Please use a PC Browser to access Register-Tadawul

Matson (MATX) Valuation in Focus as Analysts Flag Container Shipping Weakness and Earnings Uncertainty

Matson, Inc. MATX | 119.39 | -2.59% |

Jefferies analysts are sounding cautious about container shipping stocks as freight rates have slipped below break-even for major carriers. Matson (MATX) remains under watch, with analysts emphasizing an uncertain earnings outlook. The company maintains a solid balance sheet.

Matson’s share price has felt the pressure from this shipping market volatility, giving up serious momentum in 2025. Its latest 1-year total shareholder return sits at -0.26%, mirroring the downbeat mood as freight rates hit new lows. While recent weeks haven’t brought much relief, the company’s longer-term investors are still up, with a total return of over 60% across three years. This underscores just how cyclical this industry can be, even for well-capitalized players.

If you’re weighing which other companies could ride out this turbulence or emerge stronger, now’s a smart time to broaden your investing lens and discover fast growing stocks with high insider ownership

With Matson trading at a significant discount to analyst targets but facing pressured earnings and soft freight rates, investors have to ask if the market is already accounting for rough waters ahead or if there is real value yet to be unlocked.

Most Popular Narrative: 8.7% Undervalued

Compared to Matson's last close of $100.39, the most widely followed narrative suggests a fair value of $110. This implies notable upside even as analysts temper future expectations. This setup hints at both opportunity and tension around Matson's valuation, given the sector’s persistent volatility and currently pressured earnings.

“Investments in fleet modernization and LNG-ready vessels enhance Matson's operational efficiency and regulatory readiness, reducing long-term operating costs and likely securing higher net margins as emissions standards tighten industry-wide.”

Want to know what’s really fueling this higher valuation? One bold bet is that margin improvement and strategic investments can offset weak near-term growth. Curious which financial forecasts and market shifts this narrative is banking on? Dive in to uncover the specifics that drive the numbers behind this valuation.

Result: Fair Value of $110 (UNDERVALUED)

However, persistent volatility in global trade or a downturn in Matson’s concentrated trade lanes could quickly undermine even the most compelling value story.

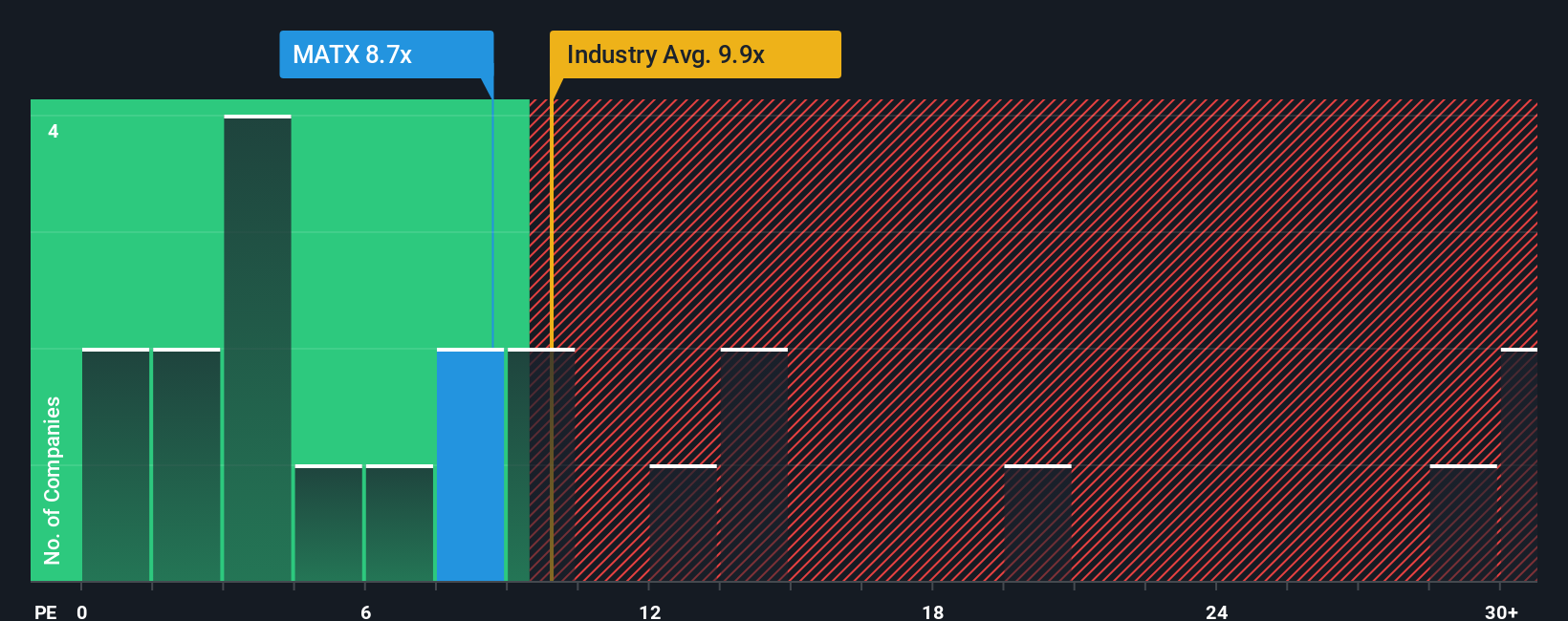

Another View: Market Multiples Paint a Different Picture

Looking at Matson from a market multiples angle, things appear more complicated. While the company’s current price-to-earnings ratio is 6.5x, peers are trading higher at 9.1x, and the industry sits at 6.4x. Interestingly, the market’s fair ratio for Matson is 6.2x, which is slightly lower than what it’s trading at now. This gap highlights some valuation risk if the stock moves closer to the fair ratio. Might the market still be missing something, or is this a red flag for further downside?

Build Your Own Matson Narrative

If you see things differently or want your own perspective reflected, it takes less than three minutes to dive into the data and craft your own view. Do it your way

A great starting point for your Matson research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities pass you by. The next market leader could be just a click away. Use these tailored picks to quickly scan for top stocks worth your time:

- Catch the upside of artificial intelligence advances by checking out these 24 AI penny stocks, which are driving new waves of innovation and business transformation.

- Lock in steady income and financial resilience with these 19 dividend stocks with yields > 3%, offering strong yields and attractive fundamentals.

- Target high-growth early movers among these 3563 penny stocks with strong financials that have robust balance sheets and proven financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.