Please use a PC Browser to access Register-Tadawul

Maximus Expands AI Role In SNAP As States Face 2027 Funding Shift

MAXIMUS, Inc. MMS | 92.38 | -2.24% |

- Maximus (NYSE:MMS) has launched Accuracy AssistantTM, an AI-powered tool for state Supplemental Nutrition Assistance Program (SNAP) agencies.

- The solution uses predictive analytics and intelligent automation to flag and resolve data inconsistencies before benefit determination errors occur.

- The launch comes ahead of 2027 federal changes that will tie state funding responsibility to SNAP payment error rates.

For Maximus, which focuses on technology enabled services for government clients, Accuracy AssistantTM fits squarely into its push to support complex public benefit programs. SNAP remains a core part of the US social safety net, and states are under growing pressure to manage large case volumes while maintaining compliance with federal rules.

Investors may watch how quickly states evaluate or adopt tools like Accuracy AssistantTM as they prepare for the 2027 cost sharing rules. The product also provides an additional data point on how Maximus is positioning its AI capabilities in government services, particularly in areas with clear regulatory and financial consequences for its customers.

Stay updated on the most important news stories for Maximus by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Maximus.

Accuracy AssistantTM looks like Maximus leaning harder into AI-powered quality control for benefits administration, at a time when SNAP payment accuracy will directly affect state budgets from October 2027. For investors, this sits at the intersection of Maximus’s core operations work and higher value software and analytics, which can help deepen relationships with existing SNAP clients and potentially open doors with states that are more exposed to future error related funding rules.

How this fits the Maximus narrative

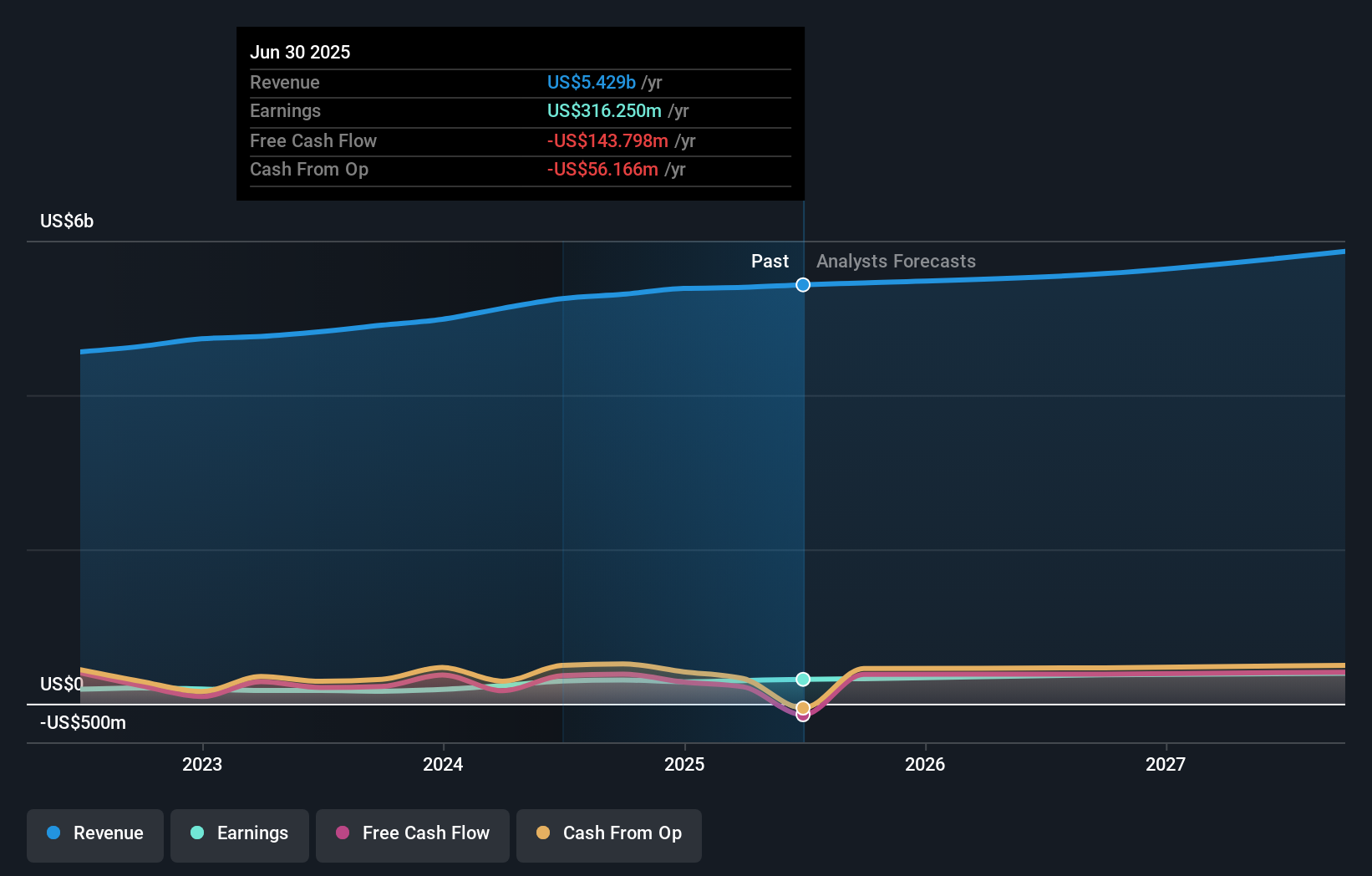

Both existing analyst narratives highlight regulatory complexity, rising compliance demands, and AI driven process improvements as key themes for Maximus, and this product launch is a concrete example of that story playing out in SNAP. While Maximus recently reported flat revenue and weaker full year guidance, Accuracy AssistantTM aligns with the idea that AI and digital tooling could support more efficient delivery of government services and help the company compete for future compliance heavy contracts against peers such as Accenture, CGI and DXC Technology.

Risks and rewards investors should weigh

- ⚠️ Maximus is highly exposed to government budgets and contract timing, so slower SNAP technology upgrades or states choosing in house tools could limit demand for Accuracy AssistantTM.

- ⚠️ AI based decisions in sensitive programs like SNAP carry regulatory and reputational risk if accuracy checks or data handling fall short of evolving standards.

- 🎁 If states see lower error rates and better workflow efficiency, Maximus could strengthen retention on existing SNAP work and be better placed to win new eligibility and compliance contracts.

- 🎁 This launch shows Maximus trying to move up the value chain into software rich, data driven offerings, which some investors view as helpful for differentiating it from more traditional consulting and BPO competitors.

What to watch next

From here, the key questions are how many states pilot or adopt Accuracy AssistantTM, whether it links to measurable changes in SNAP error metrics, and how convincingly Maximus integrates tools like this across other benefits programs. If you want to see how other investors and analysts are framing these developments, take a look at the community narratives for Maximus on this page that pulls the different viewpoints together.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.