Please use a PC Browser to access Register-Tadawul

Microsoft (MSFT) Settles Patent Lawsuit With Virtru Over Data Encryption Technology

Microsoft Corporation MSFT | 478.53 | -1.02% |

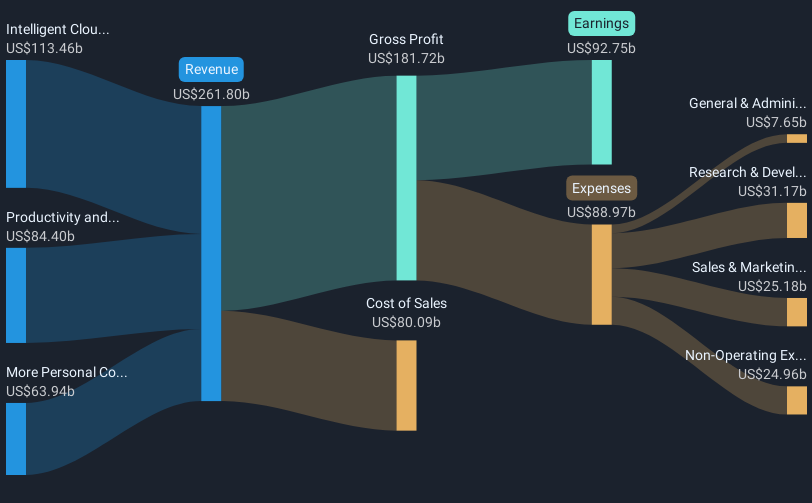

Microsoft (MSFT) recently marked a 9% rise over the last quarter, a movement influenced primarily by its legal settlement with Virtru Corporation over patent infringement claims. This event, coupled with strong earnings growth reflecting a significant revenue and net income boost, underpinned market confidence. Furthermore, Microsoft's announcement of a continued dividend and substantial buyback efforts added support to its share price. The company's partnerships, like the extended collaboration with the NFL, affirmed ongoing innovation. In a flat broader market, these developments added weight to Microsoft's positive performance.

The recent legal settlement with Virtru Corporation and Microsoft's commitment to dividends and buyback initiatives are significant in shaping investor sentiment and potentially bolstering the company's future performance. Over the past five years, Microsoft's total shareholder return was 133.19%, showcasing strong long-term growth and robust shareholder value appreciation. This contrasts with its 1-year performance, which outpaced the broader US market but fell short of the software industry average return.

Microsoft's forward-looking initiatives in AI and cloud services could see an uptick after the legal resolution, supporting revenue streams like Azure AI and enhancing enterprise cloud solutions. Microsoft's share price, currently at $504.26, shows potential relative to the consensus price target of $614.60, implying a possible upside. Earnings forecasts also point to substantial growth, considering this context of resolved legal proceedings and strategic focus, although analysts expect earnings to grow slower than the US market annually. This reinforces Microsoft's appeal to long-term investors looking for stable revenue and profit expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.