Please use a PC Browser to access Register-Tadawul

Markel Group Underwriting Profitability With Sub 96% Combined Ratios Challenges Earnings Slowdown Concerns

Markel Group Inc. MKL | 2061.88 | -0.94% |

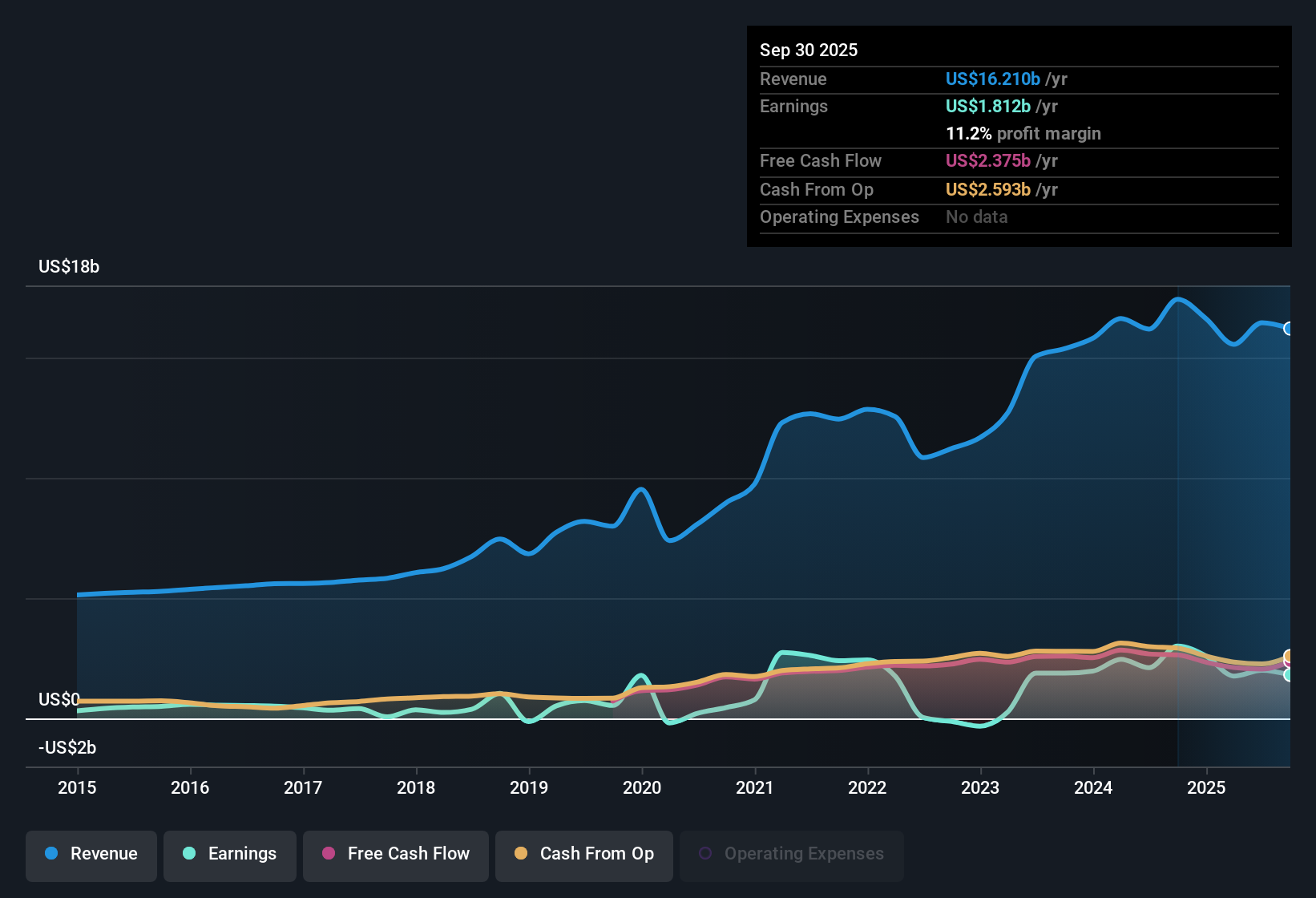

Markel Group (MKL) just wrapped up FY 2025 with Q4 revenue of US$4.2 billion and basic EPS of US$48.95, alongside trailing 12 month revenue of US$16.6 billion and EPS of US$169.74. Over the past year, the company has seen revenue move from US$16.6 billion and EPS of US$199.69 on a trailing basis at Q4 2024 to US$16.6 billion and EPS of US$169.74 at Q4 2025. Over the same period, net income went from US$2.6 billion to US$2.1 billion, setting up an earnings print where investors are likely to focus on how underwriting margins and insurance profitability are holding up.

See our full analysis for Markel Group.With the headline numbers on the table, the next step is to see how this earnings profile lines up against the prevailing narratives about Markel, and where the recent results challenge those stories.

Margins Soften, Net Profit Margin Slips To 12.5%

- Over the last 12 months, Markel earned US$2.1b of net income on US$16.6b of revenue, which works out to a 12.5% net profit margin compared with 15.6% a year earlier, pointing to earnings growing more slowly than revenue.

- What stands out for a bearish view is that this softer margin lines up with the reported negative earnings growth over the past year and a forecast 1.8% earnings decline per year over the next three years, even though:

- Trailing basic EPS on a 12 month basis is US$169.74, below the US$199.69 level a year earlier, which bears see as reinforcing the idea of earnings pressure rather than temporary noise.

- Net income over the last 12 months is US$2.1b versus US$2.6b a year earlier, so critics can point to both margin compression and lower overall profit when they argue that profitability is moving in the wrong direction.

Bears argue that a lower net margin and shrinking profits could matter more than any attractive multiples right now, especially if analysts are already expecting a multi year earnings decline.

🐻 Markel Group Bear CaseUnderwriting Quality Shows In Sub 96% Combined Ratios

- On an insurance specific measure, the combined ratio was 92.3% in Q3 FY 2025 and 95.8% in Q1 FY 2025, and stood at 95.2% on a trailing 12 month basis at Q4 FY 2024, which points to underwriting remaining profitable across several recent periods.

- Supporters of a more bullish interpretation often focus on this underwriting picture, arguing that consistently sub 100% combined ratios can help underpin earnings quality even when reported EPS is choppy, because:

- Q3 FY 2025 combined ratio of 92.3% coincided with US$755.99m of net income and basic EPS of US$60.18, which suggests that at least part of the earnings power is coming from core insurance operations rather than only investment swings.

- The earlier 95.8% combined ratio in Q1 FY 2025 still came alongside positive net income of US$155.06m on US$3.4b of revenue, which fans of the bullish line see as evidence that underwriting has remained disciplined through different quarters.

Slower Growth, Yet P/E And DCF Signal Value Angle

- Markel is reported on a trailing P/E of 12.7x versus a 13x US insurance industry average and 13.5x peer average, and a DCF fair value of US$4,810.53 compared with the current share price of US$2,095.03, all while revenue is forecast to grow at 2.9% per year against a 10.3% US market forecast.

- What is interesting here is how a more optimistic narrative leans on those numbers, suggesting the shares might look appealing even with slower growth baked in, because:

- The P/E discount to both the industry and peer averages, combined with the DCF fair value sitting more than US$2,700 above the current price, heavily supports the bullish idea that the market is pricing in a lot of caution already.

- At the same time, the company is described as having delivered 7.3% annual earnings growth over the past five years, so investors who lean bullish point to that history plus the lower multiples when they argue that the current share price may not reflect the longer term earnings record.

If you want to see how these numbers fit into the bigger story on growth, risks, and valuation, take a look at the full market narrative for Markel and how different investors are joining the dots around these earnings and the current share price. 📊 Read the full Markel Group Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Markel Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Markel's softer 12.5% net margin, lower EPS and net income, and modest revenue growth expectations leave some investors questioning its overall earnings momentum.

If that mix of margin pressure and slower growth makes you cautious, it could be worth checking out 55 high quality undervalued stocks that pair stronger value signals with solid fundamentals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.