocking more data-driven marketing decisions and improved supplier relationships.

- We'll explore how LiveRamp's deeper integration with Meta campaign data could reinforce its role as a neutral data collaboration partner in marketing analytics.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

LiveRamp Holdings Investment Narrative Recap

To be a shareholder in LiveRamp Holdings, you need to believe in the growing demand for neutral data connectivity and privacy-preserving solutions as digital advertising grows more complex and cross-channel measurement becomes essential. The recent expansion of measurement capabilities for retail media networks enhances LiveRamp's value proposition but doesn’t significantly change the core short-term catalysts or reduce the ongoing risk of revenue concentration among its largest customers, which remains a critical focus for investors.

Among recent company announcements, the rollout of new agentic AI tools stands out as particularly relevant alongside the expanded measurement features. These solutions could support LiveRamp's role as a trusted enabler for more precise, AI-powered campaign analytics and help address the need for interoperability across client data systems, aligning closely with the industry's shift toward first-party and privacy-safe insights.

However, against these opportunities, investors should be aware that one persistent risk lies in...

LiveRamp Holdings' narrative projects $969.7 million in revenue and $154.0 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $141.3 million increase in earnings from $12.7 million today.

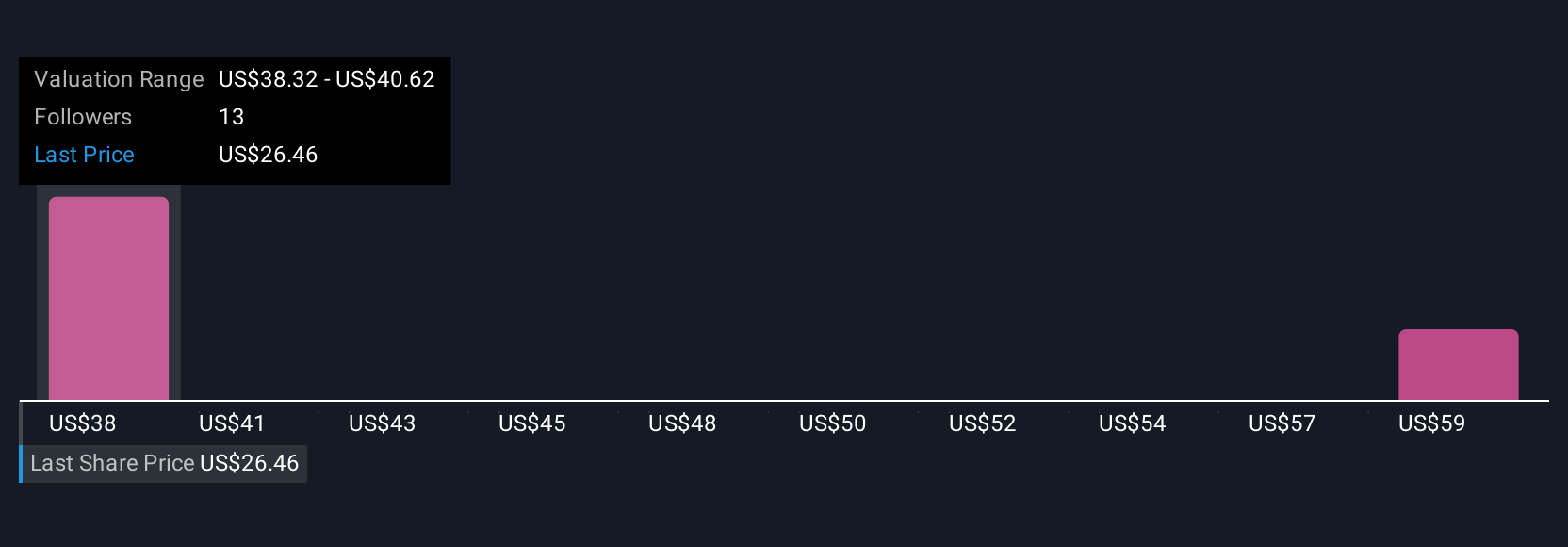

Uncover how LiveRamp Holdings' forecasts yield a $39.62 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Four individual fair value calculations from the Simply Wall St Community range from US$28 to US$52.85, showing diverse opinions on LiveRamp Holdings’ potential. While some see upside, ongoing reliance on a limited pool of enterprise clients continues to shape expectations and may affect overall business resilience, explore different viewpoints to assess your own outlook.

Explore 4 other fair value estimates on LiveRamp Holdings - why the stock might be worth as much as 87% more than the current price!

Build Your Own LiveRamp Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LiveRamp Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LiveRamp Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.