Please use a PC Browser to access Register-Tadawul

McDonald's (MCD): Assessing Valuation as New Menu Collaborations Spark Holiday Buzz

McDonald's Corporation MCD | 325.97 327.19 | +0.11% +0.37% Pre |

McDonald's (MCD) is rolling out a slew of limited-time offerings, including The Grinch Meal and a Disneyland Resort anniversary collaboration, just ahead of the holiday rush. These promotions aim to drive fresh consumer interest and boost foot traffic.

Against the backdrop of fresh offerings and energetic holiday marketing, McDonald's share price has shown steady progress, up 3.1% over the past month and delivering a total shareholder return of 7.8% for the year. Although the company has seen a few operational bumps and ongoing local activism, momentum has generally held as McDonald’s relies on brand power, expansion, and promotions to bolster investor sentiment in an evolving consumer landscape.

If a global icon’s strategic moves inspire you to think beyond the golden arches, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With new collaborations, steady returns, and ongoing brand expansion, investors may wonder whether McDonald’s stock still has room to run or if all this optimism is already reflected in the current price. Is this a buying opportunity, or are future gains already priced in?

Most Popular Narrative: 5.9% Undervalued

The most closely followed narrative puts McDonald's fair value at $331.53, a modest premium to the last close price of $311.82. The current share price sits just below the narrative’s outlook, raising questions about whether market consensus is underestimating some of the company’s levers for future growth.

The accelerated rollout of technology initiatives (AI-powered order-taking, kitchen automation, edge computing, and IoT-enabled operations) is poised to materially improve operational efficiencies, reduce labor and equipment downtime costs, and ultimately enhance operating margins and EPS as tech investments mature after 2026.

Want to know the bold assumptions shaping this fair value? The narrative leans heavily on game-changing tech investments and margin expansion that could reset McDonald’s earnings profile. Wonder which key financial drivers set this price apart? Dig into the full story to see what’s making analysts optimistic about the next chapter.

Result: Fair Value of $331.53 (UNDERVALUED)

However, persistent declines in low-income traffic or sustained cost inflation could hinder McDonald's ability to deliver on these optimistic growth projections.

Another View

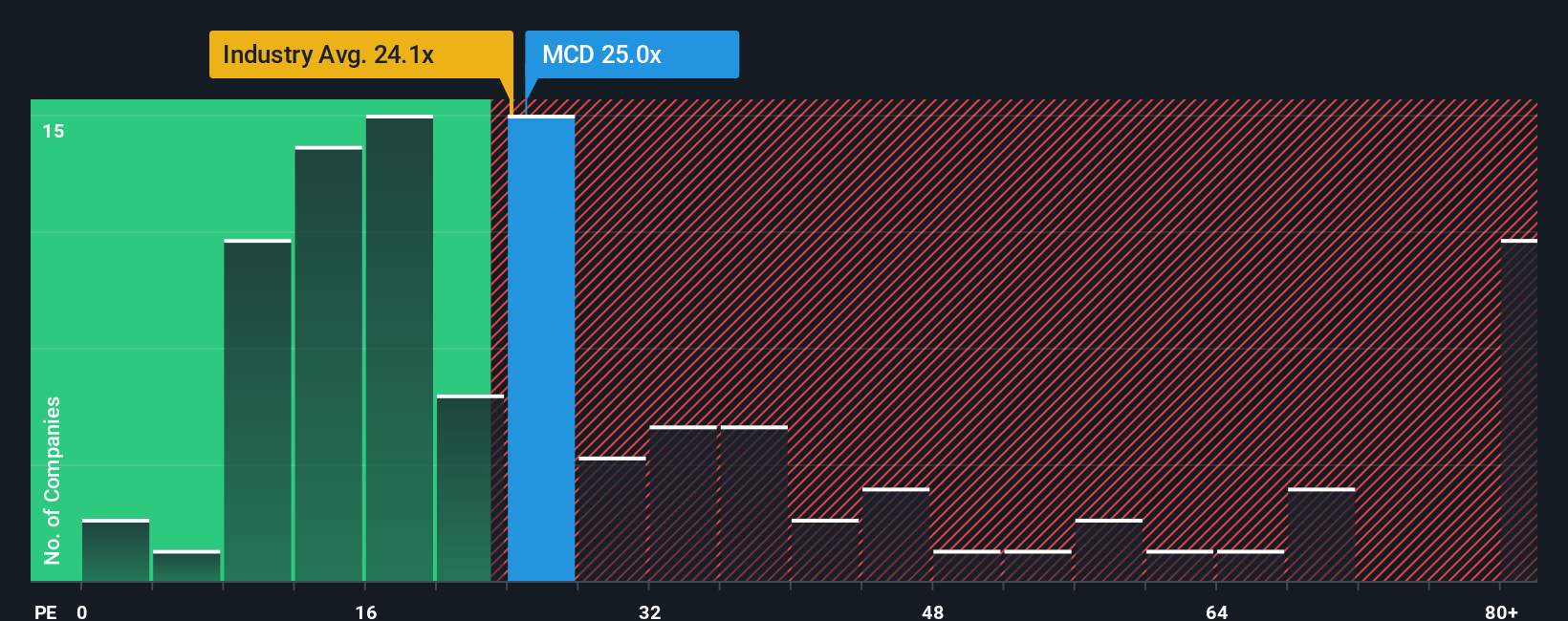

Looking from another angle, McDonald's is trading at a price-to-earnings ratio of 26.4x. That is above the industry average of 21.4x, but below what our fair ratio suggests the market could support at 29.5x. While peers average a much steeper 52.9x, this middle ground highlights both potential and risk. Will investors bet on further upside, or does the current premium signal caution?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out McDonald's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own McDonald's Narrative

If you see the numbers differently or want to explore your own insights, you can piece together a personalized McDonald's story in just a few minutes. Do it your way

A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Broaden your strategy and uncover untapped potential by checking out our pre-screened selections below. You might just find your next winning move.

- Capture high yields and stable growth by reviewing these 15 dividend stocks with yields > 3% with payouts above 3% and proven financial resilience.

- Get ahead of transformative trends with these 25 AI penny stocks featuring companies at the forefront of artificial intelligence innovation.

- Unlock overlooked value. See these 920 undervalued stocks based on cash flows based on robust cash flow, ready for a potential market re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.