Please use a PC Browser to access Register-Tadawul

Lumentum’s AI Backlog And Valuation Put Growth Expectations To The Test

Lumentum Holdings, Inc. LITE | 667.77 | +5.05% |

- Lumentum Holdings (NasdaqGS:LITE) has reported a sizable backlog in optical circuit switches linked to AI data center build outs.

- The company has secured a multihundred million dollar co-packaged optics order tied to next generation AI infrastructure.

- Management has flagged AI supply chain ramps that are expected to support demand for its products through at least 2027.

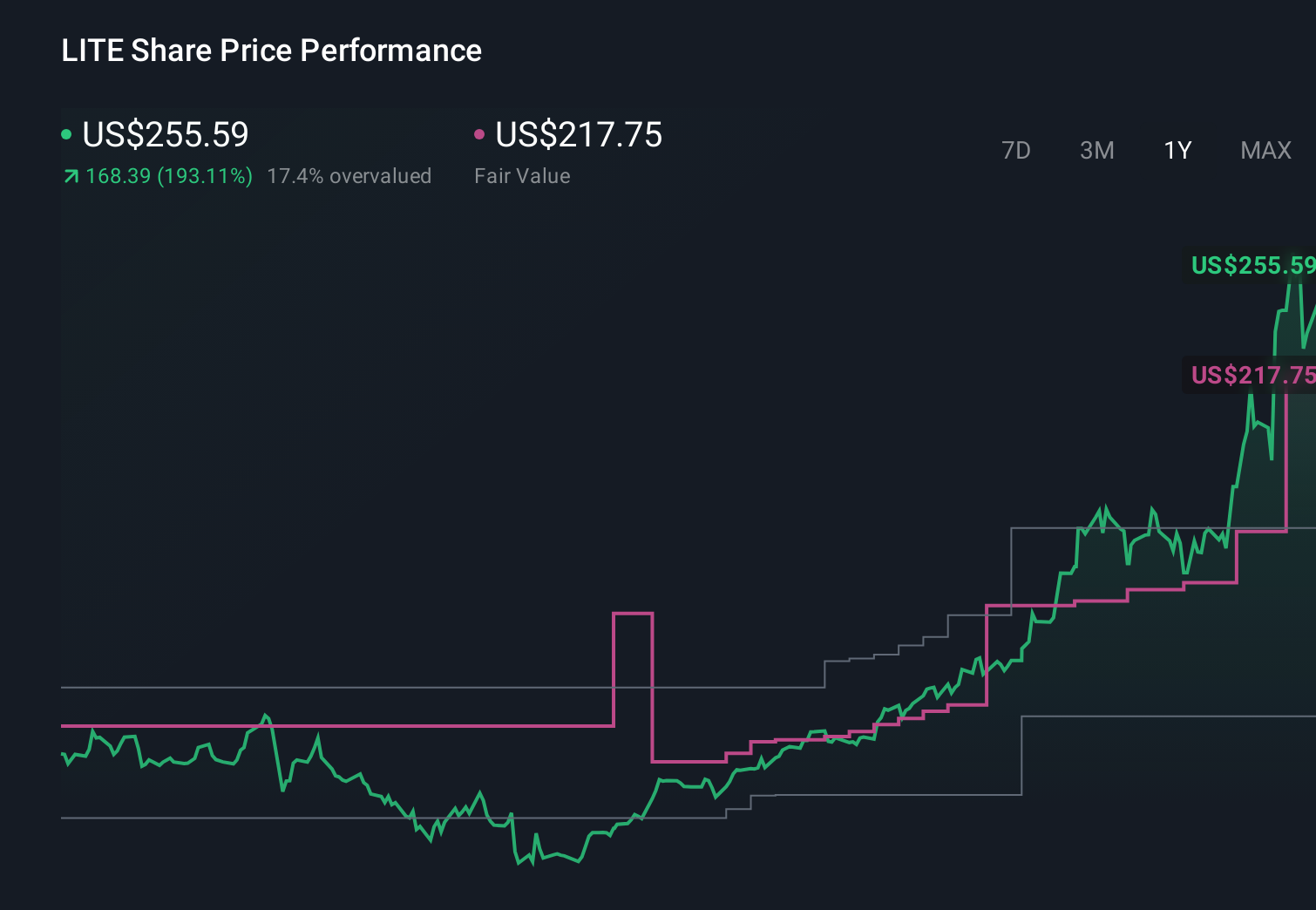

Lumentum, trading at $583.46, is increasingly tied to the build out of AI data centers, positioning its optical technologies at the core of high bandwidth infrastructure. The stock’s move, up 15.7% over the past week and 61.5% over the past month, suggests investors are paying close attention to this AI angle. With a year-to-date gain of 51.1%, the market is already treating NasdaqGS:LITE as a key AI hardware supplier.

The new backlog in optical circuit switches and the multihundred million dollar co-packaged optics order highlight how AI build outs are shaping Lumentum’s order book. If AI infrastructure spending continues to focus on higher speed, lower latency connections in data centers, this type of optical hardware exposure could remain central to how investors think about NasdaqGS:LITE.

Stay updated on the most important news stories for Lumentum Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Lumentum Holdings.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$583.46, the share price sits about 4.7% above the US$557.24 analyst target, within the 10% band of “fair” territory.

- ✅ Simply Wall St Valuation: Simply Wall St’s model suggests the stock is trading about 31.5% below its estimated fair value, flagging it as undervalued.

- ✅ Recent Momentum: A 61.5% 30 day return shows very strong recent momentum as AI related demand comes into focus.

There is only one way to know the right time to buy, sell or hold Lumentum Holdings. Head to the Simply Wall St company report for the latest analysis of Lumentum Holdings's Fair Value..

Key Considerations

- 📊 The sizeable AI related backlog and co packaged optics order tie the story closely to AI data center spending and capacity build outs.

- 📊 Keep an eye on how the P/E of about 166, AI infrastructure order visibility and any updates to the fair value estimate evolve against today’s price.

- ⚠️ One flagged major risk is that debt is not well covered by operating cash flow, which matters if AI demand or customer orders soften.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Lumentum Holdings analysis. Alternatively, you can check out the community page for Lumentum Holdings to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.