Please use a PC Browser to access Register-Tadawul

Lucid CEO Scrambles For Damage Control As Shares Plunge 47% This Year: 'As A Major Shareholder…Believe Me, Nobody Is More Incentivized Than Me For Success'

Lucid LCID | 12.39 | -1.20% |

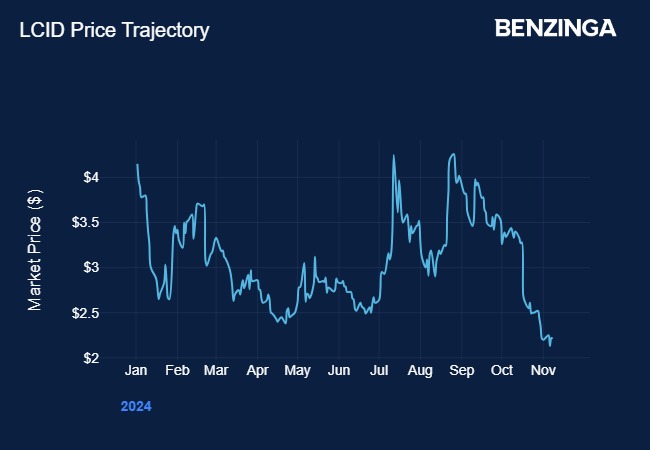

Shares of EV maker Lucid Motors (NASDAQ:LCID) closed at $2.21 on Friday, down by nearly 47% since the start of this year.

What Happened: Lucid CEO Peter Rawlinson sought to assuage investor concerns of dropping share value at the company’s third-quarter earnings call this week.

“I want to assure you that we’re taking significant steps to deliver long-term shareholder value,” Rawlinson said while adding that “challenging” market conditions combined with a number of factors have affected the company’s share price. “This is a long-term play, and we’re indeed, we’re actively working on several initiatives both to drive growth and to improve our financial performance.”

Rawlinson pointed to his holding in the EV company and said, “…as a major shareholder myself personally, believe me, nobody is more incentivized than me for success. And what’s less known, I relate to you all because I put so many of my own savings into this company to make it happen.”

Rawlinson added that he has not sold a single share of his Lucid stock “except what was necessary for tax purposes.”

Rawlinson evaded another question on whether Saudi Arabia’s Public Investment Fund (PIF) will consider buying out Lucid saying it is not his place to speak for the sovereign wealth fund. PIF is a majority stakeholder in Lucid with a nearly 60% stake in the company. It has invested about $8 billion in Lucid since 2018.

Why It Matters: According to data from Benzinga Pro, Rawlinson currently owns about 18.5 million shares of Lucid, worth roughly $41 million as of the stock’s closing price on Friday of $2.21.

Rawlinson, however, is not the sole CEO with a stake in the company they run.

Tesla Inc CEO Elon Musk holds 411 million shares of his EV giant, worth about $132 billion as of the company’s closing share price on Friday of $321.22.

Rivian Automotive CEO RJ Scaringe, meanwhile, holds about 3.5 million shares of his company, worth about $37 million.

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

- Lucid Rises Nearly 5% In Pre-Market After Strong Q3 Results, Opening Orders For Gravity SUV

Photo by Around the World Photos on Shutterstock