Please use a PC Browser to access Register-Tadawul

March 2025's Top Dividend Stocks For Your Portfolio

Autoliv Inc. ALV | 121.27 | -0.21% |

As March 2025 unfolds, U.S. markets are experiencing a downturn, with major indices like the Dow Jones and S&P 500 seeing declines amid renewed tariff concerns and economic uncertainty. In such volatile times, dividend stocks can offer a layer of stability to investors' portfolios by providing consistent income streams even when market conditions are challenging.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.78% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 6.03% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.83% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.10% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.79% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.46% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.00% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.77% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.85% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Chord Energy (NasdaqGS:CHRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chord Energy Corporation is an independent exploration and production company in the United States with a market cap of approximately $6.20 billion.

Operations: Chord Energy Corporation generates its revenue primarily from the exploration and production of crude oil, natural gas liquids (NGLs), and natural gas, amounting to $4.92 billion.

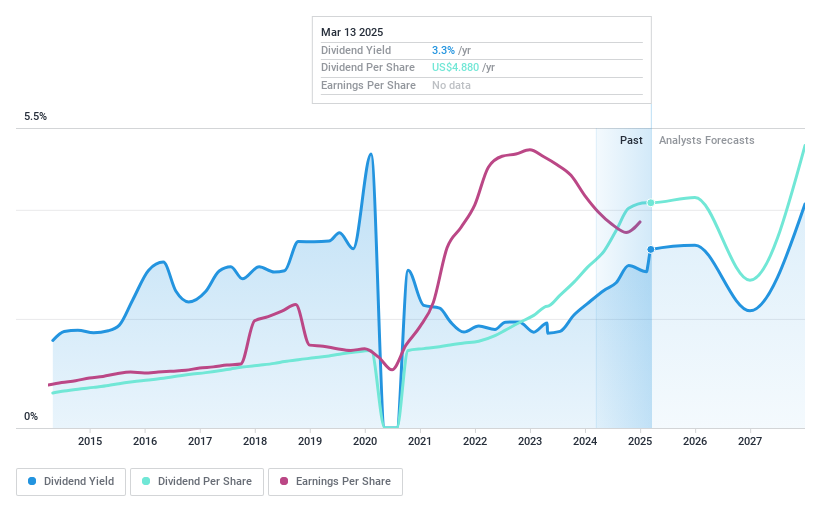

Dividend Yield: 8.1%

Chord Energy offers a compelling dividend yield of 8.09%, placing it in the top 25% of U.S. dividend payers, with dividends covered by earnings and cash flows. However, its track record is unstable due to volatility over four years. Recent financial maneuvers include a US$750 million senior notes offering to manage debt and fund operations, reflecting strategic efforts to optimize capital structure despite past shareholder dilution and declining profit margins.

Autoliv (NYSE:ALV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Autoliv, Inc. is a company that develops, manufactures, and supplies passive safety systems to the automotive industry across Europe, the Americas, China, Japan, and other parts of Asia with a market cap of approximately $7.44 billion.

Operations: Autoliv's revenue primarily comes from its Airbag and Seatbelt Products and Components segment, which generated $10.39 billion.

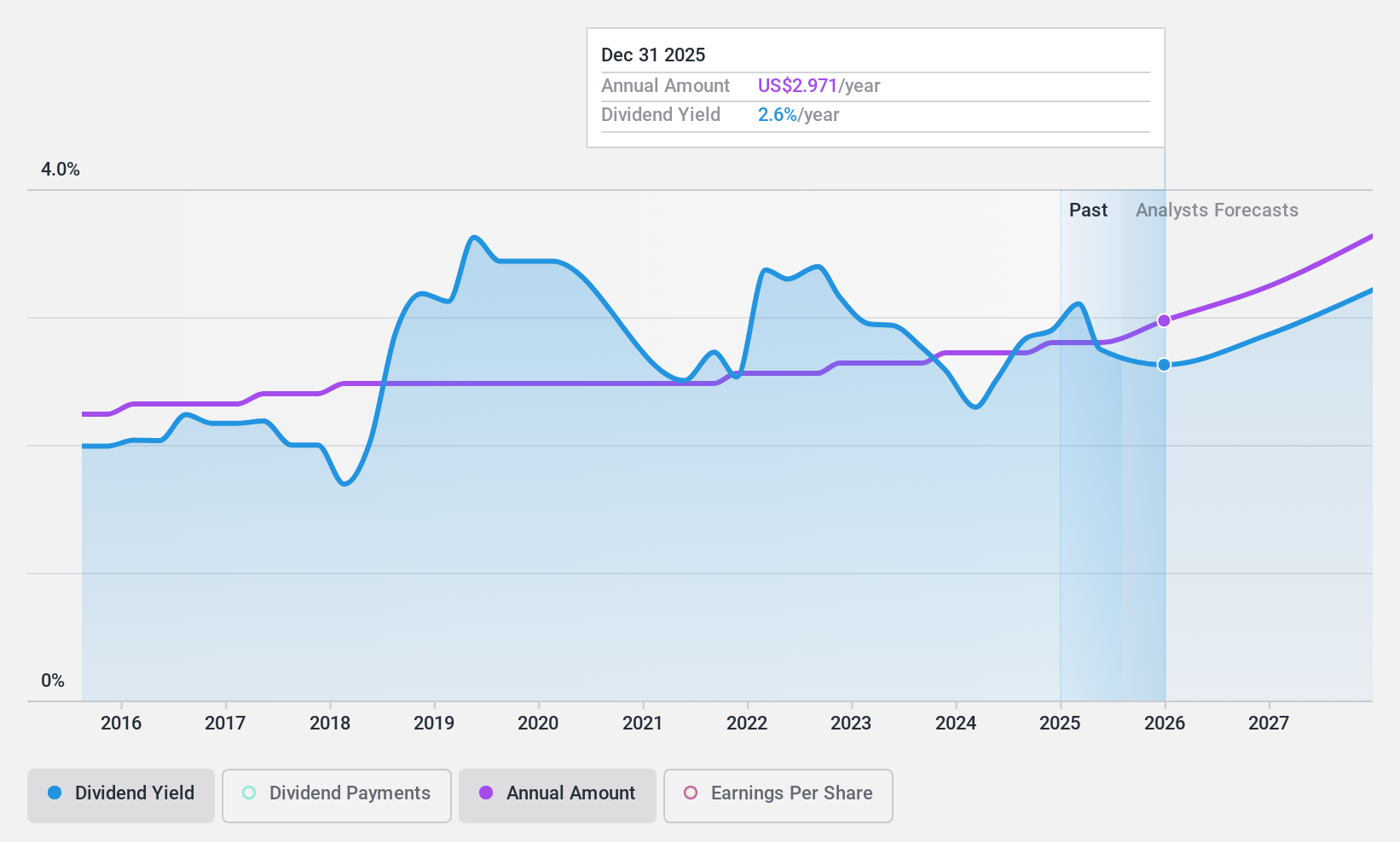

Dividend Yield: 3%

Autoliv's dividend payments are well-supported by earnings and cash flow, with payout ratios of 34% and 45.3%, respectively. However, its dividend history is marked by volatility over the past decade. The company recently declared a quarterly dividend of US$0.70 for early 2025, reflecting an increase despite trading below estimated fair value by 54.1%. While not among the highest yielders at 3%, Autoliv maintains a solid financial position with recent earnings growth enhancing its sustainability profile amidst high debt levels.

Penske Automotive Group (NYSE:PAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Penske Automotive Group, Inc. is a diversified transportation services company that operates automotive and commercial truck dealerships worldwide, with a market cap of approximately $11.17 billion.

Operations: Penske Automotive Group generates revenue through its Retail Automotive segment, which accounts for $26.16 billion, and its Retail Commercial Truck segment, contributing $3.52 billion.

Dividend Yield: 3%

Penske Automotive Group's dividend payments are well-covered by earnings and cash flow, with payout ratios of 32.3% and 40.2%, respectively, despite a volatile history over the past decade. The company announced its 17th consecutive quarterly increase to US$1.22 per share for March 2025. While trading at a favorable P/E ratio of 11.6x compared to the US market, Penske's dividend yield remains modest at 3.05%, amidst high debt levels and substantial share buybacks totaling $2.13 billion since 2010.

Summing It All Up

- Unlock our comprehensive list of 162 Top US Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.