Please use a PC Browser to access Register-Tadawul

Lyft (LYFT): Valuation in Focus Following Analyst Reviews and Autonomous Ride-Hailing Partnership with Waymo

Lyft LYFT | 20.37 | -0.73% |

Lyft (LYFT) shares slipped following a wave of new analyst coverage, which included both fresh opinions and updated outlooks from several firms. At the same time, investors are keeping an eye on Lyft's partnership with Waymo to deploy autonomous ride-hailing, a move that hints at shifting dynamics in the sector.

Despite the recent analyst downgrades and a high-profile push into autonomous ride-hailing partnerships, Lyft has continued to post stable results, highlighting momentum from its customer-focused turnaround. The stock’s total shareholder return over the past year stands at 0.83%, a modest but notable improvement given fierce competition and mixed market sentiment, suggesting investors are cautiously optimistic about Lyft’s growth story.

If you’re tracking shifts in the mobility sector, this could be a great moment to discover See the full list for free.

With analyst sentiment mixed and Lyft doubling down on innovation and partnerships, the stock’s subdued performance raises an important question for investors: is this resilience an opportunity to buy before stronger growth emerges, or is the market already accounting for all the good news?

Most Popular Narrative: 24% Overvalued

The most widely followed narrative signals Lyft’s shares are trading well above fair value, with the estimated fair price at $18.22 compared to a recent $22.61 close. This gap has caught investor attention, especially as the market debates what is driving such a premium.

Expanded and deepened autonomous vehicle (AV) partnerships (Waymo, Baidu, BENTELER Mobility) are seen as strategically narrowing the competitive gap and positioning Lyft to benefit from the ongoing AV transition. However, long-term AV risk remains a structural concern for ride-hailing incumbents.

What is Wall Street betting on? The fuel for this bullish story is in forward-looking projections about relentless user growth, stricter margins, and the future payoff from global alliances. Which bold assumptions push Lyft far above its proposed “fair” value? The missing piece is just a click away.

Result: Fair Value of $18.22 (OVERVALUED)

However, rapid regulatory shifts or intensified competition from Uber could quickly undermine these optimistic projections and cast doubt on Lyft’s long-term momentum.

Another View: Are the Multiples Telling a Different Story?

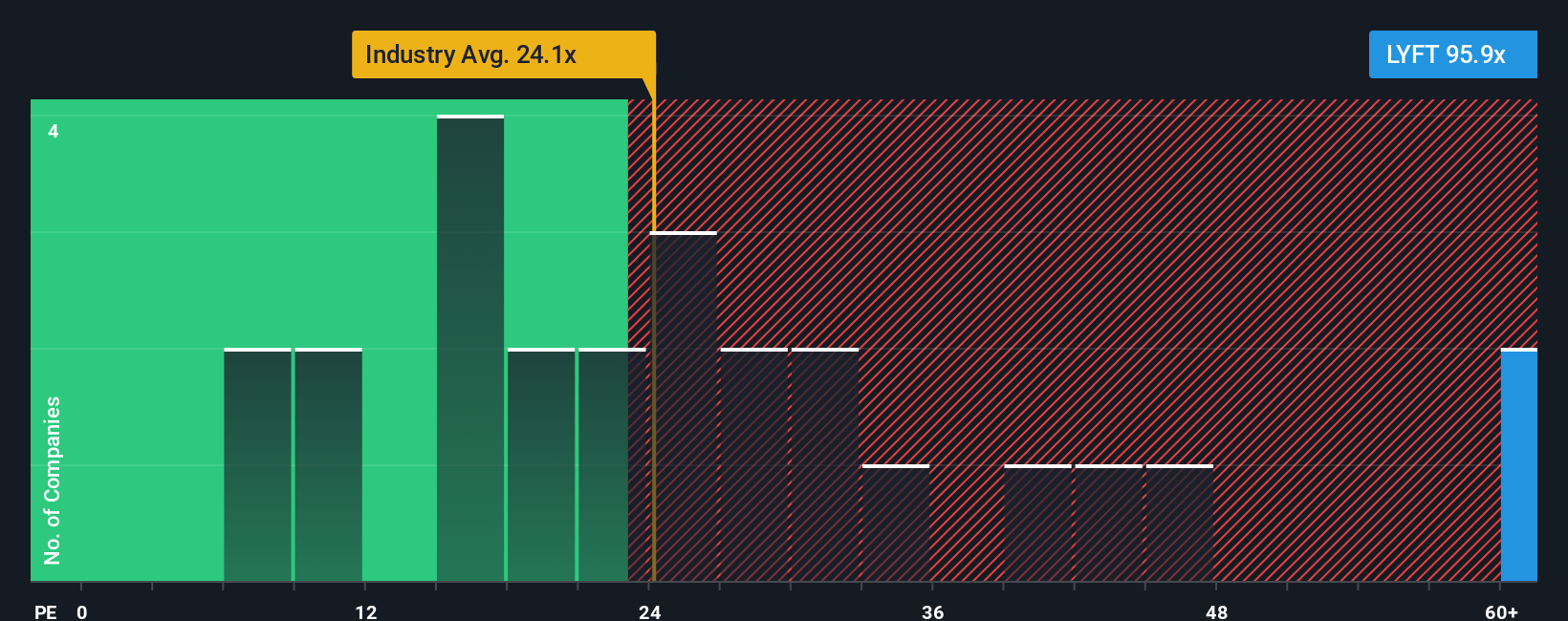

Looking at Lyft’s valuation through its price-to-earnings ratio, the company trades at 99.7 times earnings. This figure stands out against both the peer average of 23.5 and a fair ratio estimate of 21. This steep premium implies investors expect substantial growth, but it also increases the risk if those expectations aren't met. Does this disconnect signal danger for optimists?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lyft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lyft Narrative

Keep in mind, if you have a different perspective or want to analyze the numbers firsthand, you can craft your own narrative in just minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lyft.

Looking for More Investment Ideas?

Don’t limit your portfolio to just one story. Outstanding opportunities are only a click away. Sharpen your investing strategy by exploring these unique markets:

- Lock in potential for high returns by targeting these 3563 penny stocks with strong financials that are building real momentum and defying conventional expectations.

- Boost your passive income by scanning these 19 dividend stocks with yields > 3% that consistently deliver yields above 3% and provide a strong foundation for your returns.

- Capitalize on the booming future of artificial intelligence by seeking out these 24 AI penny stocks positioned to benefit from the next wave of tech innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.