Please use a PC Browser to access Register-Tadawul

MicroVision Weighs Luminar Asset Deal With Valuation Gap And Dilution Risks

MicroVision, Inc. MVIS | 0.79 0.81 | -2.95% +2.71% Post |

- MicroVision (NasdaqGM:MVIS) has agreed to acquire key assets from Luminar Technologies through a Section 363 bankruptcy sale process.

- The package includes intellectual property, critical inventory, engineering staff, and existing commercial contracts, subject to bankruptcy court approval.

- The transaction is tied to Luminar's ongoing bankruptcy proceedings and remains contingent on court and procedural milestones.

MicroVision focuses on lidar sensors and advanced perception solutions for applications such as automotive and industrial systems. The lidar space has seen ongoing interest as companies look for sensing technologies that can support driver assistance and automation features over time.

For you as an investor, this deal is notable because it may affect MicroVision's product mix, partnerships, and cost structure if it is closed and integrated. The rest of this article explains what is being acquired, how it relates to MicroVision's existing business, and key questions to watch as the transaction moves through the court process.

Stay updated on the most important news stories for MicroVision by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on MicroVision.

Quick Assessment

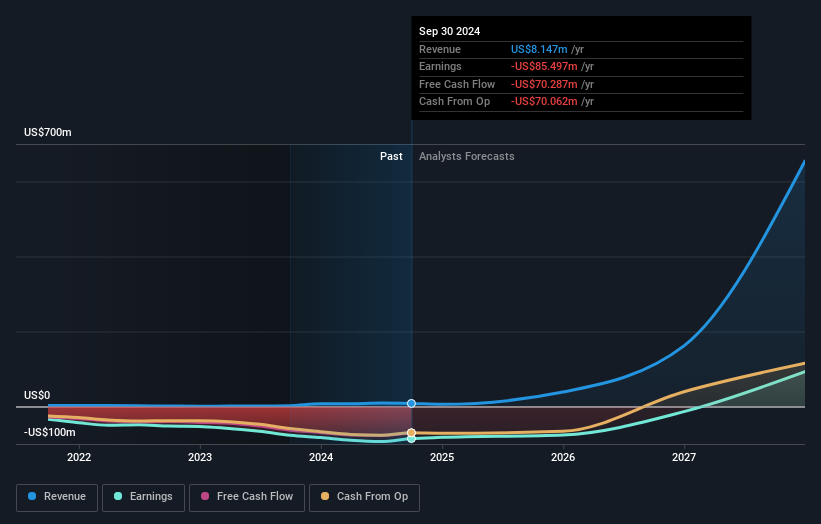

- ✅ Price vs Analyst Target: At US$0.91, the price is roughly 64% below the US$2.50 analyst target range midpoint.

- ⚖️ Simply Wall St Valuation: Valuation status is currently unknown, so there is no clear under or overvaluation signal.

- ✅ Recent Momentum: The 30 day return is about 0.18%, which is slightly positive.

Check out Simply Wall St's in depth valuation analysis for MicroVision.

Key Considerations

- 📊 This asset purchase could expand MicroVision's lidar portfolio and customer relationships if the court approves and the integration is executed as planned.

- 📊 Watch how the deal affects cash burn, any changes in share count, and whether new contracts from Luminar's book start contributing to revenue.

- ⚠️ The company is loss making, has low revenue of US$2.64m, and shareholders were heavily diluted over the past year, so financing and dilution risk remain front and center.

Dig Deeper

For the full picture including more risks and rewards, check out the complete MicroVision analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.