Please use a PC Browser to access Register-Tadawul

Lyft (LYFT) Co-Founders Exit Board as Sean Aggarwal Takes Charge

Lyft LYFT | 20.37 20.37 | -0.73% 0.00% Pre |

Lyft (LYFT) recently announced significant executive changes, with co-founders Logan Green and John Zimmer stepping down from the Board of Directors, a move that could have implications for board independence under new Chair Sean Aggarwal. This shift coincides with Lyft's share price gaining 2.89% over the past week, aligning with broader market trends where the Dow Jones reached record highs, though the S&P 500 and Nasdaq saw slight declines. These executive moves at Lyft add weight to the broader market movements, reflecting investor interest amid ongoing major index performance and complex market dynamics.

The recent executive changes at Lyft, with co-founders stepping down from the board, signal a potential shift in strategic direction under new Chair Sean Aggarwal. This executive transition may influence board independence and could impact Lyft's long-term focus on initiatives like autonomous vehicles and global partnerships. The associated 2.89% share price gain aligns with broader market trends, but it's important to contextualize with Lyft's total shareholder return of 35.25% over the past year. This performance is noteworthy considering the US market's return of 17.4% in the same period, as well as surpassing the US Transportation industry's 6.1% increase.

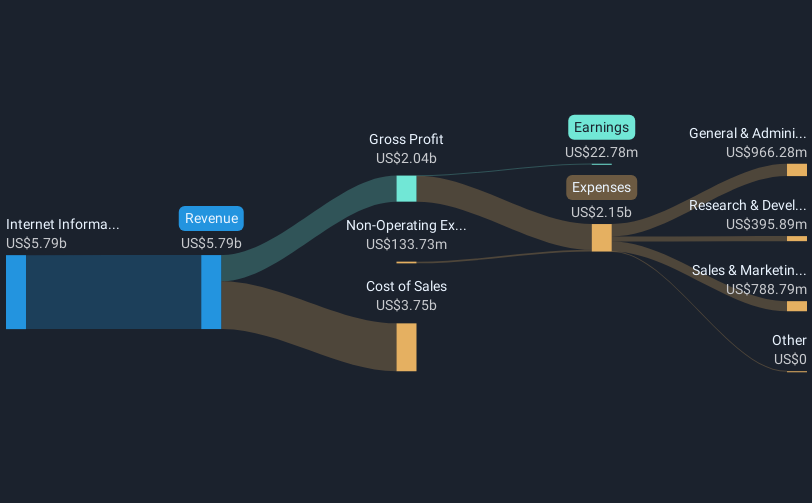

Given the current share price of US$14.62, analysts' consensus price target of US$17.20 reflects expectations for future revenue and earnings growth. If Lyft successfully leverages its autonomous vehicle technology and international partnerships, it could significantly enhance its total addressable market and margins. However, the reliance on partnerships and investment-intensive AV developments present risks. This potential upside contrasts with the challenges, urging investors to closely monitor ongoing revenue and earnings projections, which are anticipated to grow significantly over the next three years. The 17.4% discount to the target could imply optimism over these future growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.