Please use a PC Browser to access Register-Tadawul

LPL Financial (LPLA) Margin Compression Challenges Bullish Growth Narrative After FY 2025 Results

LPL Financial Holdings Inc. LPLA | 376.10 | +3.18% |

LPL Financial Holdings (LPLA) just wrapped up FY 2025 with Q4 revenue of US$4.8 billion and basic EPS of US$3.76, alongside net income of US$300.7 million. This puts fresh numbers on the table for investors tracking its full year. The company has seen quarterly revenue move from US$3.4 billion in Q4 2024 to US$4.8 billion in Q4 2025, with basic EPS shifting from US$3.62 to US$3.76 over the same stretch, while trailing 12 month revenue sits at US$16.6 billion and EPS at US$10.97. Margins are firmly in focus here, as investors weigh these headline results against the pressure seen in profitability over the past year.

See our full analysis for LPL Financial Holdings.With the numbers on the board, the next step is to see how this earnings print lines up with the prevailing stories about LPL and where the margin and growth narrative might need a rethink.

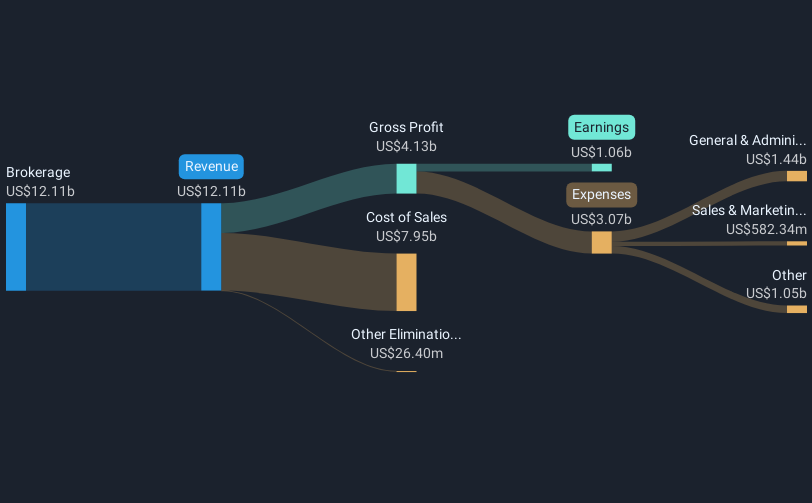

5.2% Net Margin Versus 8.8% Last Year

- Over the last 12 months LPL converted US$16.6b of revenue into US$863.0 million of net income, which works out to a 5.2% net profit margin compared with 8.8% in the prior year.

- What stands out for the bullish view that focuses on high earnings quality and 17.1% EPS compound growth is that this margin compression sits alongside solid reported profits, which creates a mixed picture:

- Bulls point to trailing EPS of US$10.97 and Q4 FY 2025 EPS of US$3.76 as evidence that the business is still earning well per share, even with a lower margin.

- At the same time, the drop from an 8.8% to a 5.2% net margin means more of that US$16.6b revenue is being absorbed by costs, so anyone leaning bullish has to be comfortable with this pressure on profitability.

Revenue Forecast Around 11% With Faster 22.1% Earnings Growth

- Revenue is forecast to grow about 11% per year while earnings are expected to grow around 22.1% per year, which is faster than the 10.6% forecast for the wider US market in the data provided.

- Consensus narrative thinking that sees LPL as a growth name finds some support here, but the recent margin profile adds a twist:

- The combination of US$16.6b in trailing revenue and a 5.2% net margin implies that a lot of the expected 22.1% earnings growth would need to come from either stronger margins or continued top line expansion.

- Because the latest trailing margin is below last year’s 8.8%, anyone leaning on the bullish growth story has to weigh whether forecasts are assuming a shift back toward that higher margin level or simply more revenue on today’s thinner margin base.

Valuation Tension: 33.8x P/E And Upside To Targets

- At a P/E of 33.8x versus peer and industry averages of 19.9x and 23.9x, the shares at US$364.50 trade on a richer multiple. This is occurring even though the stock is about 6.7% below a fair value estimate and below the US$390.73 DCF fair value, while the analyst price target in the data sits at US$448.92.

- For a bearish narrative that worries LPL is priced too highly, the numbers give both supporting evidence and some pushback:

- The higher 33.8x P/E compared with peers, together with a trailing 5.2% net margin, lines up with the concern that investors are paying more for each dollar of earnings while profitability is not at last year’s 8.8% level.

- On the other hand, the current US$364.50 share price sitting below the US$390.73 DCF fair value and under the US$448.92 analyst target means valuation models in the data are not unanimously flagging the stock as stretched at today’s level.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on LPL Financial Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

LPL's compression from an 8.8% to 5.2% net margin, along with a 33.8x P/E, leaves investors paying a premium while profitability feels under pressure.

If you are uneasy about paying up for earnings when margins are tight, use our these 868 undervalued stocks based on cash flows to quickly focus on ideas where pricing looks more forgiving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.