Please use a PC Browser to access Register-Tadawul

MaxLinear (MXL) Margin Loss Deepens, Challenging Bullish Narratives Despite Forecast 15.1% Revenue Growth

MaxLinear, Inc. Class A MXL | 17.41 | -6.25% |

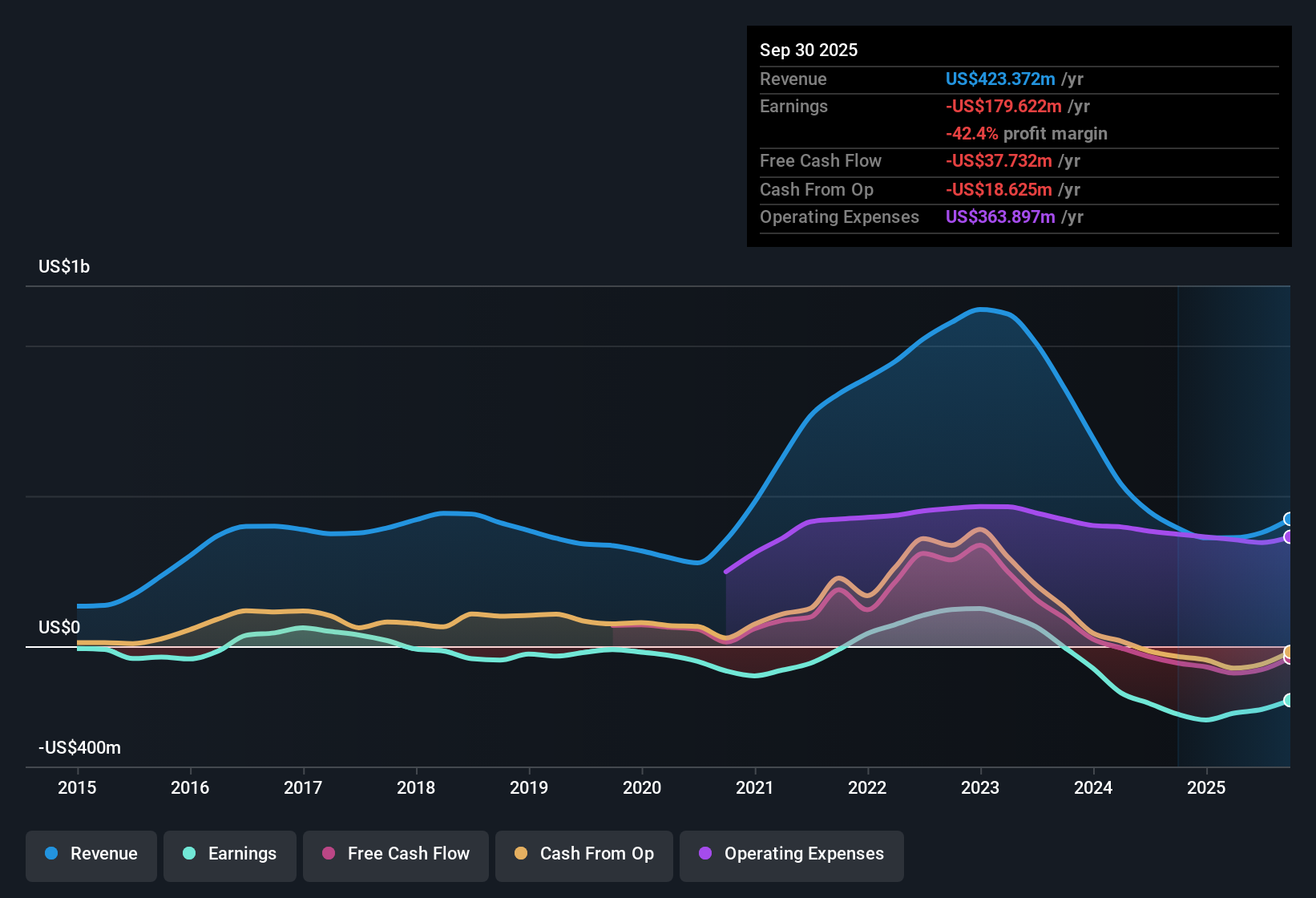

MaxLinear (MXL) is set to outpace the broader US market with forecasted revenue growth of 15.1% per year, compared to a 10% industry average. Even with this top-line momentum, the company has remained unprofitable, and losses have deepened over the past five years at an average rate of 38.3% per year, with no meaningful improvement in margins. Shares currently trade at $15.62, well below the estimated fair value of $33.90, while the Price-To-Sales ratio of 3.2x sits under the industry’s 5.3x average but slightly above peers at 2.9x. Investors are weighing the rewards of discounted valuation and faster growth against persistent unprofitability and rising losses.

See our full analysis for MaxLinear.Next, we’ll see how the latest financial results stack up against the narratives that investors and analysts have built around MaxLinear. Sometimes these results reinforce existing perspectives, while other times they reshape them.

Profit Margins Stuck Deep in Red

- MaxLinear's profit margins remain firmly negative, with losses compounding at 38.3% per year over the last five years and no improvement on the horizon, as forecasts predict ongoing unprofitability for at least three more years.

- Analysts' consensus view highlights the tension between the company's aggressive growth prospects and its continuing struggles with margins:

- While revenue is expected to grow well above the 10% industry average, the lack of progress on margins raises concerns about whether this growth will translate into sustainable earnings.

- Analysts note that absent a turnaround in profitability, the stock may not fully capitalize on upcoming industry tailwinds, despite strong customer partnerships and design wins.

Discounted Valuation vs. Analyst Target

- Shares currently trade at $15.62, noticeably below both the DCF fair value of $33.90 and the only allowed analyst price target of $20.35. This makes MaxLinear one of the more steeply discounted names in the US semiconductor sector.

- According to analysts' consensus view, this gap offers a potential opportunity if MaxLinear can execute on its earnings recovery:

- At the analyst target, the implied upside is about 30% from today's share price, contingent on revenues reaching $630.9 million and earnings swinging to $89.0 million by September 2028.

- However, the lack of forecasted profitability in the next three years and reliance on a future PE of 28.6x means this optimism comes with significant execution risk.

Industry-Leading Revenue Pace, But With Risks

- MaxLinear’s projected revenue growth stands at 15.1% annually, outstripping both the industry’s 10% average and many of its closest peers. This growth is fueled by major design wins and new partnerships in key markets.

- The analysts' consensus narrative focuses on the company's balanced risk-reward profile:

- Consensus calls out the company’s exposure to cyclical broadband markets, rapid technological shifts, and deepening reliance on maturing product lines as factors that could undermine this growth and keep margins under pressure.

- Even with strong momentum from next-generation solutions and Tier 1 customer integrations, bears argue that industry commoditization and global supply chain friction could erode any gains. This makes the revenue acceleration fragile.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MaxLinear on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a different take on MaxLinear's results? Share your perspective and shape your own view directly. Get started in just a few minutes. Do it your way

A great starting point for your MaxLinear research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

MaxLinear’s attractive revenue growth is overshadowed by persistent losses and ongoing margin pressure, making profitability uncertain for the foreseeable future.

If steady performance and predictable earnings matter to you, focus on companies showing consistent expansion and financial resilience by using our stable growth stocks screener (2098 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.