Please use a PC Browser to access Register-Tadawul

Market Cool On Dragonfly Energy Holdings Corp.'s (NASDAQ:DFLI) Revenues Pushing Shares 30% Lower

Dragonfly Energy Holdings Corp - Common Stock DFLI | 0.75 | -6.70% |

The Dragonfly Energy Holdings Corp. (NASDAQ:DFLI) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. For any long-term shareholders, the last month ends a year to forget by locking in a 78% share price decline.

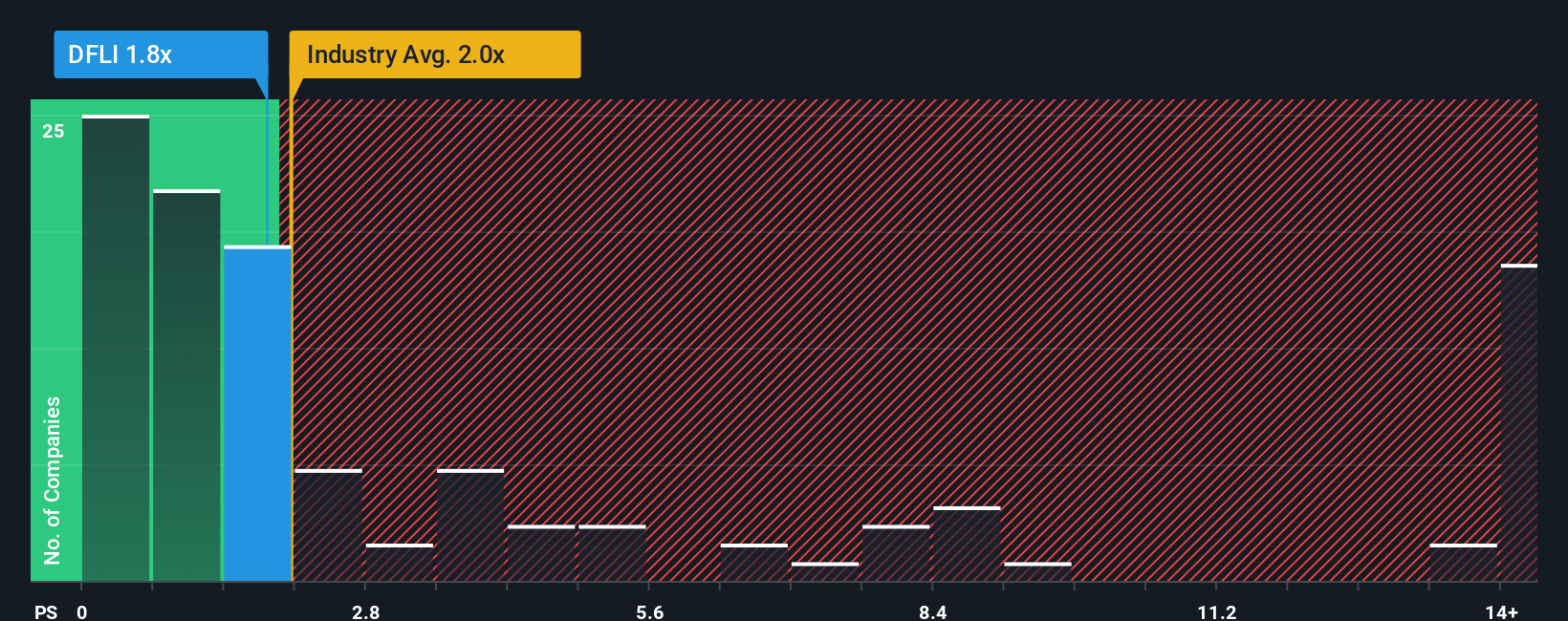

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Dragonfly Energy Holdings' P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in the United States is also close to 2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Dragonfly Energy Holdings' P/S Mean For Shareholders?

Recent revenue growth for Dragonfly Energy Holdings has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Dragonfly Energy Holdings will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Dragonfly Energy Holdings will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Dragonfly Energy Holdings?

The only time you'd be comfortable seeing a P/S like Dragonfly Energy Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 33% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 29% each year during the coming three years according to the dual analysts following the company. With the industry only predicted to deliver 16% each year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Dragonfly Energy Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Dragonfly Energy Holdings' P/S Mean For Investors?

Dragonfly Energy Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Dragonfly Energy Holdings' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

If these risks are making you reconsider your opinion on Dragonfly Energy Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.