Please use a PC Browser to access Register-Tadawul

Meta Platforms (META) Joins Global Signal Exchange, Reports Strong Q2 Earnings Growth

Meta Platforms META | 649.84 | +0.36% |

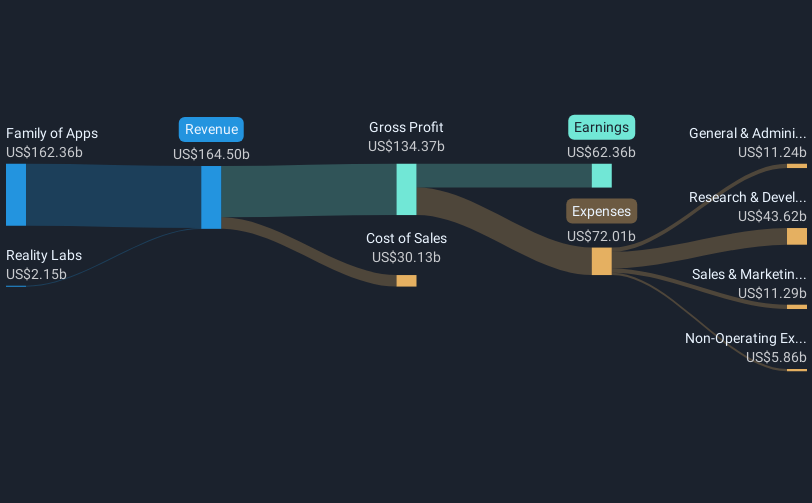

Meta Platforms (META) recently saw a 21% rise in share price over the last quarter, reflecting a period marked by significant developments. The company's strong Q2 financial performance, with a notable 22% revenue increase to $47.52 billion, was bolstered by its breakthroughs in AI-powered advertising systems. The Global Signal Exchange partnership with Microsoft and others to combat online scams highlighted Meta's commitment to digital safety, aligning with broader market optimism in the tech sector. The general positive trend in major indices, fueled by strong earnings from tech giants, provided an advantageous backdrop for Meta's stock performance.

In light of Meta Platforms' recent developments highlighted in the introduction, the company's commitment to enhancing digital engagement and safety through AI and partnerships could drive sustained revenue and earnings growth. Specifically, the Q2 financials marked by a revenue increase to US$47.52 billion and a strong strategic focus on AI-powered advertising are key elements in potentially boosting both short and longer-term profitability. However, the financial strain from large-scale AI investments and operational hurdles in Europe may pose challenges to maintaining profitability levels.

Examining the company's longer-term performance, Meta shares have delivered an impressive total return of a very large percentage over the past three years, demonstrating robust shareholder value. This return significantly outpaces its 1-year performance against the Interactive Media and Services industry, which saw a return of just 25.5%. Over the same annual period, Meta outperformed the broader US market, presenting itself as a strong contender in the tech sector.

Regarding analyst expectations, with forecasted revenue growth of 11.5% annually and the expectation of a 34.6% profit margin within three years, Meta's earnings are projected to grow modestly compared to broader market trends. The recent share price movement to US$695.21 shows the stock trading slightly below the consensus price target of US$756.13. This suggests room for appreciation, though analysts propose a relatively close alignment between the current value and future projections. Investors may find the narrow price gap to the target reflective of general market sentiment and sector forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.