Please use a PC Browser to access Register-Tadawul

Lumentum Holdings (LITE) Is Up 10.6% After Profit Turnaround and AI-Focused Manufacturing Expansion

Lumentum Holdings, Inc. LITE | 576.54 | +4.45% |

- Lumentum Holdings Inc. recently reported a significant turnaround in its fourth quarter and full year results, posting net income of US$213.3 million for the quarter and issuing revenue guidance of US$510 million to US$540 million for the start of fiscal 2026.

- This performance coincided with the company's announcement of a major U.S.-based semiconductor manufacturing expansion to support AI data center demand, further reinforcing Lumentum's positioning in advanced optical networking.

- Let's examine how Lumentum's improved profitability and manufacturing expansion shapes the company's investment narrative and longer-term growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Lumentum Holdings Investment Narrative Recap

If you are considering Lumentum as a shareholder, the core belief hinges on the company’s ability to capitalize on surging AI data center demand while navigating sector volatility and competitive pressures. The recent earnings turnaround and expanded manufacturing guidance may reinforce confidence in near-term growth, but ongoing risks like supply chain constraints and margin pressures remain, none of which appear materially eased by these results in the short run.

The most pertinent announcement from recent news is Lumentum’s US$510 million to US$540 million revenue guidance for Q1 FY2026, which directly relates to expectations around their new manufacturing expansion. This signals both the company’s intent to scale with AI-driven market forces and ongoing exposure to operational risks, such as production ramp-up yields and supply chain reliability.

However, investors should be aware that rapid capacity expansion comes with its own risks should demand fail to meet elevated expectations…

Lumentum Holdings is expected to reach $2.7 billion in revenue and $99.3 million in earnings by 2028. This outlook is based on projected annual revenue growth of 22.0% and an earnings increase of $539.2 million from current earnings of -$439.9 million.

Uncover how Lumentum Holdings' forecasts yield a $104.06 fair value, a 13% downside to its current price.

Exploring Other Perspectives

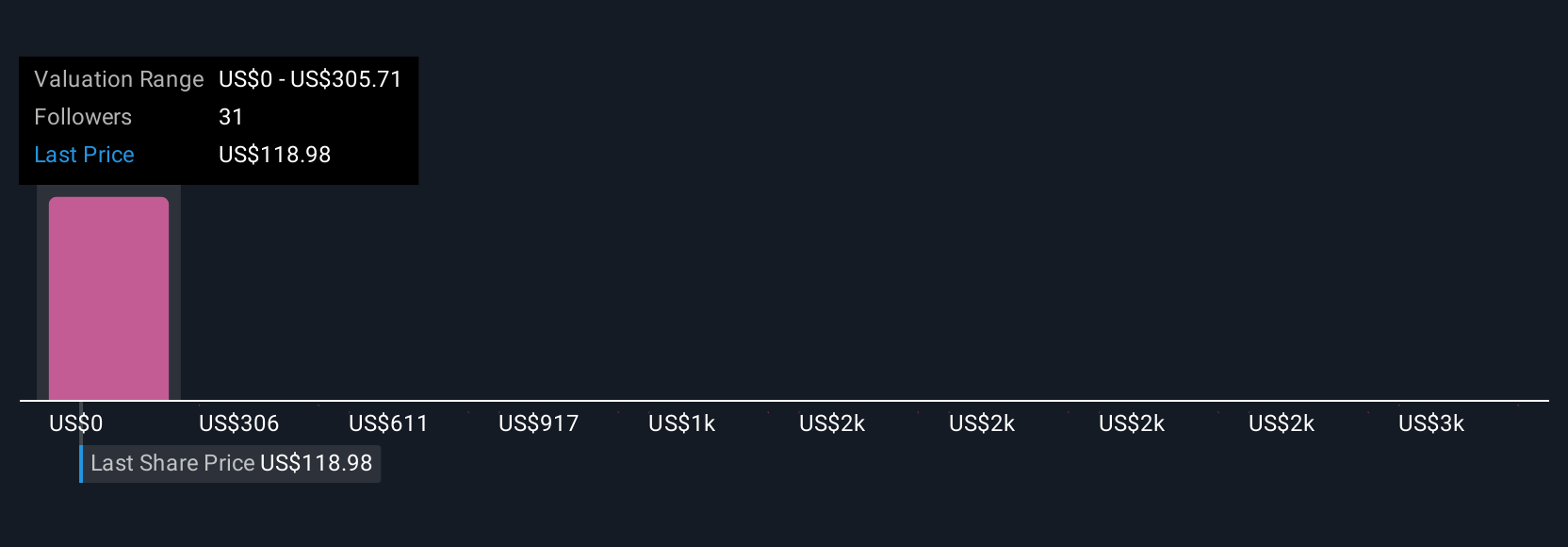

Simply Wall St Community members provided nine fair value estimates for Lumentum between US$305,706 and US$3,057,060, showing wide variance in outlooks. With capacity investment a key catalyst mentioned above, your view on future demand could make all the difference, explore these perspectives for a broader picture.

Explore 9 other fair value estimates on Lumentum Holdings - why the stock might be worth just $305.71!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.