Please use a PC Browser to access Register-Tadawul

Market Buzz | Should You Follow Pelosi in Betting on Nvidia and Broadcom?

Arista Networks, Inc. ANET | 124.76 | -7.17% |

Comfort Systems USA, Inc. FIX | 967.95 | -5.56% |

JPMorgan Chase & Co. JPM | 318.52 | +0.36% |

Apple Inc. AAPL | 278.28 | +0.09% |

Amazon.com, Inc. AMZN | 226.19 | -1.78% |

As the U.S. stock market continues its upward trajectory this year, with the S&P 500 index(SPX.US) hitting record highs 33 times already, investor sentiment is riding high.

Amidst the market frenzy, Pelosi (former House Speaker Nancy Pelosi) has revealed her husband Paul Pelosi's recent trading activities.

According to filings, the Pelosi family made four trades recently, including purchasing call options on Broadcom Limited(AVGO.US) and stock in NVIDIA Corporation(NVDA.US), while selling shares of Tesla Motors, Inc.(TSLA.US) and Visa Inc. Class A(V.US) .

On the buying side:

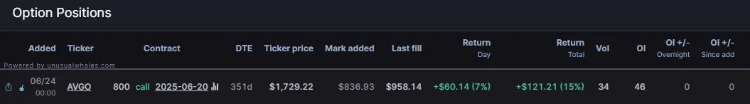

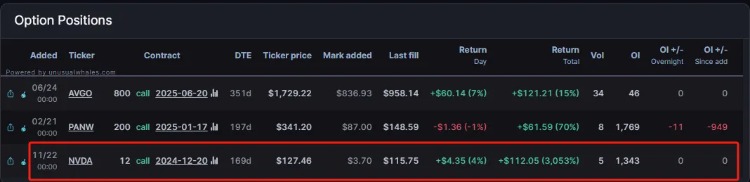

- On June 24th, they bought 20 call options for Broadcom ( Broadcom Limited(AVGO.US) ) with a strike price of $800, expiring on June 20, 2025, valued between $1 million and $5 million.

- On June 26th, they acquired 10,000 shares of Nvidia ( NVIDIA Corporation(NVDA.US) ), also valued between $1 million and $5 million.

On the selling side:

- On June 24th, they sold 2,500 shares of Tesla ( Tesla Motors, Inc.(TSLA.US) ), valued between $250,000 and $500,000.

- On July 1st, they sold 2,000 shares of Visa ( Visa Inc. Class A(V.US) ), valued between $500,000 and $1 million.

How did Pelosi fare?

Given the current AI boom, Paul Pelosi’s latest moves indicate his bullish outlook on two chip giants, Nvidia and Broadcom.

A glance at Broadcom’s Broadcom Limited(AVGO.US) stock price graph reveals the company reached an all-time high on June 18th followed by a pullback. Following Pelosi’s acquisition on June 24th, the stock stabilized and rallied toward its previous high.

Per Unusual Whales, Pelosi's trade on Broadcom Limited(AVGO.US) has yielded a 15% return in less than 10 trading days.

On June 26th, another significant investment saw Pelosi buying 10,000 shares of NVIDIA Corporation(NVDA.US).

Pelosi has a remarkable trading history with Nvidia; she executed a brilliant options trade in late 2023. Since November 22, last year, Nvidia’s stock has surged 163%.

As calculated by Unusual Whales, Pelosi's call options on Nvidia netted over $4 million within 224 days, more than twenty times her salary.

Regarding the selling activities, Pelosi offloaded 2,000 Visa Inc. Class A(V.US) shares on July 1st.

This sale could have generated substantial profits. Pelosi initially bought these shares in 2011 for under $30, while Visa closed at $263.24 on July 1st, marking nearly an eightfold increase.

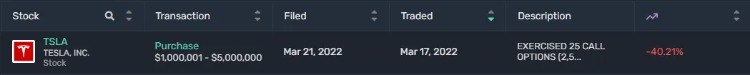

However, even "Wall Street's Oracle" has missteps, as detailed in filings showing Pelosi sold 2,500 Tesla Motors, Inc.(TSLA.US) shares on June 24th.

Historically, Pelosi bought Tesla shares on March 17, 2022, valued between $1 million and $5 million, with Tesla closing at approximately $290 that day. On June 24th, Tesla closed at $182.58, marking a 47% decline since the purchase.

Notably, Tesla shares have surged by 30% since Pelosi's sale. Thus, had Pelosi delayed the sale by a few days, the losses would have been significantly mitigated.

How to Track Congressional Holdings?

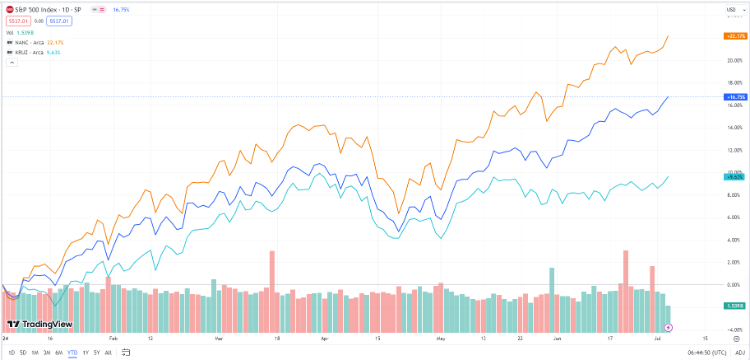

In February 2023, investment firm Subversive Capital Advisor and data hub Unusual Whales launched two ETFs aimed at tracking the investment moves of U.S. lawmakers. The funds, aptly named the Unusual Whales Subversive Democratic Trading ETF ( Unusual Whales Subversive Democratic Trading ETF(NANC.US) ) and the Unusual Whales Subversive Republican Trading ETF ( Unusual Whales Subversive Republican Trading ETF(KRUZ.US) ), provide insights into the stock picks of Democratic and Republican members of Congress, respectively.

The Democratic ETF, named in honor of former House Speaker Nancy Pelosi, and its Republican counterpart, acknowledging Senator Ted Cruz, exhibit stark contrasts in performance this year. As of now, the Democratic “oracle” investments reflected in NANC have outperformed the broader market as well as their Republican counterparts significantly. Unusual Whales Subversive Democratic Trading ETF(NANC.US) has surged by 22.17%, whereas Unusual Whales Subversive Republican Trading ETF(KRUZ.US) has posted a modest return of just over 9%. During the same period, the S&P 500 Index has returned 16.75%.

The performance disparity between the two funds primarily stems from the Democrats’ heavy allocation to high-growth tech stocks, especially those leveraged to the burgeoning AI sector. The top five holdings of Democratic lawmakers include Nvidia ( NVIDIA Corporation(NVDA.US) ), Microsoft ( Microsoft Corporation(MSFT.US) ), Amazon ( Amazon.com, Inc.(AMZN.US) ), Apple ( Apple Inc.(AAPL.US) ), and Alphabet ( Alphabet Inc. Class C(GOOG.US) ).

In contrast, Republican legislators' holdings differ markedly. The main investments for Republican lawmakers center around JPMorgan Chase ( JPMorgan Chase & Co.(JPM.US) ), Nvidia ( NVIDIA Corporation(NVDA.US) ), Comfort Systems USA ( Comfort Systems USA, Inc.(FIX.US) ), United Therapeutics ( United Therapeutics Corporation(UTHR.US) ), and Arista Networks ( Arista Networks, Inc.(ANET.US) ).

| Democratic ETF Top 5 Holdings | Weighting In ETF |

|---|---|

| NVIDIA Corporation(NVDA.US) | 13.1% |

| Microsoft Corporation(MSFT.US) | 9.6% |

| Amazon.com, Inc.(AMZN.US) | 5% |

| Alphabet Inc. Class C(GOOG.US) | 4.9% |

| Apple Inc.(AAPL.US) | 4.8% |

Data source: Morningstar.com.

| Republican ETF Top 5 Holdings | Weighting In ETF |

|---|---|

| JPMorgan Chase & Co.(JPM.US) | 3.16% |

| NVIDIA Corporation(NVDA.US) | 2.76% |

| Comfort Systems USA, Inc.(FIX.US) | 2.63% |

| United Therapeutics Corporation(UTHR.US) | 1.9% |

| Arista Networks, Inc.(ANET.US) | 1.8% |

Data source: Morningstar.com.

Additionally, Tuttle Capital has announced a new ETF, preliminarily dubbed NPEL, scheduled to take effect on August 26. This ETF, named after Nancy Pelosi, will track the trading activities of members of Congress and their families.

The operational model of NPEL will take into account each lawmaker’s seniority, committee involvement, and historical ability to generate excess returns to construct its initial portfolio. Subsequently, when a U.S. Congressman or Senator reports a stock transaction, NPEL will automatically adjust its holdings to reflect the reported trade.