Please use a PC Browser to access Register-Tadawul

Meta Platforms (NasdaqGS:META) Signs 20-Year Clean Energy Deal with Constellation

Meta Platforms META | 653.06 | +1.08% |

Meta Platforms (NasdaqGS:META) experienced a price increase of nearly 12% over the past month. This rise aligns with the broader market performance, which has seen an increase of 13% over the last year. Meta's recent 20-year power purchase agreement with Constellation for nuclear energy and its collaboration with Red Hat to enhance AI capabilities serve as positive industry moves that potentially add weight to its stock performance. The declaration of a quarterly dividend and addressing shareholder proposals present stable financial and governance strategies as potential incremental factors supporting the company's latest share price movement.

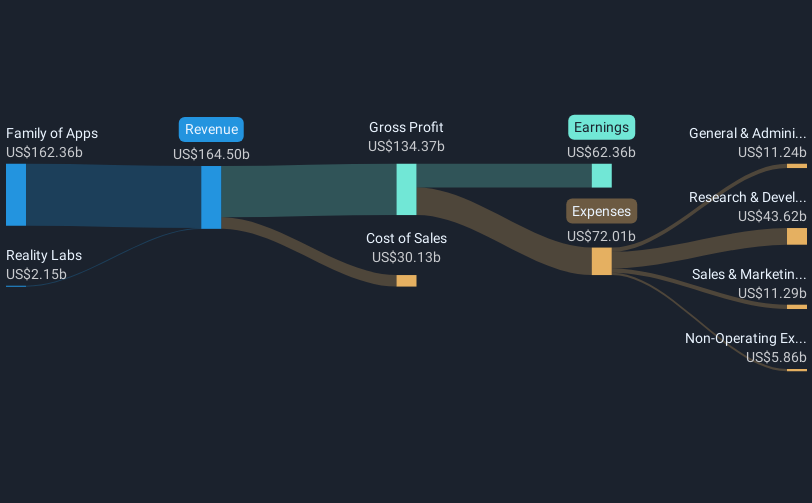

The recent power purchase agreement with Constellation for nuclear energy positions Meta Platforms to potentially stabilize operational costs, enhancing financial predictability. Additionally, the collaboration with Red Hat to improve AI capabilities could bolster Meta's revenue streams by enhancing digital engagement and optimizing advertising. However, increased AI investments could affect profitability if cost pressures mount. Over the past three years, Meta's total shareholder return, including share price and dividends, was 242.44%. This remarkable growth reflects its ability to outperform the broader US market and the Interactive Media and Services industry, both of which saw significantly lower returns.

One-year figures show Meta exceeding the market's return of 12.6% and the industry's return of 10.3%. The recent dividend announcement could solidify investor confidence, potentially supporting the share price. Current revenue and earnings projections might be positively influenced by AI-driven advancements and business messaging opportunities, which are crucial for maintaining growth momentum. The share price's recent 12% increase puts it within 6.74% of the consensus analyst price target of US$703.89, indicating potential upside if growth forecasts materialize. Investors should assess if these strategic initiatives can sustain long-term rewards against possible challenges in profitability and operational adjustments in Europe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.