Please use a PC Browser to access Register-Tadawul

Market Cool On indie Semiconductor, Inc.'s (NASDAQ:INDI) Revenues Pushing Shares 25% Lower

Indie Semiconductor Inc Ordinary Shares - Class A INDI | 4.29 | -4.24% |

Unfortunately for some shareholders, the indie Semiconductor, Inc. (NASDAQ:INDI) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 68% loss during that time.

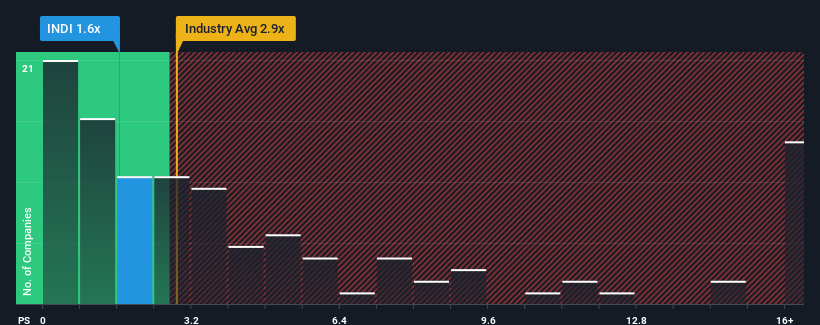

After such a large drop in price, indie Semiconductor's price-to-sales (or "P/S") ratio of 1.6x might make it look like a buy right now compared to the Semiconductor industry in the United States, where around half of the companies have P/S ratios above 2.8x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Our free stock report includes 1 warning sign investors should be aware of before investing in indie Semiconductor. Read for free now.

What Does indie Semiconductor's Recent Performance Look Like?

While the industry has experienced revenue growth lately, indie Semiconductor's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on indie Semiconductor.Is There Any Revenue Growth Forecasted For indie Semiconductor?

In order to justify its P/S ratio, indie Semiconductor would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 2.9% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 39% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 24% per annum, which is noticeably less attractive.

In light of this, it's peculiar that indie Semiconductor's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does indie Semiconductor's P/S Mean For Investors?

indie Semiconductor's recently weak share price has pulled its P/S back below other Semiconductor companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

indie Semiconductor's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

If you're unsure about the strength of indie Semiconductor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.