Please use a PC Browser to access Register-Tadawul

May 2025's Top Stock Selections Estimated Below Intrinsic Value

Autodesk, Inc. ADSK | 297.64 | -1.09% |

The United States market has experienced a notable upswing, rising 5.3% over the last week and 12% over the past year, with earnings projected to grow by 14% annually. In this environment, identifying stocks that are potentially undervalued can be an effective strategy for investors seeking opportunities that may offer growth potential relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $17.98 | $35.55 | 49.4% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $26.78 | $52.65 | 49.1% |

| Valley National Bancorp (NasdaqGS:VLY) | $9.20 | $18.28 | 49.7% |

| Horizon Bancorp (NasdaqGS:HBNC) | $15.80 | $30.73 | 48.6% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.30 | $18.49 | 49.7% |

| Bel Fuse (NasdaqGS:BELF.A) | $72.65 | $142.88 | 49.2% |

| Shoals Technologies Group (NasdaqGM:SHLS) | $6.03 | $11.81 | 48.9% |

| FinWise Bancorp (NasdaqGM:FINW) | $15.05 | $29.22 | 48.5% |

| Clearfield (NasdaqGM:CLFD) | $37.73 | $74.78 | 49.5% |

| MAC Copper (NYSE:MTAL) | $10.06 | $20.00 | 49.7% |

We'll examine a selection from our screener results.

Autodesk (NasdaqGS:ADSK)

Overview: Autodesk, Inc. offers 3D design, engineering, and entertainment technology solutions globally and has a market cap of approximately $62.73 billion.

Operations: The company generates revenue primarily from its CAD/CAM software segment, amounting to $6.13 billion.

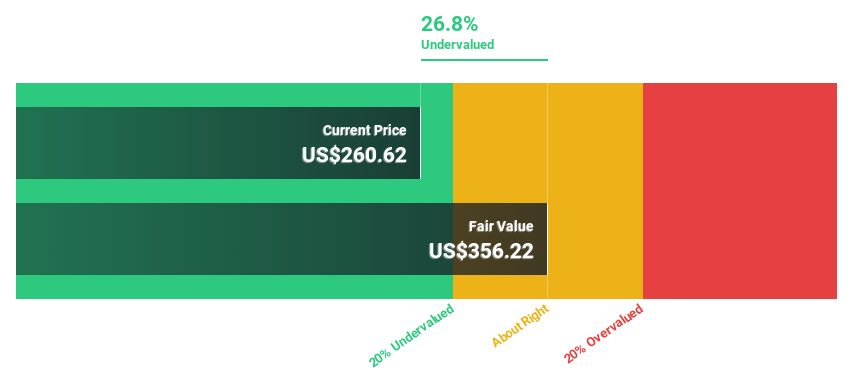

Estimated Discount To Fair Value: 11.7%

Autodesk is trading at US$297.01, approximately 11.7% below its estimated fair value of US$336.47, indicating potential undervaluation based on cash flows. The company's revenue and earnings are forecast to grow faster than the U.S. market at 9.7% and 14.3% per year, respectively. Recent strategic moves include a new US$1.5 billion credit agreement for flexibility in working capital and corporate purposes, enhancing its financial position to support growth initiatives and operational efficiency improvements through integrations with Autodesk Construction Cloud®.

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc. operates a commerce platform that links merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $81.40 billion.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, amounting to $11.24 billion.

Estimated Discount To Fair Value: 43.7%

DoorDash is trading at US$197.8, significantly below its estimated fair value of US$351.17, highlighting potential undervaluation based on cash flows. The company recently turned profitable and reported Q1 2025 earnings with sales of US$3.03 billion and net income of US$193 million, a turnaround from a loss last year. Earnings are forecast to grow substantially over the next three years, surpassing the broader U.S. market's growth rate.

Formula One Group (NasdaqGS:FWON.K)

Overview: Formula One Group, along with its subsidiaries, operates in the motorsports industry across the United States and the United Kingdom, with a market cap of approximately $23.25 billion.

Operations: Formula One Group generates revenue through various segments including motorsport events, broadcasting rights, and sponsorships.

Estimated Discount To Fair Value: 15.6%

Formula One Group is trading at US$96.48, below its estimated fair value of US$114.27, pointing to potential undervaluation based on cash flows. Despite a challenging first quarter with net income dropping to US$5 million from last year's US$203 million, earnings are projected to grow significantly over the next three years, outpacing the broader U.S. market growth rate. However, profit margins have decreased compared to the previous year and return on equity forecasts remain modest.

Seize The Opportunity

- Navigate through the entire inventory of 169 Undervalued US Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.