Please use a PC Browser to access Register-Tadawul

Loop Industries, Inc.'s (NASDAQ:LOOP) 74% Jump Shows Its Popularity With Investors

Loop Industries, Inc. LOOP | 0.92 0.94 | -4.66% +2.26% Post |

Loop Industries, Inc. (NASDAQ:LOOP) shares have had a really impressive month, gaining 74% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

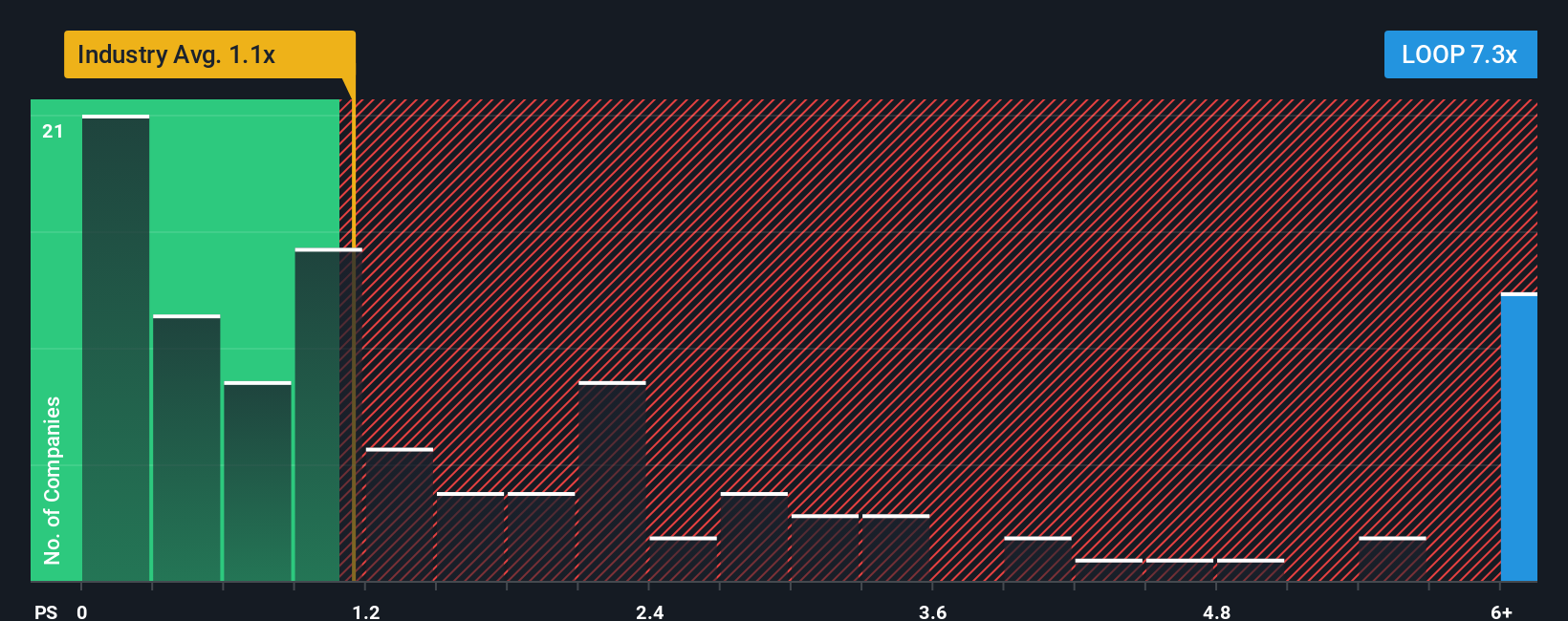

Since its price has surged higher, when almost half of the companies in the United States' Chemicals industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Loop Industries as a stock not worth researching with its 7.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Loop Industries Has Been Performing

With revenue growth that's superior to most other companies of late, Loop Industries has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Loop Industries.How Is Loop Industries' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Loop Industries' to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 50% per year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 32% per year growth forecast for the broader industry.

With this information, we can see why Loop Industries is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Loop Industries have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Loop Industries shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Loop Industries (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.