Please use a PC Browser to access Register-Tadawul

Macy's Massive Automated Fulfillment Center Might Change The Case For Investing In Macy's (M)

Macy's Inc M | 24.15 | +0.63% |

- Macy's recently opened its largest and most advanced fulfillment center in China Grove, North Carolina, spanning 2.5 million square feet and equipped with cutting-edge automation and a new warehouse management system designed to streamline fulfillment and store replenishment.

- This milestone represents a significant step in Macy's supply chain modernization, emphasizing the company's commitment to faster deliveries, operational efficiency, and enhanced customer experiences across its omnichannel platform.

- We'll explore how this major supply chain investment may influence Macy's long-term outlook as outlined in the investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Macy's Investment Narrative Recap

If you're considering Macy's as an investment, the core thesis to believe in centers on the retailer’s ability to modernize its supply chain and unlock efficiencies across the omnichannel network. The opening of the China Grove fulfillment center meaningfully supports this catalyst, but store closures and soft unit demand remain the most important risks to short-term revenue stabilization, and the new facility does not materially alleviate these pressures for now.

Among recent company announcements, the exclusive Marvel’s Spider-Man-inspired collection stands out, reinforcing Macy's focus on unique product offerings to attract diverse customer segments. This sort of merchandising play complements supply chain improvements, but ultimately, success relies on Macy’s being able to sustain traffic growth and margin improvement as it balances physical and digital retail investments.

In contrast, investors should keep in mind that while automation drives efficiency, the persistent consumer shift toward e-commerce could still challenge Macy’s store-driven sales and revenue mix...

Macy's narrative projects $18.5 billion in revenue and $663.0 million in earnings by 2028. This requires a 6.5% annual revenue decline and an earnings increase of $169.0 million from current earnings of $494.0 million.

Uncover how Macy's forecasts yield a $15.79 fair value, a 15% downside to its current price.

Exploring Other Perspectives

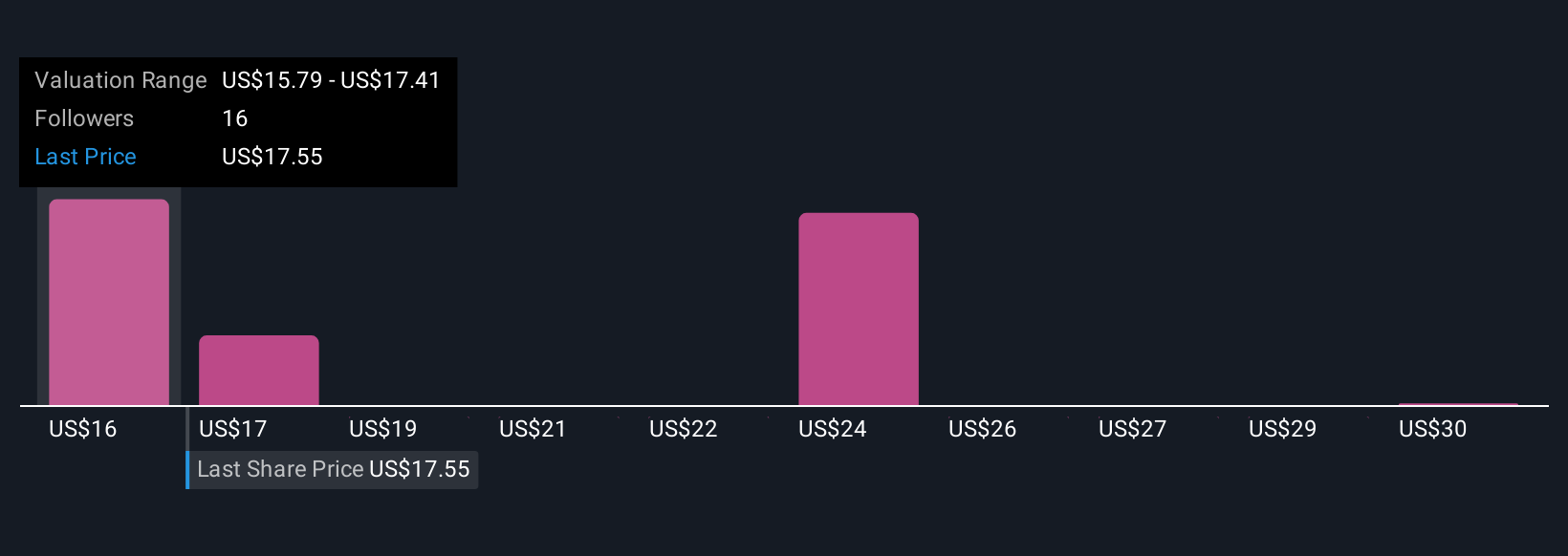

Four Simply Wall St Community members estimate Macy's fair value between US$15.79 and US$32, reflecting a large gap in expectations. This diversity of views comes as Macy’s modernization efforts seek to boost margins, yet the risk of further store traffic declines remains in focus for many observers.

Explore 4 other fair value estimates on Macy's - why the stock might be worth as much as 72% more than the current price!

Build Your Own Macy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Macy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macy's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.