Please use a PC Browser to access Register-Tadawul

Market Buzz | Should Investors Chase the Recent Rally in Tesla's Stock?

Tesla Motors, Inc. TSLA | 477.38 | +0.44% |

Tesla Motors, Inc.(TSLA.US) experienced a significant boost on Tuesday, with its shares soaring 10.20% to close at $231.15. The surge followed the release of Tesla's second-quarter delivery numbers, which revealed the company had delivered 443,956 vehicles, surpassing the consensus analyst estimate of 436,000 deliveries. This marks the first time in four quarters that Tesla's deliveries have exceeded expectations, with the most considerable margin since Q4 of 2021.

Not Just About EV Sales

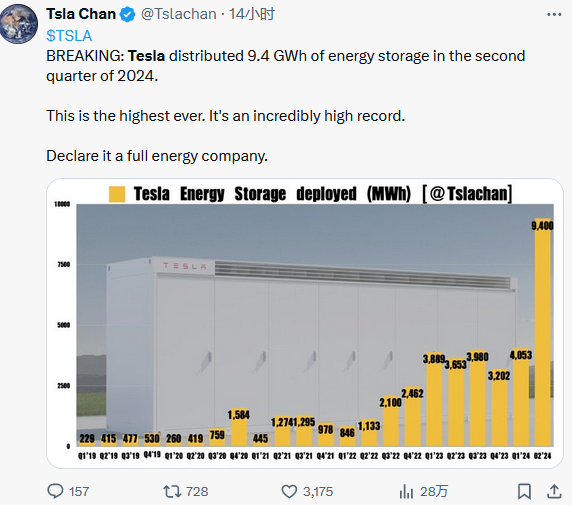

While the impressive Q2 delivery figures contributed to Tesla's mid-day 10% stock rally, it's not the only piece of good news. Tesla's solar and energy storage business also saw significant advancements during the quarter.

Data released on Tuesday by Tesla's energy subsidiary, Tesla Energy, showed a record deployment of 9.4 GWh of energy storage products in the second quarter, surpassing the first quarter's 4.053 GWh. This nearly matches the total energy storage deployments for the entire previous year in just the first half of 2024. Analysts view the energy storage segment as a beacon of hope amid slowing vehicle sales, though converting this growth into meaningful revenue remains a challenge.

Morgan Stanley analyst Adam Jonas remains highly optimistic about Tesla's energy storage business. Jonas forecasts that buoyed by rapid market development, Tesla Energy's revenue could exceed $7 billion in fiscal 2024, with profit margins potentially surpassing those of Tesla's automotive segment by 2025. He projects that Tesla's energy storage business will outpace its solar division, significantly contributing to the company's overall profitability by 2030, with a valuation for Tesla Energy pegged around $130 billion.

What's Next For Tesla?

Tesla enthusiasts and investors are keenly anticipating a pivotal event: Robotaxi Day on August 8, a day that Wedbush analyst Dan Ives believes could mark a turning point for the electric vehicle (EV) giant.

"The worst is behind Tesla, as we see the demand for EVs beginning to revitalize this disruptive tech titan ahead of a historic Robotaxi Day," said Ives.

Highlighting the significance, Ives referred to Tesla's recent second-quarter delivery numbers as "the appetizer to the main event," suggesting the upcoming Robotaxi Day will "unleash the next chapter in Tesla's autonomous vehicle saga with Wall Street watching closely."

Ives emphasized the importance of Robotaxi Day for Tesla's ambition of returning to a $1 trillion market capitalization. "We continue to view Tesla as more of an AI and robotics company than a conventional automaker. With August 8th on the horizon, it is a critical juncture for Tesla's narrative."

Tesla is also set to release its second-quarter financial results on July 23, after the market close. According to Benzinga Pro data, analysts are predicting earnings per share of 60 cents and revenues of $24.19 billion for the quarter. It's important to note that Tesla has fallen short of analyst estimates for earnings and revenue in the past three quarters.

Tesla Stock Price Targets

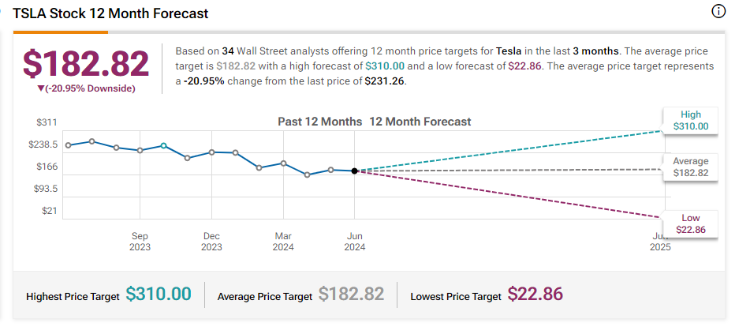

Morgan Stanley analyst Adam Jonas has reiterated his 'Buy' rating on Tesla, maintaining a target price of $310. According to data from TipRanks, Jonas has a 50.8% success rate over the past year, with an average return of 5.3%.

Wedbush Securities' Dan Ives has also adjusted his outlook, raising Tesla's target price from $275 to $300, and predicting a bullish scenario where the stock could reach as high as $400.

However, there's considerable disparity in Wall Street's outlook on Tesla's price target. Based on insights from 34 Wall Street analysts offering 12-month price targets for Tesla over the last three months, the average price target stands at $182.82, with a high forecast of $310.00 and a low forecast of $22.86. This average price target reflects a --20.95 % change from Tesla's last closing price of $231.26.

Technical Analysis

Tesla's stock has broken above its descending top trendline on the weekly chart, a pattern starting in summer 2023, according to FXStreet analyst Clay Webster. This breakthrough suggests further rally potential.

TSLA is also trading above its 200-week Simple Moving Average (SMA) for the first time since January, signaling additional bullish momentum. The Inverse Head-and-Shoulders pattern (seen in pink) indicates a price target of $246.20, with historical resistance around $265.

Investors will be watching these levels closely as Tesla's upward trajectory continues.