Looking Into Casey's General Stores's Recent Short Interest

Casey's General Stores, Inc. CASY | 0.00 |

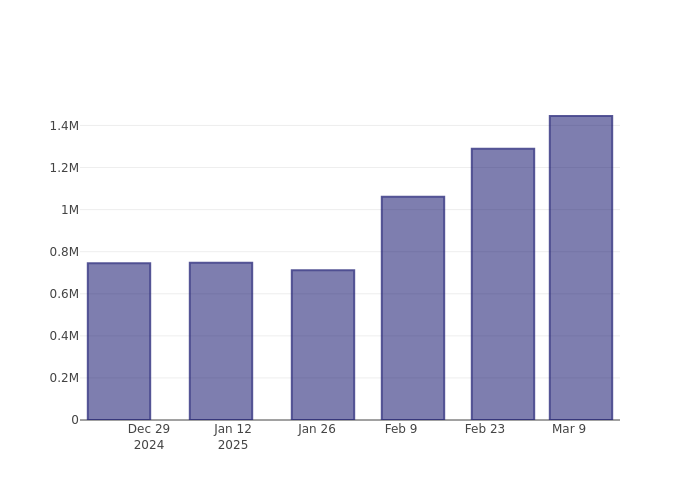

Casey's General Stores's (NYSE:CASY) short percent of float has risen 12.08% since its last report. The company recently reported that it has 1.44 million shares sold short, which is 3.99% of all regular shares that are available for trading. Based on its trading volume, it would take traders 4.81 days to cover their short positions on average.

Why Short Interest Matters

Short interest is the number of shares that have been sold short but have not yet been covered or closed out. Short selling is when a trader sells shares of a company they do not own, with the hope that the price will fall. Traders make money from short selling if the price of the stock falls and they lose if it rises.

Short interest is important to track because it can act as an indicator of market sentiment towards a particular stock. An increase in short interest can signal that investors have become more bearish, while a decrease in short interest can signal they have become more bullish.

See Also: List of the most shorted stocks

Casey's General Stores Short Interest Graph (3 Months)

As you can see from the chart above the percentage of shares that are sold short for Casey's General Stores has grown since its last report. This does not mean that the stock is going to fall in the near-term but traders should be aware that more shares are being shorted.

Comparing Casey's General Stores's Short Interest Against Its Peers

Peer comparison is a popular technique amongst analysts and investors for gauging how well a company is performing. A company's peer is another company that has similar characteristics to it, such as industry, size, age, and financial structure. You can find a company's peer group by reading its 10-K, proxy filing, or by doing your own similarity analysis.

According to Benzinga Pro, Casey's General Stores's peer group average for short interest as a percentage of float is 11.93%, which means the company has less short interest than most of its peers.

Did you know that increasing short interest can actually be bullish for a stock? This post by Benzinga Money explains how you can profit from it.

This article was generated by Benzinga's automated content engine and was reviewed by an editor.

Recommend

- Benzinga News 19/11 20:46

Piper Sandler Maintains Overweight on Global E Online, Raises Price Target to $48

Benzinga News 20/11 09:27Vipshop Holdings Q3 Adj. EPS $0.42 Beats $0.35 Estimate, Sales $3.000B Beat $2.960B Estimate

Benzinga News 20/11 10:01Nvidia Blackwell Sales Off The Chart, Walmart Earnings Powered By Value-Seeking Consumers

Benzinga News 20/11 18:27Ollie’s Army Loyalty Metrics and Artisan’s Endorsement Might Change the Case for Investing in OLLI

Simply Wall St Today 02:26Option Signals | U.S. Stocks on a Roller Coaster: Top 10 Options by Volume Surge; One RKLB Put Option Soars 280%, Signaling Bets on Short-Term Decline

Sahm Platform Today 09:46Is MINISO a Bargain After Global Expansion and Recent Double-Digit Price Swings?

Simply Wall St Today 11:32What's Driving the Market Sentiment Around Casey's General Stores Inc?

Benzinga News 7m