Please use a PC Browser to access Register-Tadawul

Merck (NYSE:MRK) Gains FDA Priority Review For WINREVAIR PAH Treatment sBLA

Merck & Co., Inc. MRK | 98.27 | -1.98% |

Merck (NYSE:MRK) recently announced the FDA's priority review for an sBLA for WINREVAIR™ and results from its ZENITH trial, showcasing significant improvements in pulmonary arterial hypertension treatment. Despite a 6.5% increase in Merck’s share price last month, market dynamics show a correlation rather than a direct causation, as the broader market rose as well. Key events included Merck's inclusion in the Russell 3000 and 1000 Value Indexes and regulatory achievements for treatments like ENFLONSIA™, reinforcing investor confidence amidst an overall positive trend in the market, reflected particularly in the tech sector's gains.

Merck's recent FDA priority review for WINREVAIR™ and promising ZENITH trial results could bolster its narrative of driving future market dynamics through strategic investments. Over the last five years, Merck has achieved a total shareholder return of 27.33%, underscoring strong longer-term performance. However, in the past year, Merck underperformed the US Pharmaceuticals industry, which saw a 11.8% decline, and the broader US market, which returned 13.9%.

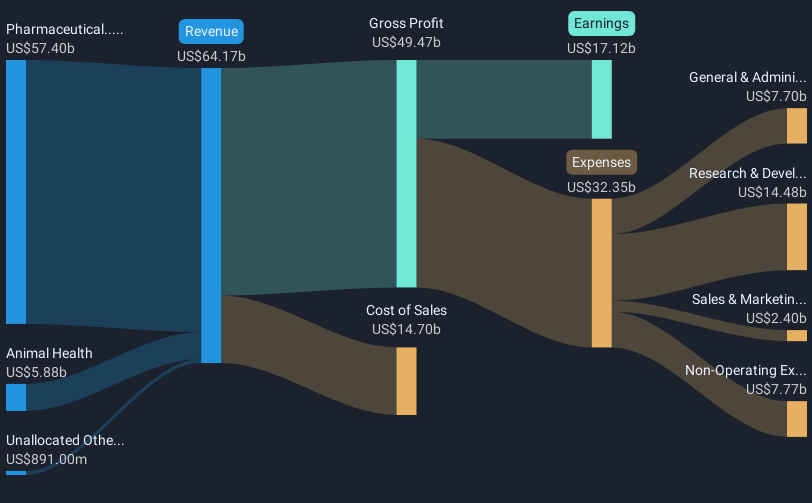

The FDA review and product launch announcements are expected to positively influence Merck's revenue and earnings forecasts by solidifying its leadership in key therapeutic areas, thereby supporting projected earnings growth to $24.6 billion by 2028. These developments contribute to analysts maintaining a consensus price target of US$105.02, which is a 24.7% premium to the current share price of US$79.04. This target reflects confidence in the firm's ability to leverage its growth drivers effectively amidst broader market trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.