Please use a PC Browser to access Register-Tadawul

Mercury General (MCY): Assessing Valuation After Analyst Upgrade Highlights Earnings Outlook and Attractive Ratios

Mercury General Corporation MCY | 93.39 | -0.13% |

If you have been on the fence about Mercury General (MCY), a wave of fresh attention may now have you reconsidering. The company just received an upgrade to a strong buy rating, with analysts highlighting its attractive valuation metrics such as lower P/E, P/S, and P/CF ratios compared to its industry peers. This kind of endorsement often catches the eye of investors looking for a combination of solid earnings outlook and competitive price, especially in insurance stocks where fundamentals are under constant scrutiny.

Throughout the past year, MCY has seen its stock climb 36.8%, with gains accelerating over the past 3 months and half-year period. These movements seem to line up with improving company performance and renewed optimism about its long-term profitability, even as some voices remain cautious due to return on equity falling short of industry benchmarks. While its results have spurred momentum, the debate about whether this surge is justified or just a temporary uptick remains active.

So the question is clear: do current levels reflect a real bargain, or is the market already factoring in all the potential growth Mercury General has to offer?

Most Popular Narrative: 11.8% Undervalued

The prevailing narrative suggests that Mercury General’s shares are currently undervalued, with the company trading below what analysts see as its fair value based on future earnings and growth expectations.

The company's core underlying business, excluding catastrophe losses, is strong with favorable underlying combined ratios in their personal auto and homeowners business. This suggests potential for improvement in future earnings stability and net margins.

Want to know what bold financial moves are expected to push Mercury General’s price higher? The narrative lays out a plan backed by credible projections for revenue, profit margins, and a sharply higher future earnings multiple. Want to discover which precise assumptions analysts have baked into their valuation model, and what dramatic shifts could be in store for the company’s profitability? The answers might surprise you. The full breakdown reveals exactly what is behind this undervalued rating.

Result: Fair Value of $90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as unpredictable wildfire losses and rising reinsurance costs could quickly challenge this optimistic outlook for Mercury General’s future earnings.

Find out about the key risks to this Mercury General narrative.Another View: Discounted Cash Flow Model

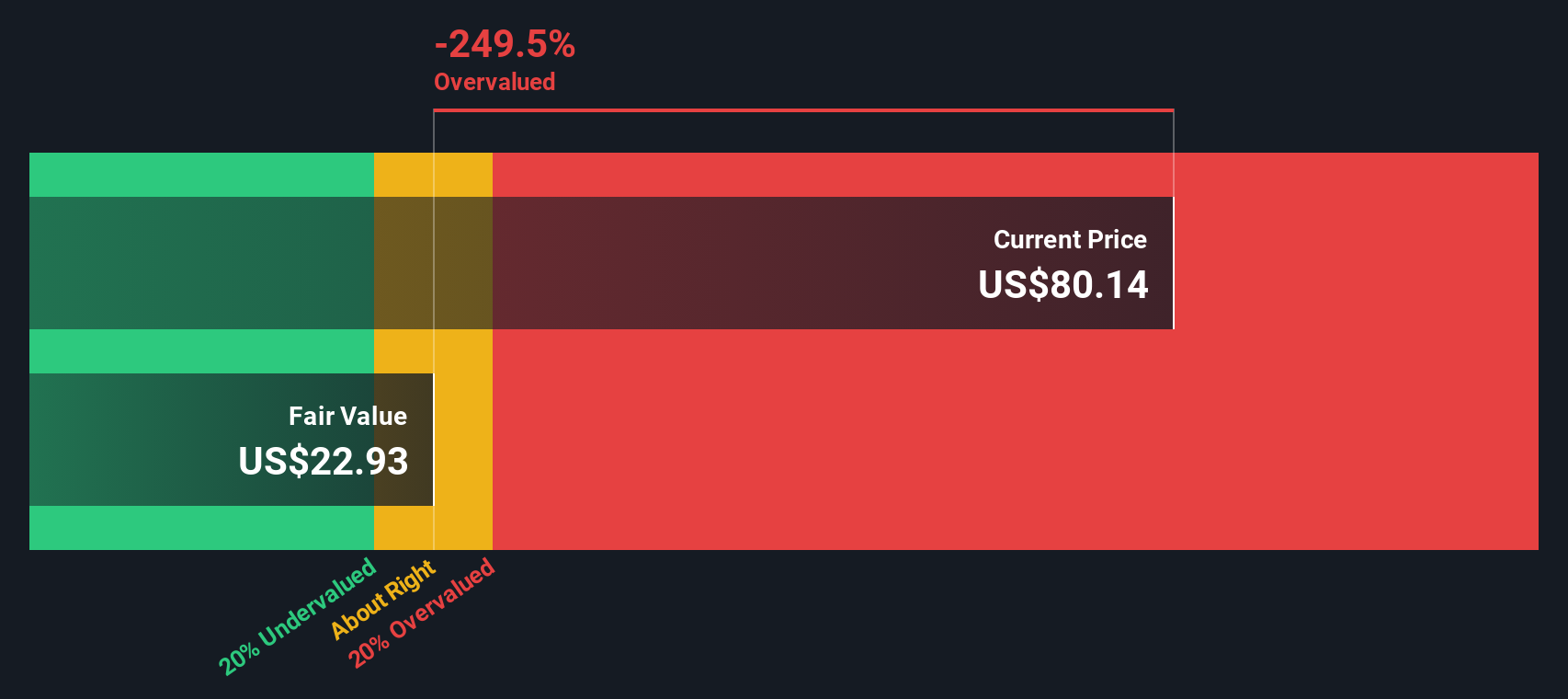

Taking a step back, our DCF model offers a different perspective compared to looking solely at how the stock trades relative to others in its field. This approach currently suggests Mercury General might be overvalued. Could the market be missing something, or is it pricing in too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mercury General Narrative

If you have a different view, or want to independently analyze Mercury General’s story, you can easily craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Mercury General research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t limit yourself to just one stock when so many promising ideas await. Seize the momentum, broaden your outlook, and unlock strategies used by confident investors right now.

- Capture what top investors chase by using AI penny stocks to pinpoint emerging companies at the forefront of artificial intelligence breakthroughs and redefining how industries operate.

- Boost your portfolio’s stability and income with dividend stocks with yields > 3%, which highlights companies offering robust yields above 3% along with a strong track record of payouts.

- Capitalize on the market’s hidden gems by leveraging undervalued stocks based on cash flows to find attractive stocks that appear underpriced based on future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.