Please use a PC Browser to access Register-Tadawul

Lumen Technologies (LUMN): Evaluating Valuation After Fiber Sale to AT&T and New Tech Contracts

Lumen LUMN | 8.50 | -1.62% |

Lumen Technologies has caught investor attention after announcing the sale of its mass market fiber division to AT&T. This deal is expected to inject substantial capital into the company. At the same time, new contracts from major tech firms are providing fresh momentum for its advanced connectivity services.

Lumen Technologies’ share price has surged an impressive 52% over the last three months, with the year-to-date return up 22%. This signals momentum is building as investors react to recent deals and a stronger technology focus. Still, a 1-year total shareholder return of 11% shows the longer-term picture is only modestly positive, and uncertainty remains given debt and revenue headwinds.

If you’re tracking big moves in the communications sector, this could be the perfect moment to discover fast growing stocks with high insider ownership. Check out fast growing stocks with high insider ownership.

With share prices climbing but some valuation models suggesting over-optimism, the key question emerges: Is Lumen Technologies now a bargain ready for further upside, or is the market already factoring in all its future growth?

Most Popular Narrative: 32.2% Overvalued

With a fair value of $5.20 recently assigned by the most widely followed narrative and Lumen Technologies closing at $6.87, the current share price is considerably above the latest fair value estimate. This sets up a debate about the sustainability of the rally.

Strategic refinancing, deleveraging, and the pending sale of the consumer fiber-to-the-home business to AT&T will materially strengthen Lumen's balance sheet, reduce interest expense by $300 to $400 million annually, and free up capital for enterprise-focused growth initiatives. These moves directly impact future net earnings and free cash flow.

What bold financial moves do analysts see powering this valuation? The secret sauce: a full transformation of the balance sheet and a strong bet on future profit margins. Curious about the unconventional numbers and surprising forecasts used? Explore the narrative’s blueprint for what could be a defining turnaround.

Result: Fair Value of $5.20 (OVERVALUED)

However, risks remain, such as continued declines from legacy products and overreliance on a handful of large enterprise customers, as each is capable of derailing recovery expectations.

Another View: Value Signals from Sales Multiples

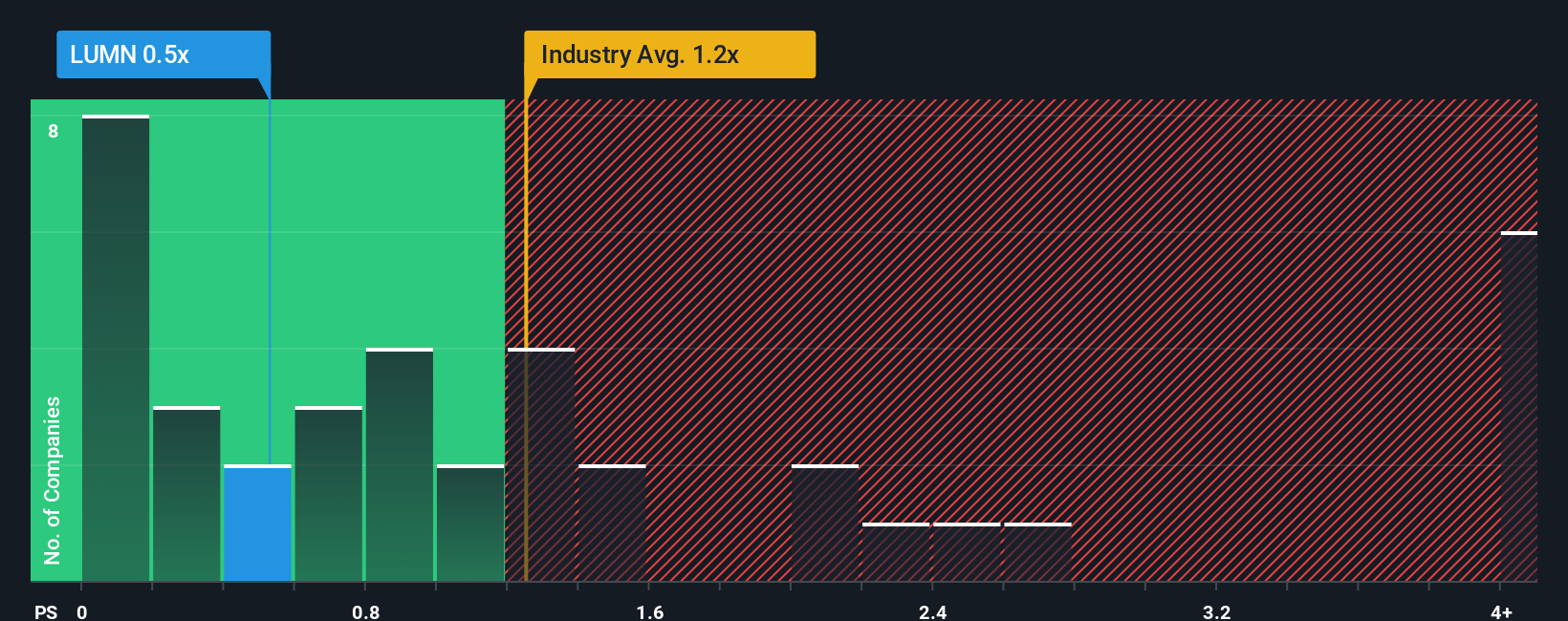

Looking beyond analyst forecasts, market multiples tell a different story. Lumen Technologies is trading at a price-to-sales ratio of 0.5x, much lower than both the US Telecom industry average of 1.2x and its peer average of 5.9x. Even compared to its estimated fair ratio of 1x, the gap suggests potential value that some investors may be missing. This discount could indicate an overlooked opportunity, or it could reflect concerns about business risks.

Build Your Own Lumen Technologies Narrative

Prefer to follow your own intuition or craft a personalized outlook? Dive into the numbers and generate your own narrative in just a few minutes with Do it your way.

A great starting point for your Lumen Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always on the lookout for tomorrow’s big opportunities. Don’t limit yourself to one story. Put your money to work across markets and get ahead of the curve with unique stock ideas from the Simply Wall St screener.

- Boost your returns with income opportunities by tapping into these 18 dividend stocks with yields > 3% offering yields over 3% and robust fundamentals.

- Tap into the future of artificial intelligence and see which innovators top the list through these 25 AI penny stocks for cutting-edge growth possibilities.

- Seize the chance to uncover underrated gems with these 881 undervalued stocks based on cash flows based on reliable cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.