Please use a PC Browser to access Register-Tadawul

Marcus & Millichap (MMI): Exploring Valuation as Institutional Interest and Lending Conditions Improve

Marcus & Millichap, Inc. MMI | 28.93 | -0.58% |

Marcus & Millichap (NYSE:MMI) has drawn investor attention in recent weeks as renewed institutional interest and a gradually improving lending environment start to shift sentiment around the stock, even as the sector continues to face headwinds.

While the commercial real estate sector remains challenging, Marcus & Millichap’s recent series of high-profile conference appearances suggests a company eager to demonstrate resilience. Despite a steep 1-month share price return of -9.5% and a year-to-date slide of -22.1%, renewed institutional interest and hopes for better lending conditions are shifting investor perception. Over the past year, total shareholder return is down 22.2%, reflecting near-term struggles. Momentum could build if broader market sentiment continues to turn.

If you’re curious about how other companies with rising momentum are catching investors’ attention, now is a great time to broaden your approach and discover fast growing stocks with high insider ownership.

With mixed signals from recent price declines and emerging optimism, the key question now is whether Marcus & Millichap is undervalued at current levels or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 2.9% Undervalued

Marcus & Millichap’s most widely followed narrative sets a fair value slightly above the last close price, suggesting markets may not fully reflect shifting business dynamics. The gap between consensus valuation and current pricing points to potential upside if transformation efforts accelerate.

The company is benefiting from renewed institutional investor activity and an improving lending environment, which is fueling larger transaction volumes and a stronger capital markets pipeline, both factors that are likely to boost future revenue and earnings growth.

Curious about the story behind the number? Analysts built their view around bold revenue acceleration, margin recovery, and a turnaround from losses to strong profits. Unlock the blockbuster projections shaping this target. Something in the details could surprise you.

Result: Fair Value of $30 (UNDERVALUED)

However, heavy reliance on commission-driven transactions and fee compression pressures could quickly derail the optimistic outlook if real estate activity stalls again.

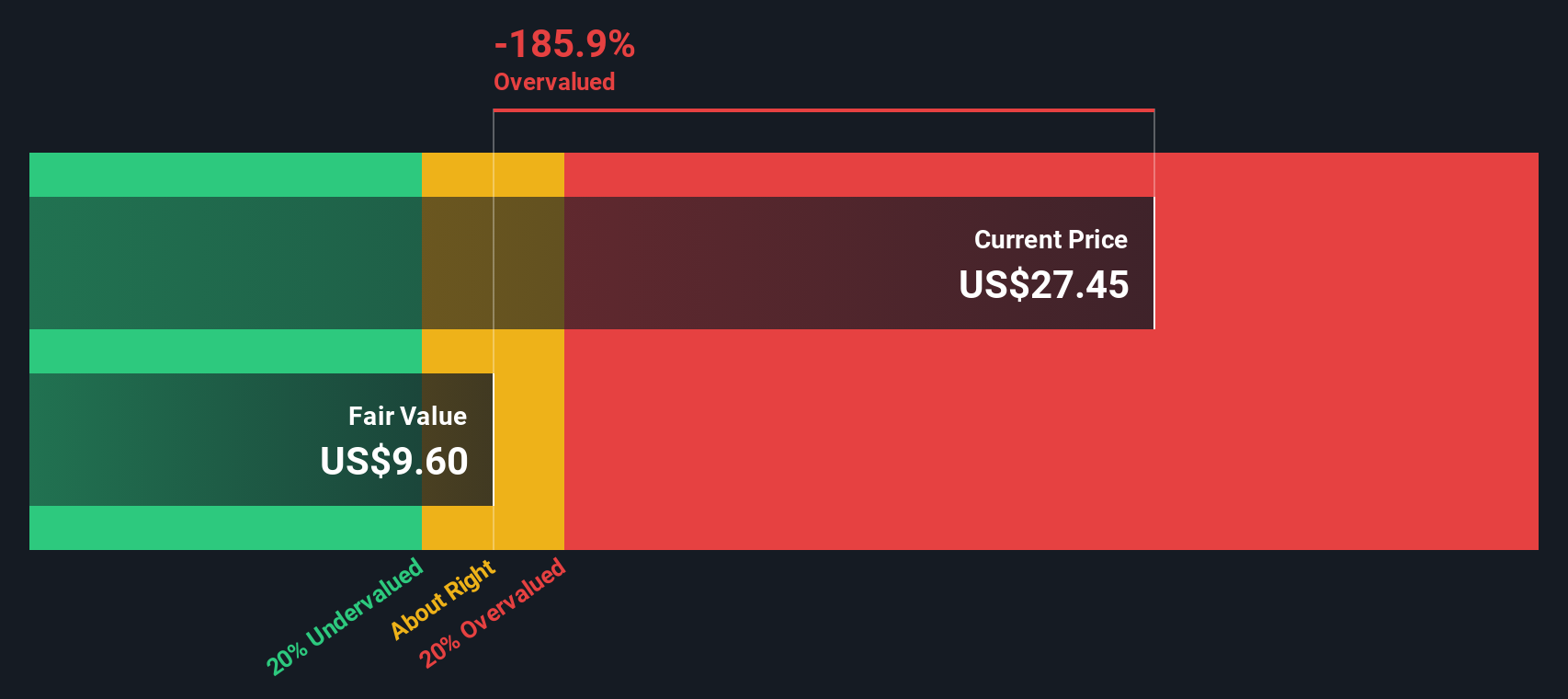

Another View: The DCF Model Tells a Different Story

While analyst consensus sees Marcus & Millichap as slightly undervalued, our SWS DCF model presents a more cautious picture. Based on our cash flow projections, the DCF fair value estimate is much lower than the current market price. This suggests the stock could be expensive if growth expectations are not met. Could this be a red flag, or is the market right to look ahead?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marcus & Millichap for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marcus & Millichap Narrative

If you'd like to dive deeper into the numbers or approach the story from your own angle, it's easy to build your own narrative in just minutes. Do it your way.

A great starting point for your Marcus & Millichap research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

Smart investors never settle for just one idea. Widen your edge and get ahead of market moves by tapping into high-potential stocks and untapped sectors with these powerful tools:

- Amplify your income by scanning for top yields and financial strength in these 18 dividend stocks with yields > 3% that consistently beat inflation and reward shareholders.

- Catch tomorrow’s sector leaders by tracking innovators among these 24 AI penny stocks who are pushing the boundaries in artificial intelligence and automation.

- Step into the world of disruptive tech by targeting hidden gems in these 79 cryptocurrency and blockchain stocks that are capitalizing on blockchain and digital payment trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.