Please use a PC Browser to access Register-Tadawul

Manhattan Associates (MANH): Fresh Perspectives on Valuation After Recent Pullback

Manhattan Associates, Inc. MANH | 179.69 | +0.61% |

Most Popular Narrative: 5% Undervalued

According to the most popular narrative, Manhattan Associates is undervalued by about 5%. This reflects analysts' belief that the company's long-term earnings and margin progression could outpace current market expectations given ongoing technology shifts.

Enhanced investments in AI, automation, and unified product development (such as Agentic AI and the Manhattan Active Agent Foundry) position Manhattan to capture increasing customer demand for real-time analytics and next-generation supply chain automation. This could potentially drive new bookings, average contract value, and expansion into underpenetrated markets, supporting sustainable double-digit top-line growth.

Want to discover the secret sauce behind Manhattan Associates’ high valuation call? The narrative hinges on ambitious projections for both the company’s top and bottom line. There are bold assumptions baked into this fair value target. Are they realistic or wishful thinking? The answers just might surprise you.

Result: Fair Value of $227.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, cloud migration delays and services revenue volatility could quickly challenge even the most optimistic long-term views on Manhattan Associates’ future growth.

Find out about the key risks to this Manhattan Associates narrative.Another View: What Do Other Valuation Methods Say?

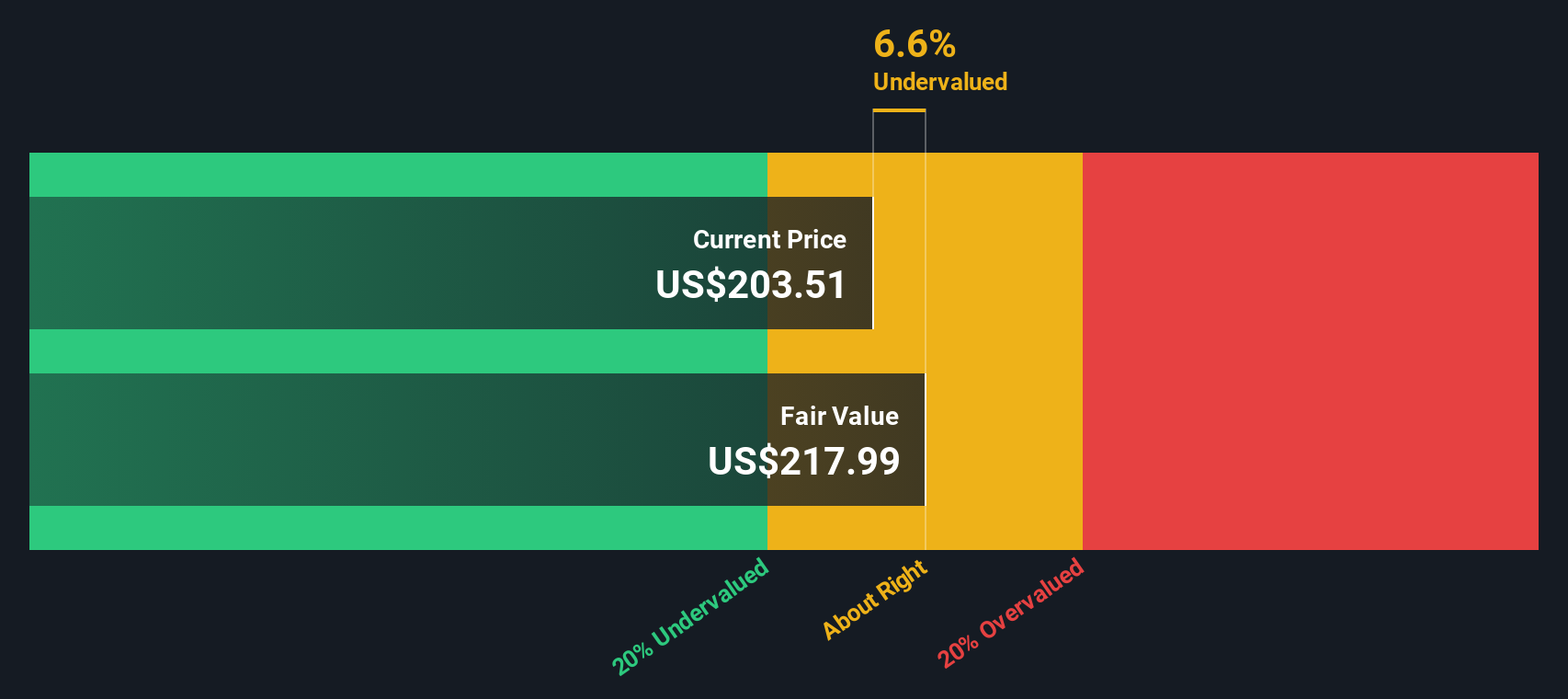

While the most popular approach pegs Manhattan Associates as undervalued, taking a fresh look using our DCF model reveals only a slight disconnect between price and fair value. It is possible that the real answer lies somewhere in the middle.

Build Your Own Manhattan Associates Narrative

If you have a different perspective or want to dig deeper into Manhattan Associates’ story, you can create your own narrative in just a few minutes. Do it your way.

A great starting point for your Manhattan Associates research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. Get ahead with fresh, data-driven strategies tailored to the trends shaping tomorrow’s markets, and don’t let the next big opportunity slip away.

- Unlock the potential of overlooked small companies and uncover promising growth possibilities by using our screener for penny stocks with strong financials.

- Capture the momentum behind rising artificial intelligence leaders and spot early-stage innovators by exploring companies highlighted in our exclusive AI penny stocks.

- Build your portfolio with shares that may be trading below their true worth. See which names make the cut with our tool for spotting undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.